'Despite the spread of 'AI effects'… Global trade contracts to the 1% range due to Trump's tariff policy'

Summary

- The Economist said that due to President Trump's tariff policies, geopolitical conflicts, and policy uncertainty, this year's global economic growth will be limited to 2.4%.

- It evaluated that continued AI investment by large U.S. tech firms will lead to the economic effects of AI becoming pronounced from this year.

- The Economist said that prolonged tariff uncertainty is pushing companies toward supply-chain reshaping, reduced investment, and securing cash.

The Economist's World Outlook

Trump's unpredictable policies continue

Global economic growth likely to be limited to 2.4%

Spread of AI demand helps Taiwan's economy

India overtakes Japan to become the world's 4th largest economy

Europe, with high defense spending, grows by 1%

'A turning point for the economic effects of artificial intelligence (AI), Trump's unpredictability…'

These are the main keywords presented by British weekly The Economist in <2026 World Outlook>. The Economist predicted that while the impact of large-scale corporate AI investment remains unclear, the real effects of AI will begin to appear from this year. However, with U.S. President Donald Trump's unpredictable policies continuing, the global economy is slowing, and world trade is expected to show a growth rate below 2%.

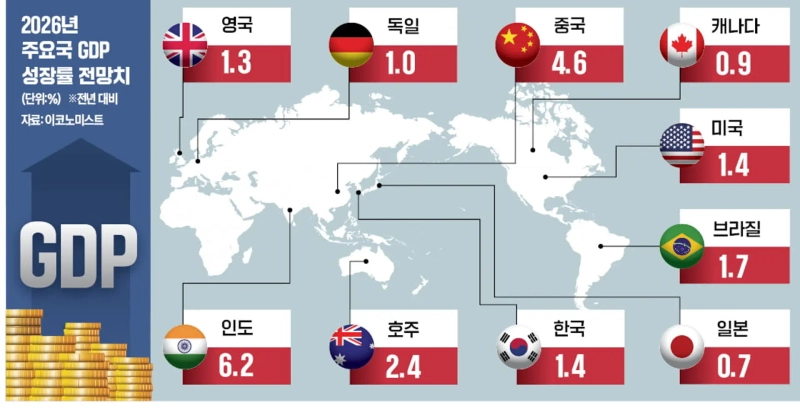

Slowdown in the U.S. and China

The Economist said President Trump's tariff policies will slow economic growth in the United States and the world. It forecast global economic growth of 2.4% this year. It explained that the Trump administration's tariff policies, geopolitical conflicts, and policy uncertainty will curb investment and trade. Various industries such as automobiles, metal manufacturing, shipping, and pharmaceuticals will be affected by U.S. protectionism, and world trade growth is also estimated to remain below 2%. Retail sales are also expected to be limited to 2% growth as consumer confidence wavers.

U.S. gross domestic product (GDP) growth is expected to be only 1.4%. Tariffs will reduce the availability of goods, and immigration policies will reduce the labor supply, leading Americans to feel higher prices. This is likely to show up in GDP and price indicators this year. The Economist diagnosed that tariffs could raise the U.S. annual core inflation rate by 1% point by this spring. If a candidate favorable to monetary easing is appointed as Jerome Powell's successor as chair of the U.S. central bank (Fed), concerns about the size of U.S. government debt will expand further.

One thing to expect is increased AI-related spending. Large U.S. tech firms poured more than $400 billion into data centers and related infrastructure last year. Some estimates say $7 trillion could be invested by 2030. The Economist assessed, "This year is when AI's economic and social impact begins in earnest."

China is also expected to see lower economic growth due to the impact of U.S. trade policies. The Economist's projection for China's GDP growth this year is 4.6%. With U.S. pressure and weaker demand for Chinese exports, the economy will slow, and the Chinese government is likely to continue stimulus measures and infrastructure investment to boost domestic demand.

Taiwan benefits from the AI boom

South Korea's GDP growth is expected to be 1.4%, and Japan's 0.7%. Japanese Prime Minister Sanae Takaichi's loose fiscal and monetary policies risk increasing national debt. Taiwan's growth is forecast at 2.2%. While the front-loading of goods exported to the U.S. (companies shipping quantities forward in anticipation of tariff increases, etc.) may fade and slow economic growth, given Taiwan's role in the technology supply chain, global AI demand could help Taiwan's economy, The Economist said.

India could overtake Japan to become the world's 4th largest economy this year. Its economic growth rate this year is projected at 6.2%—slower than the 7–8% growth rates seen in the early 2020s, but still well above the world average.

Inflation in Europe is easing, but growth drivers are lacking. Productivity is stagnant, and an aging workforce is dragging down output. The debt-to-GDP ratios of Italy, France, Spain, and Belgium have already exceeded 100%.

The Economist expects Europe to spend the most on defense since the Cold War this year. It will need to secure funds for military strengthening to counter Russia and to expand support for Ukraine. There could be debates over where to obtain those funds. The Economist forecasted that major European countries such as the UK (1.3%), France (1%), and Germany (1%) will see growth in the 1% range.

Global supply-chain reshaping

With tariff uncertainty prolonged, companies are responding in three ways. Market-dominant or strong-brand companies such as Hermès, Ferrari, and Walmart have passed tariff burdens on to consumers. In contrast, small and medium-sized firms in highly competitive sectors have had no choice but to absorb the costs. Some companies are cutting investment and new hiring and focusing on securing cash. According to S&P Global, two-thirds of companies included in global stock indices had reduced headcount over a one-year period as of last July.

Finally, there is the supply-chain reshaping card. According to consulting firm Kunning, 28% of surveyed companies responded that they "want to reorganize supply chains so that production occurs in the same region where actual product sales take place by 2030." Many companies are currently reducing dependence on China and moving to alternative production bases such as India. The Economist predicts that tariff policies will again shake up corporate strategies and the overall flow of the world economy this year.

Reporter Han Kyung hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Bitcoin retakes KRW 100 million amid reports of secret US-Iran contacts…$72,000 in focus [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/3beef0db-a8f6-4977-9dca-6130bf788a69.webp?w=250)

![[Analysis] “ETFs and short covering drove Bitcoin’s rebound…on-chain indicators are mixed”](https://media.bloomingbit.io/PROD/news/6c7dbd31-4aeb-400e-9c43-c2843062fc66.webp?w=250)