'KOSPI 5000' preparations properly laid…Retail investors who shed tears in the bull market also 'stir' [Ants Riding the Red Horse]

Summary

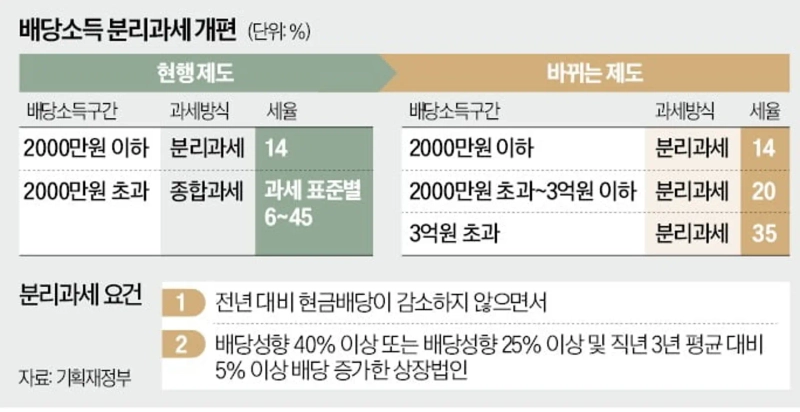

- It reported that the introduction of separate taxation on dividend income and the mandatory cancellation of treasury shares starting next year are expected to have a positive impact on the stock prices of holding companies and high-dividend firms.

- It stated that the government's KOSDAQ revitalization measures and the execution of the National Growth Fund increase expectations for growth in the KOSDAQ market and investment in policy-beneficiary stocks.

- Securities firms forecast that the sequence of announced market stimulus measures will serve as a solid support for the domestic stock market's rise next year.

(Lower) A flood of policies strengthening shareholder rights next year

"It continues into the new year"…Policy momentum to lead the recapture of KOSPI 5000

Introduction of separate taxation on dividend income and mandatory cancellation of treasury shares

KOSDAQ revitalization measures and a 150 trillion won National Growth Fund

"A strong policy drive will be the stock market's support"

[Editor's note] The KOSPI, which surpassed the unprecedented 'KOSPI 4000' milestone this year, has entered a pause as the year-end approaches. In June, the Lee Jae-myung administration proposed a plan to open the 'KOSPI 5000 era' by improving corporate governance, cited as a main cause of the Korea discount (undervaluation of the Korean stock market), and the KOSPI quickly broke through the 4000 level. Hankyung.com asked eight major securities firms whether the domestic stock market can run vigorously like this year in Byeongo year, the 'Year of the Red Horse', and requested their outlooks and response strategies.

The biggest driving force behind this year's rise in the domestic stock market was the government's capital market support measures and the resulting expectations. Securities firms expect that since various policies will continue next year, "it will be the year when expectations begin to be realized in earnest."

Introduction of separate taxation on dividend income…Removing the 'holding company' undervalued label

First, separate taxation on dividend income will be introduced from next year to encourage high dividend payouts. This system taxes investors' dividend income separately from labor and interest income at lower rates.

Earlier, on the 30th of last month, the National Assembly's Strategy and Finance Committee resolved in a plenary session a revision to the Restriction of Special Taxation Act that applies separate tax rates of 14% up to 20 million won of dividend income, 20% for over 20 million won up to 300 million won, and 25% for over 300 million won up to 5 billion won, and establishes a new bracket over 5 billion won subject to a top rate of 30%.

The measure will apply to companies with a dividend payout ratio of 40% or more, or those with a payout ratio of 25% and an increase of 10% or more compared to the previous year.

Under the current tax system, if annual financial income exceeds 20 million won, it is combined into comprehensive income and taxed at progressive rates of up to 49.5%. For this reason, it has been criticized that corporate owners and major shareholders who find paying large taxes burdensome tend to avoid dividends.

With this revision, shareholders investing in high-dividend companies will see reduced tax burdens, increasing the upside potential for holding company stocks that have much room to expand dividends, analysts say.

Kim Han-yi, a researcher at Hyundai Motor Securities, noted, "The holding company sector, which has been undervalued in terms of shareholder value enhancement, is being reassessed," and added, "Discussions on the third amendment to the Commercial Act and the introduction of separate taxation on dividend income support expectations for this sector's improvement." He especially said, "Next year is expected to be the year when expectations are realized in earnest," and recommended, "Maintain steady interest in stocks that could show an increase in net asset value (NAV) based on their business portfolios."

Mandatory cancellation of treasury shares and KOSDAQ revitalization among measures lined up

The third amendment to the Commercial Act, which centers on mandatory cancellation of treasury shares, is also gaining momentum, so interest in perpetually undervalued stocks such as holding companies is expected to increase. The ruling party originally promised to pass the amendment within the year, but business sector backlash and a filibuster by the opposition party delayed the legislative process, pushing it into next year.

The amendment would, in principle, require companies that acquire treasury shares to cancel them within one year. It also mandates that plans to dispose of treasury shares be approved at the shareholders' meeting each year. Holdings or disposal for certain purposes, such as employee compensation, would require approval through special resolutions at shareholders' meetings. Treasury shares held by companies before the law's enforcement would be subject to the same obligations but would be granted an additional six-month grace period.

Co-sponsor Han Jeong-ae, chair of the policy committee, said, "There have been many bad cases where treasury shares were used for the benefit of specific shareholders," and added, "Through amendments to the Commercial Act, we will clearly define the nature of treasury shares and eliminate the 'treasury share magic' from our capital market."

Measures to revitalize the KOSDAQ market are expected to restore the KOSDAQ's subdued momentum. The KOSPI index increased by 71.23% to 4108.62 (closing price on the 24th) from last year's year-end closing price (2399.49). In contrast, the KOSDAQ index rose 34.95% from last year's year-end closing price of 678.19 to 915.2. The KOSDAQ's rate of increase was less than half that of the KOSPI.

On the 19th, the Financial Services Commission announced the 'Measures to Restore Trust and Promote Innovation in the KOSDAQ Market.' The plan is to transform a market that had become volatile and retail-driven into a healthy market where institutional funds also participate. The core is to revise pension fund evaluation criteria to facilitate the entry of institutional investors.

The government also plans to consider tax benefits for funds that invest in corporate growth, such as citizen-participation National Growth Fund, KOSDAQ venture funds, and business development companies (BDCs). Listing review and delisting criteria will also be redesigned to create a so-called 'many births, many deaths' (多産多死) dynamic structure. The entry requirements will be made flexible while exit standards will be strictly enforced.

Kang Jin-hyeok, a researcher at Shinhan Investment Corp., said, "With KOSDAQ support measures and the activation of venture capital, institutional stable demand is likely to flow into the KOSDAQ," and added, "From next year, the activation of integrated foreigner accounts will improve foreign investors' accessibility, which is another reason the KOSDAQ may have a relative advantage over the KOSPI."

The waiting-to-launch 150 trillion won National Growth Fund has also excited policy-beneficiary stocks. This fund will begin full-scale funding of 30 trillion won annually for the next five years starting next year.

The government has chosen seven candidates for the first mega-projects in fields such as AI, semiconductors, and secondary batteries where industrial and regional economic spillovers are large. The first disclosed investment targets are △ fostering a K-NVIDIA △ National AI Computing Center △ offshore wind power in Jeonnam △ all-solid-state battery material plant in Ulsan △ power semiconductor production plant in Chungbuk △ advanced AI semiconductor foundry in Pyeongtaek △ energy infrastructure for the Yongin semiconductor cluster.

"Stronger than ever" — Sunny outlook for next year thanks to market stimulus measures

Securities analysts generally believe that the government's and ruling party's market stimulus policies, which will continue next year, will act as a solid support for index gains.

Na Jeong-hwan, a researcher at NH Investment & Securities, said, "Expectations for policy benefits across KOSDAQ, AI, and advanced industries such as pharmaceuticals and bio have expanded," adding, "Some portion of the National Growth Fund's execution funds is expected to be injected into companies in the form of equity investments, which is positive."

Lee Seung-hoon, head of research at IBK Investment & Securities, said, "With policies to resolve the Korea discount coming one after another this year, the domestic stock market atmosphere has completely changed," and predicted, "Until the first quarter of next year, trend rises are expected due to improving corporate performance and strong policies. Whether companies will respond with active shareholder return measures will determine the subsequent direction."

Reporter Shin Min-kyung, Hankyung.com radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Bitcoin retakes KRW 100 million amid reports of secret US-Iran contacts…$72,000 in focus [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/3beef0db-a8f6-4977-9dca-6130bf788a69.webp?w=250)

![[Analysis] “ETFs and short covering drove Bitcoin’s rebound…on-chain indicators are mixed”](https://media.bloomingbit.io/PROD/news/6c7dbd31-4aeb-400e-9c43-c2843062fc66.webp?w=250)