US economy more resilient than expected, growth in the 4% range… Could the 'no landing' scenario occur?

Summary

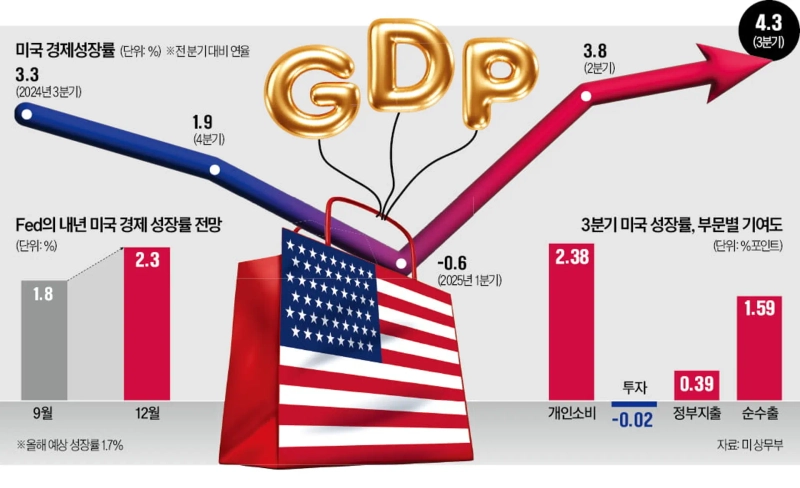

- The U.S. Department of Commerce said the US economy recorded a Q3 GDP growth rate of 4.3%, far exceeding market expectations.

- The strong growth was driven by an increase in personal consumption expenditures and an improvement in the trade balance, but experts say the federal government shutdown raises questions about the reliability of the statistics.

- Markets cautioned about the sustainability of this growth and noted that GDP figures are likely to be revised downward in the future.

3Q GDP growth rate highest in 2 years…Some say "statistical distortion"

Trump: "US growth is thanks to tariffs"

A 'lone boom' unlike Europe and Japan

Trump's policy stance likely to gain momentum

Some say "growth may stall in Q4"

Trade deficit fell more than expected and spending increased

Estimates likely to be revised later

The US economy grew by more than 4% in Q3, surpassing market expectations. An increase in personal consumption expenditures and an improvement in the trade balance drove this strong growth. Although it is a quarterly result, with the world's largest economy's gross domestic product (GDP) rising by more than 4%, the view that the US could follow a 'no landing' scenario — growing without a recession even amid high interest rates — has gained traction. However, some have pointed out that the reliability of the statistics may be reduced due to the federal government shutdown.

Highest growth rate in 2 years

The U.S. Department of Commerce said on the 23rd (local time) that Q3 growth was 4.3% at an annualized rate compared with the previous quarter. This is the highest quarterly level in two years since Q3 2023 (4.7%). It also far exceeded the market forecast of 3.2% compiled by Dow Jones. After the US economy briefly contracted (-0.6%) in the quarter before the imposition of tariffs due to a temporary surge in imports, it rebounded to 3.8% in Q2 and showed even stronger growth in Q3.

The US reports GDP three times — advance, preliminary, and final — by annualizing the quarter-on-quarter growth rate. However, because the advance release was canceled due to the longest-ever federal government shutdown that lasted 43 days from October 1 to November 12, the preliminary estimate was released as the initial Q3 GDP figure this time.

Q3's "surprise" growth was led by personal consumption. Personal consumption expenditures increased 3.5% in Q3, boosting the growth rate by 2.39 percentage points. Concerns that tariff imposition and a slowdown in employment would lead to weaker consumption were unfounded. Net exports also raised the Q3 growth rate by 1.59 percentage points. During Q3, imports fell 4.7% while exports rose 8.8%. Government spending also increased 2.2%, contributing 0.39 percentage points to the growth rate. However, private investment decreased 0.3% in Q3.

Brett Kenwell, US investment analyst at eToro Securities, said, "With US GDP exceeding economists' expectations for two consecutive quarters, it has once again confirmed consumers' and the economy's resilience," adding, "Concerns around the labor market, tariffs, and inflation persist, but the economy continues to grow steadily, defying skeptics' forecasts."

Yoon Heo, professor at Sogang University's Graduate School of International Studies, said, "US consumers seem to perceive that the economic trend has entered a stabilization phase." He added, "Companies appear to be absorbing tariff burdens to avoid losing market share, so price pass-through is likely to begin in earnest starting next year."

Some analysts also say the Q3 growth could bolster President Donald Trump's policy stance. President Trump said that "the just-released excellent US economic figures are thanks to tariffs," adding, "There is no inflation and national security is very strong." He also urged people to "pray for the US Supreme Court" while exerting pressure on the federal Supreme Court, which is hearing the legality of reciprocal tariffs.

If the current trend continues, the US economy is likely to grow more than 2% this year following last year's 2.8%. The International Monetary Fund (IMF) had projected 2% growth for the US this year in its October World Economic Outlook, before the Q3 figures were released. The Federal Reserve (Fed) recently raised its projection for next year's economic growth from 1.8% to 2.3% at a monetary policy meeting. Unlike Europe and Japan, which are in a low-growth phase, the US alone is enjoying a 'lone boom.'

"Shutdown may have distorted statistics"

There is concern that some data collection may have been omitted due to the shutdown that lasted more than a month, making it difficult to fully trust this GDP figure. Mark Zandi, chief economist at Moody's Analytics, told Business Insider that "while the reduction in the trade deficit and increased government spending raised the growth rate more than expected, this is likely the result of tariff fluctuations and measurement issues." He added, "It is hard to clearly pinpoint the relationship between the government shutdown, government data, and GDP estimates, but the (Q3 GDP) data could be revised significantly downward in the future." He also said, "(The growth rate) is not bad, but it is hard to say it is strong enough to create enough jobs while unemployment is gradually rising." In other words, the growth rate should not be interpreted too optimistically.

Domestic experts voiced similar concerns. Kim Tae-hwang, professor in the Department of International Trade at Myongji University, said, "Because the shutdown prevented key data from being properly collected and GDP was calculated based on such data, it is difficult to fully trust these figures," adding, "Given high unemployment, the explanation that producer prices (PPI) rose while consumption increased lacks structural persuasiveness." He also noted that "concerns about an investment bubble centered on the artificial intelligence (AI) industry have not yet been resolved."

Skepticism also surrounds the sustainability of the growth. Jeong Jae-hwan, professor in the Department of Political Science and International Relations at Inha University, said, "It is hard to see this growth continuing through Q4," adding, "While US trade policy may increase exports, it will inevitably raise inflationary pressure, which will ultimately lead to a contraction in personal consumption expenditures."

Im Dayeon reporter allopen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)