'Retail investors swarm' U.S. ETFs see record boom…some warn 'be cautious next year'

Summary

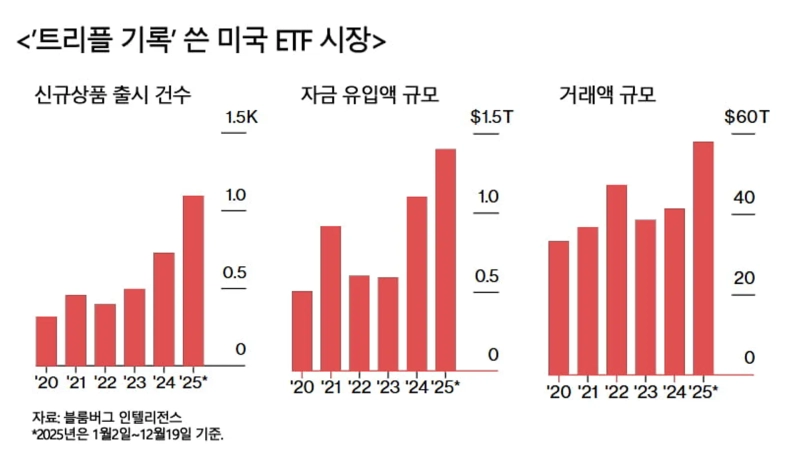

- This year the U.S. ETF market recorded all-time highs in fund inflows, new launches, and trading volume.

- Bloomberg Intelligence said that next year caution is needed regarding risk factors such as market volatility and shocks from leveraged ETFs.

- Wall Street and market research firms expect the U.S. ETF market's growth to continue for the time being, but warned to watch risks from new products such as dual-class structures.

Fund inflows, new launches, trading volume all 'triple records'

This year the U.S. exchange-traded fund (ETF) market posted an all-time boom, according to compiled data. Some market participants are sounding warnings about the "unprecedented expansion."

So far this year $1.4 trillion flowed into U.S. ETFs…'about 7 trillion won a day'

On the 25th, Bloomberg Intelligence reported that through the 19th of this year, U.S.-listed ETFs set record highs in fund inflows, number of new products, and trading volume, respectively. It is the first time since 2021 — when global liquidity surged due to the impact of COVID-19 and triggered an "investment boom" — that the three indicators simultaneously reached all-time highs in a single year.

Global funds flowing into U.S.-listed ETFs during this period amounted to $1.4 trillion (about 2,037 trillion won). This surpassed last year's previous record of $1.1 trillion. The scale is more than 1.5 times that of 2021, when fund inflows surged ($914.6 billion). The average daily inflow was about $5 billion (about 7.262 trillion won).

About 1,100 U.S.-listed ETFs were newly launched in this period, a 51.72% increase from the previous year. Annual trading volume also hit an all-time high. Trading amounted to $57.9 trillion (about 8,415.2 trillion won) this year, up about 40% from the previous year.

Index ETFs underpin growth, active ETFs drive it

Bloomberg Intelligence said, "Most inflows went to low-fee index ETFs," adding that "the S&P 500's double-digit gains for three consecutive years are among the reasons for these ETFs' growth." In other words, much money bet on the long-term upward potential of the U.S. stock market. Index ETFs gain value as their benchmark indices rise.

Active ETFs also showed clear growth. These include derivative-based ETFs or single-stock leveraged ETFs that seek to track multiples of the daily price moves of individual names such as Tesla and Nvidia. Active ETFs accounted for 84% of all newly launched ETFs. About half of these were option-based products. Active ETFs concentrated more than 30% of total ETF fund inflows.

"Next year could see 'market shock'…beware of leveraged ETFs"

Warnings have been raised about the rapidly growing U.S. ETF market. Eric Balchunas, an ETF analyst at Bloomberg Intelligence, said, "Next year there may be a period to check the gap between expectations and reality in some form."

He added, "Because the ETF market had such a perfect year, it is actually a time that requires preparation," and cautioned, "Consider scenarios including market volatility, shocks from single-stock leveraged ETFs, and mutual fund-related tax issues."

Bloomberg's analysis says that if market volatility rises, many option-based ETFs using call and put options could be tested. These ETFs amplify returns using derivatives. But in a highly volatile market, merely holding them long term can incur derivative maintenance or rebalancing costs that hurt returns, and in the worst case the ETF product could be liquidated.

A representative case is the "GraniteShares 3x Short AMD" ETF, which traded on the London Stock Exchange and the Milan Stock Exchange and was liquidated in October last year. This ETF bet three times against the share price of AMD, a Nasdaq-listed U.S. company. It was effectively a product allowing retail investors to short AMD through an ETF.

When AMD announced a large-scale collaboration with OpenAI and its stock jumped 23.71%, this ETF's return plunged 88.90% in a single day. Because it was set to track -3x the daily return of AMD, the net asset value (NAV) was eroded in a single day to an extent that could not be recovered.

GraniteShares halted new trading of the ETF at the end of that month, and about a month later, in early November, liquidated the ETF by redeeming remaining NAV in cash to investors.

"Be cautious about dual-class ETFs too"

Bloomberg also pointed to "dual-class structure ETFs" as the biggest variable for the ETF market next year. A dual-class ETF refers to a product where a manager sets up both a mutual fund and an ETF on a single fund portfolio and sells them. Originally created by Vanguard and allowed only for that company in the U.S. market, the SEC began granting individual approvals to asset managers and products starting last year.

The advantage of dual-class ETFs is that they can combine the tax efficiency of ETFs with the asset scale of mutual funds. But because the structure is more complex than before, risks are also raised. The main concern is the possibility of "tax contagion." Normally, in an ETF, even if another investor sells large amounts, the fund does not need to sell underlying shares internally, so remaining investors do not incur taxes.

With dual-class ETFs that share a portfolio between ETFs and mutual funds, the story is different. If the market swings widely and there are large redemptions from the mutual fund, underlying stocks in the portfolio may have to be sold. Realized capital gains taxes could then be allocated to ETF investors as well. That means ETF investors could bear tax burdens even if they did not trade.

So far, apart from Vanguard, there are effectively no asset managers operating dual-class ETFs at a meaningful scale. J.P. Morgan and RBC Capital Markets warned that if new products increase, the capacity of liquidity providers to respond could be strained. Because the redemption mechanisms differ between ETFs and mutual funds on the same assets, when market volatility rises, overlapping sales from both sides could amplify market shocks.

"ETF market entering maturity…growth will continue even if pace slows"

Wall Street expects the U.S. ETF market's growth to continue. Even if there is a 'speed adjustment' phase next year, the consensus is that the growth trend itself will not be broken.

Roxana Islam, head of research at TMX BetaPhi, said, "As the ETF market enters a mature stage, growth rates may slow," but added, "Product innovation will continue regardless of net inflow trends."

Todd Sohn, ETF strategist at Strategas, said, "Because new ETF products are sensitive to market conditions, launches of leveraged ETFs may slow somewhat when market volatility rises," but predicted, "U.S. ETF fund inflows and trading volume are likely to continue setting records for the time being."

Hangyeol Seon reporter always@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)