Even high-tech products affected by China's '1-cent war'…South Korea's breakthrough is 'Trust Connector' [Global Money X-file]

공유하기

- It reported that China's 'deflationary exports' and below-cost cutthroat competition in advanced industries are intensifying.

- It stated that ultra-low-cost Chinese electric vehicles and robots in the global market pose a major threat to Korean manufacturing and startups.

- It presented the 'Trust Connector' strategy as South Korea's breakthrough, saying the premiumization of trust in fields such as semiconductors, bio, and defense is key.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Recently, China's exports have evolved into 'deflationary exports.' What began as a simple low-price offensive on online shopping malls has turned into a so-called '1-cent war,' forcing cutthroat competition below cost even in high value-added areas such as advanced robots and electric vehicles. There are calls for Korean manufacturing to completely revise its existing growth model.

Entrenchment of China’s deflationary exports

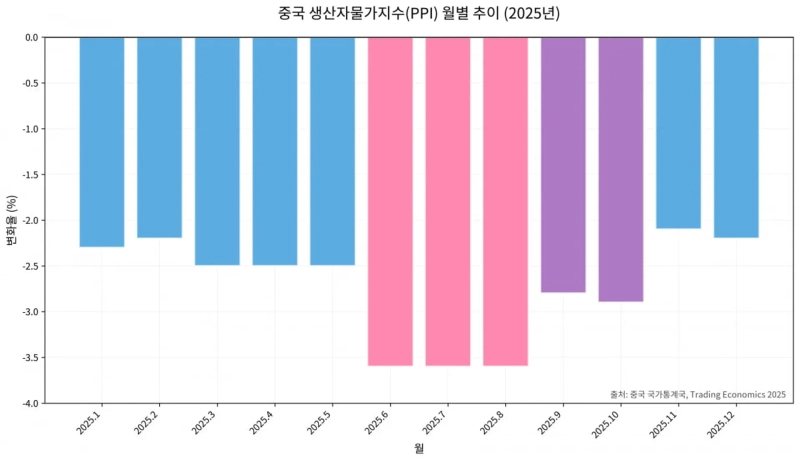

On the 1st, the latest analysis from the Federal Reserve Bank of Dallas showed that China's Producer Price Index (PPI) recorded negative for 38 consecutive months. Analysts say this is not a simple cyclical phenomenon. They argue that structural deflation has solidified, with vast excess production capacity that cannot be absorbed by the Chinese domestic market pouring into overseas markets in search of an outlet.

China's recent overproduction is not limited to past sectors like steel or cement. It is concentrated in advanced fields that the Chinese government has been cultivating with all-out efforts. In high value-added sectors such as electrical machinery, telecommunications equipment, and medical devices, about 30% of Chinese companies are continuing production despite operating at a loss.

Gordon Hanson, a professor at Harvard Kennedy School, diagnosed, "China has enormous manufacturing capacity and these goods have to go somewhere," adding, "We are now in the midst of 'China Shock 2.0' or even 3.0."

'China Shock 1.0' was the surge of light-industrial products such as clothing and toys based on low-wage labor that hit the world after China's 2001 WTO accession. Analysts say that 'China Shock 2.0,' which began in earnest in 2024 and peaked last year, is qualitatively different. It is described as a 'high-tech–ultra-low-price tsunami' created by advanced robotics, vertically integrated supply chains, and state capitalism.

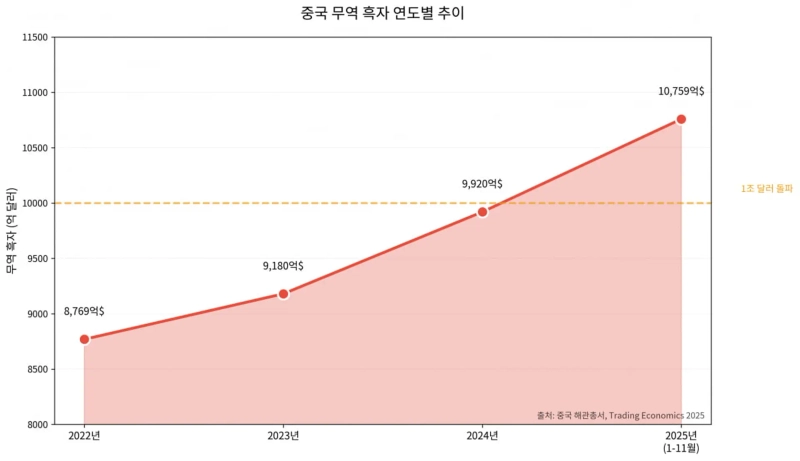

China's trade surplus in 2024 approached a record $992 billion. It is expected to surpass $1 trillion in 2025. Mever Kuzin, chief economist at Bloomberg Economics, pointed out, "Competition with Chinese goods is a challenge for many companies, and this trend is intensifying as China seeks to diversify its exports."

This phenomenon is accelerating in tandem with the domestic 'neijuan (內卷)' phenomenon. Neijuan means 'to be drawn inward.' In a situation where the growth pie does not expand, members plunge into excessive competition that harms each other. Companies focused on squeezing costs like wringing a dry towel to kill competitors rather than creating value through innovation. Cost competition that controls even the copper content of a single screw or wire down to the cent has resulted in exporting deflation globally.

Erosion reaching domestic foundational industries

A representative front of 'China Shock 2.0' is the B2B industrial goods market. When AliExpress and Temu first entered the Korean market, consumers regarded these shopping malls as places to buy cheap manufactured goods. But now they are said to be eroding the ecosystem of Korea's foundational industries, the capillaries of Korean manufacturing.

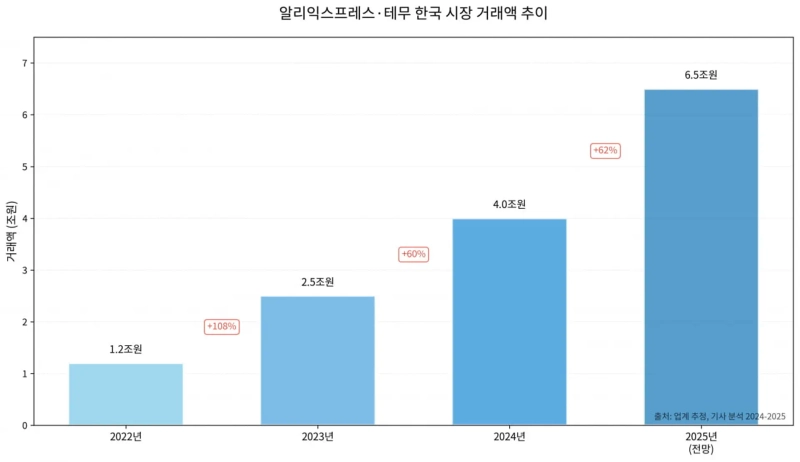

As of 2024, transactions by AliExpress and Temu in Korea exceeded 4 trillion won, showing a growth trend. Last year, they strengthened B2B-dedicated services such as 'AliExpress Business,' directly targeting Korean self-employed merchants and small manufacturing firms beyond B2C.

In the past, Korean small distributors imported parts from China, added a margin, and supplied them to domestic industrial complexes. Recently, Korean factories are known to access AliExpress or Temu with smartphones and order mold parts, screws, bearings, cutting tools, etc., directly. There have even been reports of the Chinese wholesale platform '1688.com' entering the Korean market.

China-origin 'mobility shock'

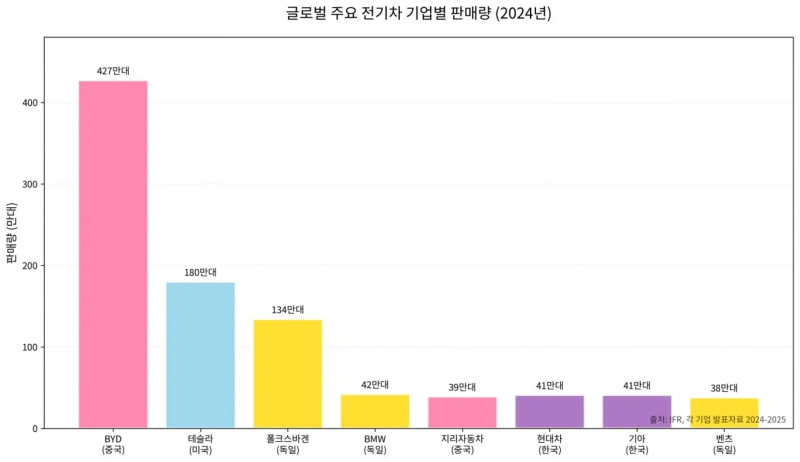

The mobility industry is where the impact of 'China Shock 2.0' is most evident. In the global electric vehicle market, China's BYD has emerged as the only rival threatening Tesla. Xiaomi's first electric car SU7, released in 2024, also received favorable reviews in the market. According to analyses by global investment bank UBS and research institutions, the Xiaomi SU7 has driving performance and specifications similar to the Tesla Model 3 Performance.

However, manufacturing costs were analyzed to be more than $10,000 cheaper than domestic electric vehicles. Analysts say Xiaomi achieved cost efficiency by applying supply chain management (SCM) capabilities accumulated from smartphone manufacturing and integrating the appliance ecosystem (IoT) into automobiles. Xiaomi lowered body assembly costs with die-casting technology that stamps dozens of parts as one. It also integrated hardware and software through its self-developed OS.

BYD's offensive is evaluated to be even more overwhelming. In the first half of 2025 alone, it sold more than 2 million vehicles, marking 31% growth year-on-year. BYD's core competitiveness is its nearly complete 'vertical integration.' According to UBS's teardown report of BYD's 'Seal,' BYD produces 75% of key components such as batteries, motors, and power semiconductors in-house. This removes external supplier margins and eliminates supply chain risk at the source.

BYD's LFP (lithium iron phosphate)-based 'Blade Battery' is also judged to have advantages in performance and price. Wang Chuanfu, chairman of BYD, said, "Batteries account for up to 40% of electric vehicle costs, and by controlling this ourselves we can maintain high margins while overwhelming competitors on price." BYD internalized logistics as well, controlling export logistics costs using car transport ships it built itself.

Threat from Chinese robots

China's offensive is fierce in the robotics industry as well. In 2025, China's share of the global industrial robot market exceeded 50%, taking an overwhelming first place. A greater threat is the price destruction in the service robot and humanoid robot markets.

Chinese robot startup Unitree announced in July 2025 that it would launch the humanoid robot R1 at 39,900 yuan. This is cheaper than the expected prices of competitors such as US-based Boston Dynamics or Tesla's Optimus. Prices for industrial quadruped robots have fallen to around 2700 dollars.

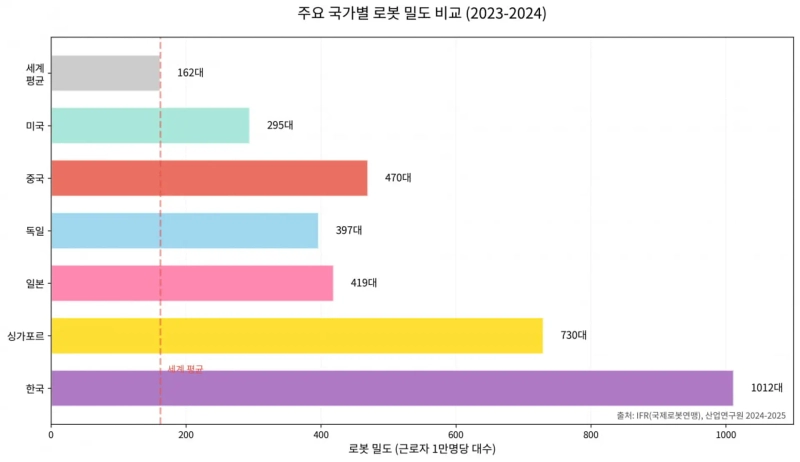

The advent of cheap robots could be a direct blow to Korean robot startups. It has become virtually impossible to beat China on hardware manufacturing costs. Korea is the country with the highest robot density (robots per 10,000 workers) in the world, but those robots could easily be filled by Chinese products. Already, Chinese-made robots account for more than 70% of the serving robot market in Korean restaurants.

Growing geopolitical risk

China-origin low-price offensives have complex macroeconomic effects. On the positive side, China's excess production acts as a 'disinflation' factor that reduces global inflationary pressure. Consumers in the US, Europe, and Korea, who had suffered from high prices, can increase real purchasing power through platforms like Temu and AliExpress and low-priced electric vehicles. According to a 2024 Ipsos survey, European consumers saved on average 24% through platforms like Temu.

But negative effects cannot be ignored. It can lead to 'industrial desertification.' In Indonesia, 250,000 jobs in the textile and apparel sector disappeared over the past two years. Mexico's President Claudia Sheinbaum said, "Mass layoffs in the footwear and textile industries are related to Chinese products," and indicated consideration of increasing tariffs on Chinese products. Thailand, Malaysia, India, and others have responded with anti-dumping investigations and increased taxes on cheap imports.

Ursula von der Leyen, President of the European Commission, warned, "Europe is open to competition but will not tolerate an endless 'race to the bottom.'"

The '1-cent competition' is also raising trade barriers. The United States effectively abolished the de minimis exemption for duty-free overseas direct purchases under $800 from August 2025. It is pursuing a plan to impose an average 30% tariff on Chinese direct-import goods. The EU is also checking Chinese electric vehicles and steel through the Carbon Border Adjustment Mechanism (CBAM) and anti-subsidy investigations. The global trade order is being reorganized from an efficiency focus to one centered on security and bloc formation.

The International Monetary Fund (IMF) warned that such geopolitical fragmentation could reduce world GDP by up to 7% in the long term. The risk is growing that facilities of global companies that made large investments in China could become 'stranded assets,' as factory utilization rates in China fall and asset-freezing risks from US-China conflicts combine.

"Switch to the Trust Connector"

Where should the Republic of Korea head in 2026? South Korea cannot beat China in an all-out war of price and volume. A bloody competition to shave off one cent is a fight without chance. The solution, analysts say, lies not in 'price' but in 'trust' and 'connect.'

This is why the 'Trust Connector' strategy is being proposed as Korea's survival roadmap. It means Korea should supply 'irreplaceable trust goods' to the Western world and become a node that connects technology and resources with Global South countries.

The core is the 'premiumization of trust.' Chinese products have price competitiveness but fatal weaknesses in data security and geopolitical instability. Analysts say Korea should use 'clean chips without backdoors' and 'reliable delivery times' as weapons in semiconductors, bio, and defense sectors.

When China's Wuxi AppTec was pushed out by U.S. biosecurity laws, Samsung Biologics and Lotte Biologics filled the gap and became partners for global pharmaceutical companies. K-defense receiving love calls from Europe proved that there is a market willing to pay this 'trust premium.'

Kim Joo-wan, reporter kjwan@hankyung.com