Rich Dad Kiyosaki "Maduro's arrest is a clash over currency dominance… Bitcoin, a refuge amid risk"

Summary

- Robert Kiyosaki said the arrest of Venezuelan President Maduro was a clash over currency dominance.

- Kiyosaki said Bitcoin can serve as a refuge for individuals and states to defend against central bank policies or political intervention.

- He said Bitcoin is showing itself to be emerging as a potential safe-haven asset in an era of financial conflict.

The arrest of Nicolás Maduro, the president of Venezuela, is not simply a political or diplomatic matter but an extension of a conflict over global currency dominance, and there are claims that in this process Bitcoin (BTC) can serve as a refuge for both states and individuals.

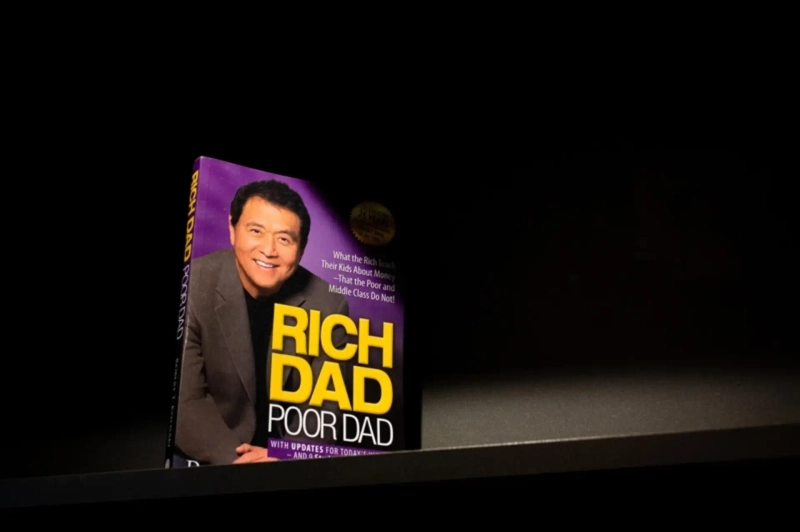

According to crypto asset (cryptocurrency) specialized media Cointribute on the 5th, American investor and author of the bestseller 'Rich Dad, Poor Dad', Robert Kiyosaki, wrote on his social media on the 4th (local time) that "Maduro's arrest is a matter of currency dominance, not oil," and that "the pattern of structurally pressuring countries trying to break away from the dollar system is repeating."

Kiyosaki noted that Venezuela, while possessing abundant oil reserves, has in recent years attempted to bypass the dollar-centered payment system. He explained, "Oil is not a simple resource but a key means of sustaining demand for the dominant currency," and "moves to reduce dollar dependence in energy transactions directly lead to geopolitical tensions."

He compared this trend to the past case of Iraq. The early 2000s attempt by Iraq to switch oil payments from the dollar to the euro, and the subsequent return of oil trade to the dollar system following the invasion, is an example that shows the significance of currency dominance in the international order.

Kiyosaki defined the current geopolitical conflict as a 'clash between systems' rather than a military confrontation. He argued, "Sanctions now extend beyond trade itself to shipping, insurance, and payment infrastructure," and "countries trying to exit the dollar system are more exposed to unconventional pressure."

In such an environment, Bitcoin's role is also being reexamined. Kiyosaki said, "Through its decentralized structure, Bitcoin can be a means for individuals and states to defend themselves against central bank policies or political intervention," and "it is increasingly likely to serve as a refuge for entities excluded from the mainstream financial system."

He viewed recent trends such as the expansion of BRICS countries, the establishment of alternative payment systems, central banks' increased purchases of gold, and the wider use of national currencies in international trade as being in the same context. He explained that crypto assets, which are not constrained by traditional financial infrastructure, are attracting attention as means of international transactions and asset preservation.

Kiyosaki predicted, "The more money becomes politicized, the more citizens and the real economy are the first to suffer," and "in countries with significant economic instability like Argentina or under geopolitical pressure like Venezuela, Bitcoin is becoming an increasingly realistic option."

He added, "Maduro's arrest has left a monetary shockwave in the crypto asset market," and "Bitcoin is showing that it is emerging beyond a mere alternative asset into a potential safe-haven asset that functions in an era of financial conflict."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.