Bitcoin (BTC) current movement influenced by tax-saving trades, not investor sentiment

공유하기

- An analysis has emerged that recent Bitcoin price movements are not directly related to investor sentiment.

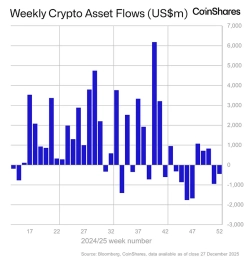

- It said that ETF managers conducted large-scale trades during portfolio rebalancing for tax savings, causing short-term supply-demand changes.

- There are suggestions that, due to the impact of ETF-related fund flows and tax strategies around year-end, non-investment factors should also be considered when interpreting Bitcoin price movements.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

An analysis has emerged that recent Bitcoin (BTC) price movements are not directly related to investor sentiment. It was suggested that short-term supply-demand changes may have stemmed from trades intended to reduce taxes.

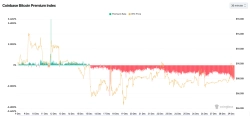

On the 29th (local time), Bloomberg ETF specialist analyst Eric Balchunas said on his X (formerly Twitter) that the recent Bitcoin price movement was similar to the so-called 'heartbeat trading (Heartbeat trades)' pattern.

He described heartbeat trading as "an abnormal form of trading that occurs regardless of actual changes in investor sentiment." It is characterized by price movements that appear short and regular like a heartbeat.

Balchunas analyzed that such trades are mainly conducted for tax-saving purposes. In particular, he explained that this can occur when ETF managers carry out large-scale trading during portfolio rebalancing to avoid capital gains tax.

In this case, prices can move regardless of changes in market participants' risk preferences or macroeconomic variables. This means that short-term price fluctuations may not necessarily reflect strong buying or selling sentiment.

Market observers say that because ETF-related fund flows and tax strategies concentrate around the end of the year, these non-investment factors should also be considered when interpreting Bitcoin price movements for the time being.