"US tariff policy negatively affects the US dollar's status"...Economists voice concern

Summary

- Economists said the uncertainty of tariff policy is having a negative impact on the international status of the U.S. dollar.

- They said that rather than tariff increases themselves, policy uncertainty and weakening of central bank independence are major causes of dollar depreciation.

- While the likelihood of large-scale capital outflows from U.S. assets is low at this time, investors are moving to hedge against the risk of dollar weakness.

"A tariff war is undermining the advantage the United States enjoys as the issuer of the reserve currency." (Oleg Itskhoki, Professor, Harvard University)

The American Economic Association (AEA) 2026 annual meeting, which began a three-day session on the 3rd (local time) in Philadelphia, was dominated by discussion of 'Trump (Donald Trump, President of the United States)'. Sessions analyzing various Trump administration policies and their potential effects on economic policy ran in succession. Conscious that the influence of 'orthodox' economists has noticeably declined, there were many sessions discussing how economics can actually influence policy.

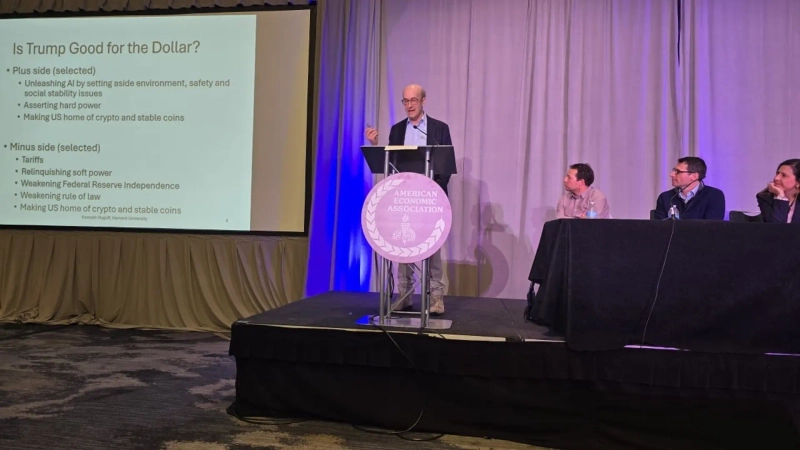

The most notable session on the first day was "The Dollar after the Tariff War," attended by Professor Kenneth Rogoff of Harvard University. Itskhoki, who received the John Bates Clark Medal in 2022 and is one of the most closely watched researchers in international finance, was the first presenter. Itskhoki argued through mathematical modeling about whether it is appropriate for a country with a serious U.S.-style trade deficit to introduce tariffs to eliminate that deficit, saying, "While the conventional wisdom is that tariff rates should be raised to eliminate trade deficits, in the case of the United States the optimal tariff rate may appropriately be not too high."

His argument is that because the United States has enormous dollar-denominated external liabilities (assets outside its borders), if tariff policy causes the dollar to appreciate, the burden from higher debt costs would be greater. He said that while maintaining high tariff rates can reduce the trade deficit, this would not be the result of a revitalized manufacturing sector but rather the outcome of the United States becoming poorer due to increased debt burdens. He also explained, "Before tariffs, holding U.S. assets served as insurance against a trade war, but after tariffs there will be demand to reduce that position," adding, "the U.S.'s ability to sustain a trade deficit will be reduced."

Various interpretations followed regarding the sharp drop in the dollar on 'Liberation Day,' when tariff uncertainty had increased. Itskhoki said, "Investors believed the dollar was always strong in crises, but on April 2 last year the dollar weakened," and predicted, "When investors buy U.S. dollar assets going forward, they will try to hedge the 'risk of dollar weakness.'"

Following him, Professor Sevcan Kalemli-Ozcan of Brown University, who spoke next, pointed out that uncertainty over tariff policy is having a negative effect on the status of the U.S. dollar. He said that raising tariffs itself should be a factor causing dollar appreciation, noting, "As in Trump’s first term (2018), the dollar should have appreciated last year as well, but it weakened last year," and explained, "The uncertainty about how tariff policy will change in the future brought about the decline in the dollar's value."

Linda Tesar, Professor at the University of Michigan, who served as a discussant for Professor Ozcan, added, "There is a lot of evidence that when tariffs are imposed, demand for domestic goods rises and the currency appreciates," and said, "In the U.S. there is also a safe-haven preference in crises that usually strengthens the dollar, so we need to examine why it weakened." She interpreted this as "meaning the uncertainty effect was large enough to outweigh the appreciation pressure from imposing tariffs."

Professor Tesar emphasized, "We should not look at tariffs alone," and listed factors that have increased uncertainty, including "the risk that the Marrakesh Agreement might be implemented, risks to the Federal Reserve's independence, taxation of foreign investors, rising public debt, and the breakdown of alliances."

Economists also noted that the 'scale' of tariffs would be an important variable. The 30% nominal tariff rate initially proposed by the Trump administration is not actually being maintained. Regarding this, Professor Ozcan said, "If tariffs are small, the impact is small," and added, "There is research showing that the impact of tariffs at the 10% level would be negligible."

The economists stressed that even amid high U.S. policy uncertainty, continued investment in the United States suggests there is no need to expect a large-scale 'exodus' of U.S. assets. Professor Ozcan interpreted, "The dollar's weakness is more of a move to hedge against uncertainty than selling U.S. assets," adding, "There is no need for a massive 'exodus' of capital from the West." Itskhoki also said, "Current data do not indicate deleveraging of U.S. assets, and even if deleveraging occurs, the process would be very slow."

Professor Rogoff's original presentation topic was stablecoins, but he spoke broadly about how Trump administration policies overall affect the dollar. Skeptical of the claim that stablecoins would stimulate demand for U.S. Treasury securities and push up the dollar's value, he warned that such coins could bring about a 'free banking era' like 19th-century America and increase financial instability.

He went on to say, "What threatens the dollar more than tariffs is the 'erosion of the rule of law' and 'corruption.'" He argued that "weakening the Fed's independence by the Trump administration and the loss of institutional trust" are eroding the dollar's status.

Philadelphia=Lee Sang-eun, correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)