- Fund managers at domestic asset management firms said they expect the domestic market's uptrend to continue this year.

- The asset classes expected to deliver the best returns this year were named as US large caps and domestic large caps.

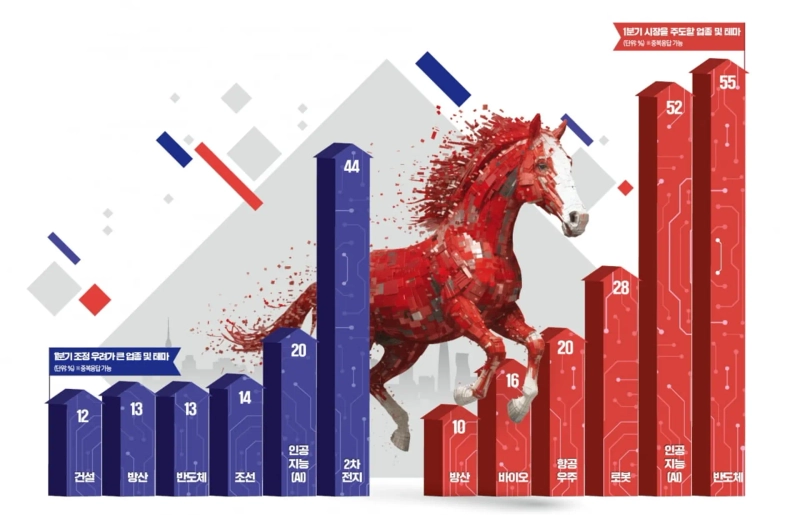

- By sector, there is a positive outlook for semiconductors, robotics, and aerospace, while the secondary battery sector was advised to watch for possible corrections.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Survey of 100 domestic asset managers

Hankyung Fund Manager Survey

25% of respondents expect KOSPI above 4500

Best returns expected from US large caps, followed by domestic large caps

Positive outlook for semiconductors, robotics, aerospace

Last year, the domestic stock market enjoyed its best year. The KOSPI index jumped more than 70%, recording the most outstanding performance among major global stock markets. Government market-support policies fired the starting shot for resolving the "Korea discount," and improved semiconductor sector earnings pushed the market up.

Fund managers at major domestic asset management firms expected the market's uptrend to continue this year. While maintaining a positive outlook for the US market, they said they would further increase the relatively large allocation they had already raised to the domestic market last year. However, they advised that the secondary battery sector, which saw a "surprise rebound" in the second half of last year, should be prepared for possible corrections.

"Domestic market's uptrend continues"

The Korea Economic Daily on the 1st conducted a survey of 100 fund managers affiliated with 23 domestic asset management firms, and 37% said they would increase their domestic equity weight in the first quarter of this year. This overwhelmingly topped the share of respondents who said they would reduce weight (5%). Thirty-nine percent of fund managers who participated in the survey had increased their domestic equity weight in the fourth quarter of last year, and the majority said they would increase weight again in the new year.

Reasons for optimism about the domestic market mainly included still-low valuations (price levels relative to earnings) and expectations for policy measures. One fund manager said, "Despite last year's sharp market rise, the price-to-book ratios (PBR) of companies listed on the stock market remain low compared with Japan, China and Taiwan," and added, "With policy efforts to channel funds into the market, a revaluation of the domestic market is likely to continue."

Fund managers forecast the KOSPI index to rise by around 10% through the first half of this year. Asked about the expected KOSPI at the end of the first half, almost half (49%) of respondents answered 4200–4499. Those expecting 4500 or above accounted for 25%. Twelve percent said the index would remain at current levels (4100–4199), and 14% expected a decline from now.

There were also many positive views on the US stock market. In the asset class expected to deliver the highest returns this year, 30% chose "US large caps," the largest share, narrowly beating domestic large caps (29%).

Mixed views on AI-related stocks

Many respondents named semiconductors as the sector that will lead the market this year. Positive views on robotics (28%) and aerospace (20%), sectors that saw large price gains in the second half of last year, also stood out. Managers forecasting semiconductor gains said, "As AI investments for data centers continue, semiconductor shortages will persist," and added, "Not only high-bandwidth memory (HBM) but also general-purpose (legacy) semiconductors such as DRAM and NAND are expected to see price increases, which could improve the earnings of domestic semiconductor companies."

AI-related stocks ranked second both among sectors expected to lead the market and among sectors with large correction risks. This indicates continued market caution about an "AI bubble." Managers with a positive view on AI-related stocks said, "Despite concerns about overvaluation, it's hard to find sectors with the earnings growth potential of AI companies," and emphasized, "They will dispel bubble concerns with numbers and the price uptrend will continue."

The secondary battery sector drew many votes (44%) as a sector expected to face corrections. The diagnosis was that despite slowing EV demand, recent sharp price rises have increased investment risks.

Reporter Suji Na suji@hankyung.com