Summary

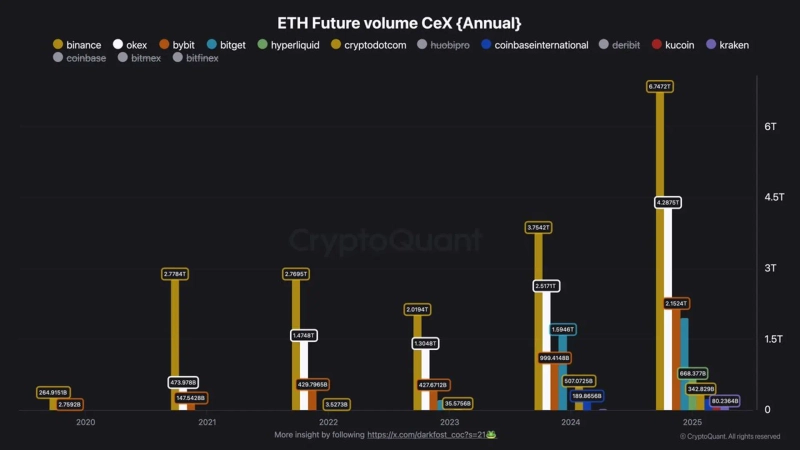

- This year, Ethereum (ETH) derivatives trading volume surpassed $6.74 trillion, marking an all-time high.

- The spot-to-futures trading ratio averaged 0.2 compared to the spot market, meaning that when about $5 was bet in the futures market, $1 was invested in the spot market.

- Darkpost diagnosed that increased reliance on leverage has made the market unstable and increased price volatility.

While the altcoin market showed mixed performance overall this year, analysis found that the Ethereum (ETH) derivatives market alone recorded explosive growth and set an all-time high.

On the 26th (local time), Darkpost (Darkost), a contributor to on-chain analytics platform CryptoQuant, said, "This year, Ethereum showed a clear tendency for derivatives trading to overshadow the spot market."

Darkpost explained, "This year was not easy for altcoin investors, but activity in the Ethereum futures market was more concentrated than ever," adding, "The share of futures trading across the crypto market has grown dramatically, and this phenomenon is most clearly seen in Ethereum."

Actual data also supports this. For global crypto exchange Binance, the Ethereum futures trading volume processed this year exceeded $6.74 trillion. Darkpost emphasized, "This figure is almost double the 2024 record, which was already a historical high."

Additionally, OKX set a new record with $4.28 trillion, and Bybit and Bitget recorded $2.15 trillion and $1.95 trillion, respectively. Darkpost said, "Data from all major exchanges point to one conclusion," adding, "This year Ethereum was one of the most actively traded assets in the global derivatives market, showing how speculative the market was."

The problem is the extreme imbalance with the spot market. This year, according to Binance, Ethereum's 'spot-to-futures trading ratio' averaged only around 0.2. He analyzed, "This ratio specifically means that when $1 is invested in the spot market, about $5 was bet in the futures market," adding, "This is a typical indicator showing that the market is extremely dependent on high leverage."

"A derivatives-led market is inherently unstable and unpredictable," he diagnosed, "Price movements tend to be excessively amplified or disorderly, and prices swing depending on liquidation volumes."

He added, "This is also why, despite the record trading volume, Ethereum only marginally surpassed its previous peak," adding, "Excessive leverage has rather hindered a healthy rise and only increased volatility."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)