PiCK

Bitcoin Sideways, Ethereum Holding… Crypto Market Ahead of the 'Trump Variable' [Lee Su-hyun's Coin Radar]

Summary

- The piece reports that Bitcoin's market direction is expected to be significantly influenced by policy and political variables, especially the U.S. 'Clarity Act' and the midterm election outcomes.

- Ethereum's upgrades, real-world asset tokenization, and stablecoin growth are cited as medium- to long-term positives, but a break below the 2,760-dollar support could trigger declines.

- Binance Coin shows resilient movement backed by reduced regulatory risk and expectations for a technical hard fork, with the 870-dollar support level identified as a short-term inflection point.

<Lee Su-hyun's Coin Radar> is a column that reviews the weekly flow of the cryptoasset (cryptocurrency) market and explains its background. Beyond simply listing prices, it analyzes global economic issues and investor movements in a multi-dimensional way and provides insights that can gauge the market's direction.

Major Coins

1. Bitcoin (BTC)

Even in the new year, Bitcoin has continued to move sideways without finding a clear direction. Over the past two weeks, the price has been trapped in the 87,000–88,000 dollar range, showing a typical box-range market. As of the 2nd, CoinMarketCap shows Bitcoin trading around 88,000 dollars.

On-chain data makes the structural background of this stagnation relatively clear. According to CryptoQuant, the 30-day moving average of the MVRV indicator, which represents market value relative to realized value, is currently around 1.55, still below 1.77, which has acted as a bull-market baseline over the past decade. This means it is still difficult to judge that the market has fully returned to a bullish structure.

Investors' profit-and-loss structure also acts as a burden on Bitcoin. The average purchase price of short-term holders is about 103,000 dollars, so many remain in loss. In addition, the breakeven point for long-term holders who have held Bitcoin for more than six months is formed around 98,000 dollars, so even if a rebound occurs, break-even selling is likely to be released easily. Analyses also indicate that about 60% of realized capital supply is in a loss state.

In this environment, the variables the market is most focused on this year are policy and politics. In particular, whether the U.S. 'Clarity Act' (Clarity Act) will finally pass is cited as a key issue. If this bill, which clearly distinguishes whether cryptoassets are securities or commodities and clarifies regulatory jurisdiction, passes, it could give banks and large institutions that have been on the sidelines a rationale to enter the market. Citigroup said regulatory clarity could be a catalyst for increased inflows into spot exchange-traded funds (ETFs).

Political variables are also important. Depending on the results of the U.S. midterm elections scheduled for November, the momentum for crypto-friendly policies may or may not be maintained. There are warnings that if the Republican Party loses control of the House and Senate, the current pro-crypto stance could weaken.

This year's outlook for Bitcoin is sharply divided. A CryptoQuant contributor affiliated with Xwin Japan Research warned, "If the recession intensifies, Bitcoin could fall below 80,000 dollars, and in an extreme scenario drop to the 50,000-dollar range." On the other hand, JPMorgan and Citigroup cited improved regulatory environment and institutional adoption as grounds to suggest mid- to long-term upside potential to 140,000–180,000 dollars. Ultimately, many assess that this is a period requiring patience rather than a time to draw firm conclusions about direction.

2. Ethereum (ETH)

Ethereum recovered to 3,000 dollars as of the 2nd on CoinMarketCap, showing relatively resilient movement among major coins. However, on-chain data captures mixed signals at the same time.

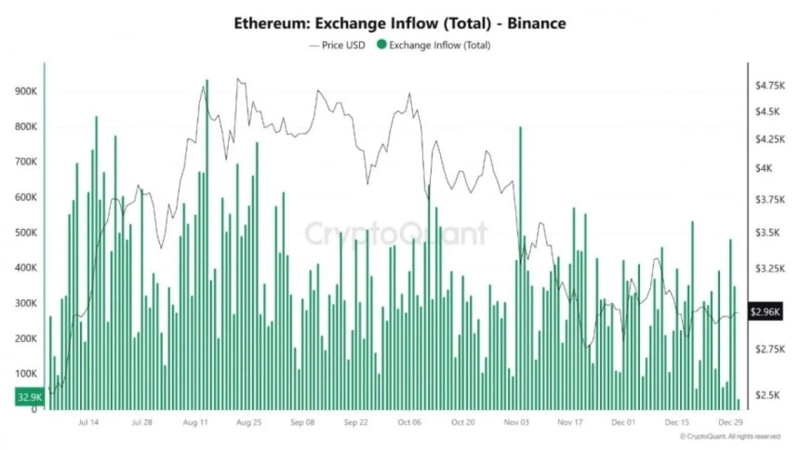

First, exchange inflows have increased significantly. In December last year alone, the amount of Ethereum flowing into Binance was about 8.5 million ETH, and exchange balances increased to 4.17 million ETH. Increased exchange inflows are a short-term burden as they can be converted to selling at any time. In particular, given Binance's high proportion of derivatives trading, the potential for increased volatility is also open.

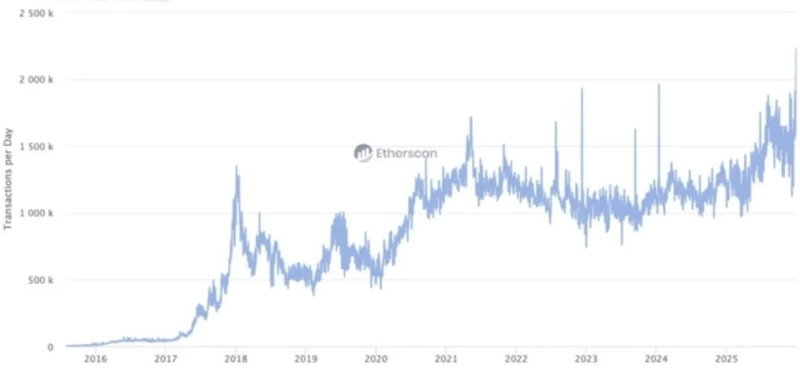

On the other hand, network activity is active. According to Etherscan, daily transactions on the Ethereum mainnet recently reached 2.12 million, an all-time high, and average fees fell to around $0.17. Compared with May 2022, when fees per transaction exceeded $200, the structural improvement is clear.

The market is focusing on an Ethereum upgrade scheduled this year. The 'Glamsterdam' upgrade, planned for the first half of the year, is expected to raise scalability and efficiency a notch through parallel execution and fee-structure improvements. The upgrade is more about laying the groundwork for the expansion of DeFi and the Web3 ecosystem than providing short-term price stimulus.

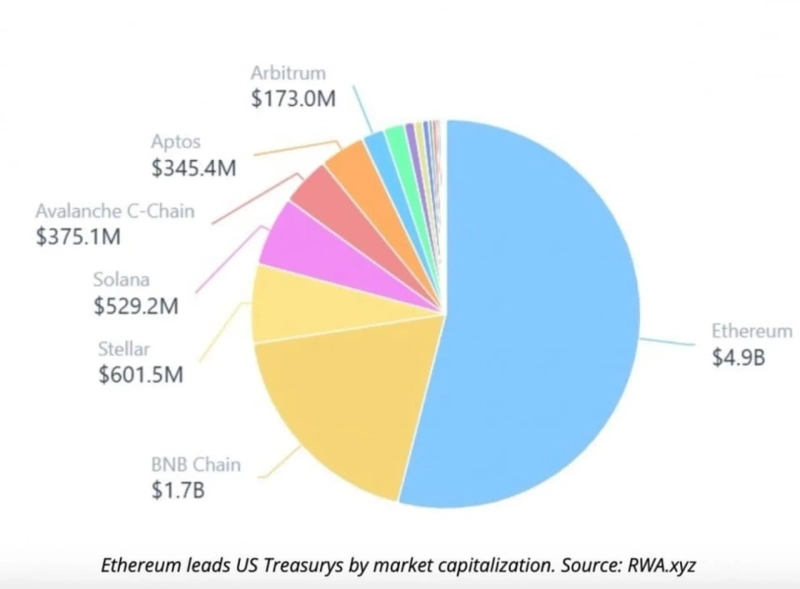

Additionally, expectations for real-world asset tokenization (RWA) and stablecoin growth are cited as medium- to long-term strengths. CoinShares projected in its '2026 Digital Asset Outlook' report that the growth of the RWA market will continue this year. It emphasized that tokenization of large assets such as U.S. Treasuries is focusing on the Ethereum network. A representative example is JPMorgan launching an Ethereum-based tokenized money market fund. Stablecoins are also expected to exceed a market size of 500 billion dollars by the end of this year, with more than half already trading on the Ethereum network.

In the short term, whether the 2,760-dollar support holds is important. Crypto media BeInCrypto suggested that if that price is breached, a drop to 2,650–2,400 dollars, and in the worst case to 1,320 dollars, is possible. Conversely, overcoming 3,470 dollars is necessary for a reversal to the upside, and a strong recovery phase is expected only above 4,770 dollars.

XRP showed the weakest performance among major coins this week. Even as Bitcoin and Ethereum modestly rebounded, XRP failed to follow the rise, giving up the $1.9 level and currently remaining in the $1.86–1.87 range.

The background to the weakness is increased exchange inflows. According to CryptoQuant, XRP inflows to Binance surged since mid-December last year. Since the 15th of last month, daily inflows have increased from a minimum of 35 million XRP to a maximum of 116 million XRP. A CryptoQuant contributor analyzed, "It is possible that profit-taking and stop-loss selling have occurred simultaneously over the past two weeks," and said, "If exchange inflows remain at high levels, a meaningful rebound will not be easy."

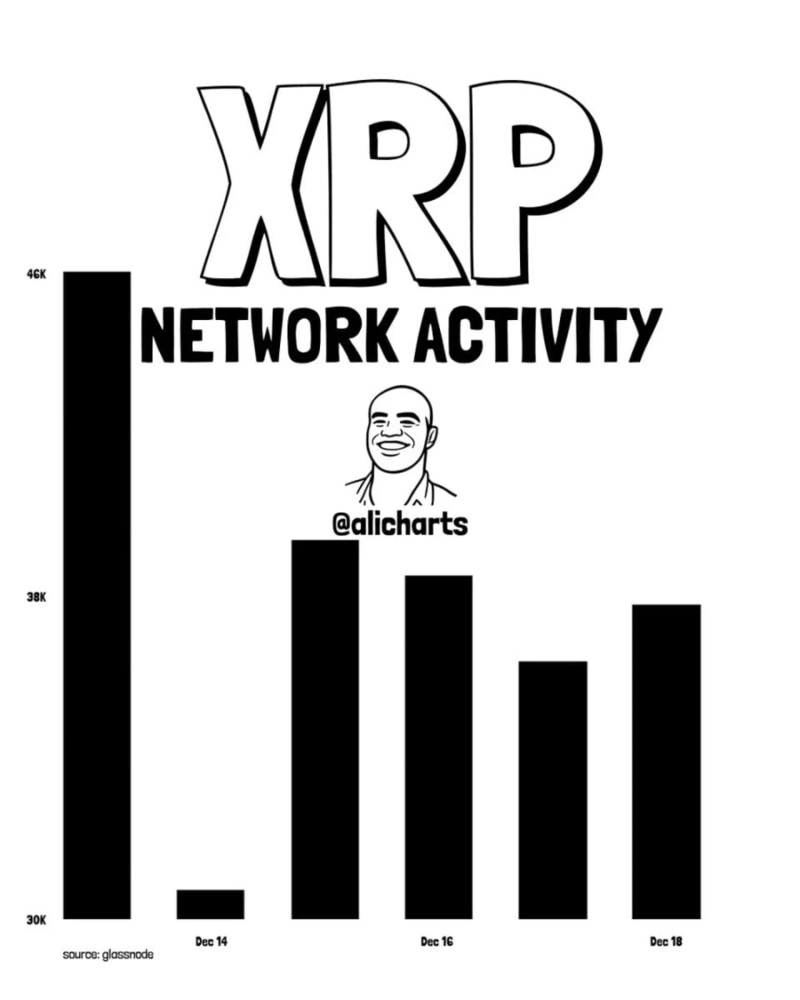

Network activity is also slowing. Analyst Ali Martinez said XRP's daily active addresses decreased from 46,000 to around 38,500, diagnosing a clear bearish trend. This is interpreted as a signal that actual user participation and interest are declining.

However, the medium- to long-term narrative remains valid. Centered on the XRP Ledger (XRPL), stablecoins, asset tokenization, and institutional DeFi functions are expanding, and an institutional lending protocol is scheduled to be launched in the first quarter.

In the short term, defending the $1.85 level is key. CoinDesk analyzed that if this level is not maintained, XRP could fall to $1.77–1.80. Conversely, if it recovers to $1.87 and then holds above $1.90, a challenge to the $1.95–2.00 range may be possible.

Long-term outlooks are mixed. Standard Chartered said, "If the regulatory environment is maintained or improved, XRP could rise up to 8 dollars this year." However, it added, "The highest probability for 2026 is that the price will remain in the $1.04–3.40 range," and analyzed that "the speed of ETF inflows and the recovery of global investment demand will determine the actual path."

Issue Coins

1. Binance Coin (BNB)

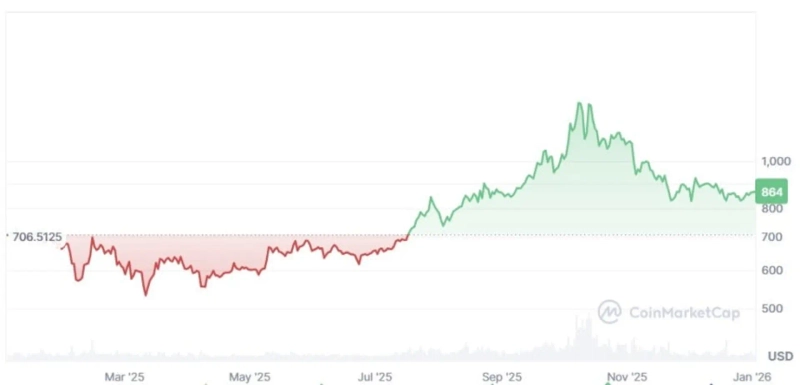

Binance Coin has shown relatively resilient movement even as the broader market undergoes corrections. It has posted the highest year-to-date gain among top market-cap coins and, after the recent correction, is trading in the $860–870 range.

The background is a reduction in regulatory risk. After President Trump took office, the pro-crypto stance in the U.S. strengthened, quickly resolving uncertainties surrounding Binance. In particular, the official withdrawal of the lawsuit with the U.S. Securities and Exchange Commission (SEC) last May had a decisive impact on investor sentiment. Additionally, the pardon of former Binance CEO Changpeng Zhao in October last year also acted as a catalyst for price gains.

Technically, the 'Fermi' hard fork scheduled for the 14th is attracting attention. Block generation speed will be shortened from 750 milliseconds to 250 milliseconds, and an indexing technology that allows only required data to be queried quickly will be introduced. This is evaluated as an infrastructure improvement aimed at high-frequency financial services and institutional demand.

In the short term, whether it breaks 870 dollars is important. If that zone is converted into support, additional upside may open, but if it is lost, a correction is also possible.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

![Bitcoin retakes KRW 100 million amid reports of secret US-Iran contacts…$72,000 in focus [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/3beef0db-a8f6-4977-9dca-6130bf788a69.webp?w=250)