"Bitcoin shows signals of structural rebound…Will preference for risk assets resume?"

공유하기

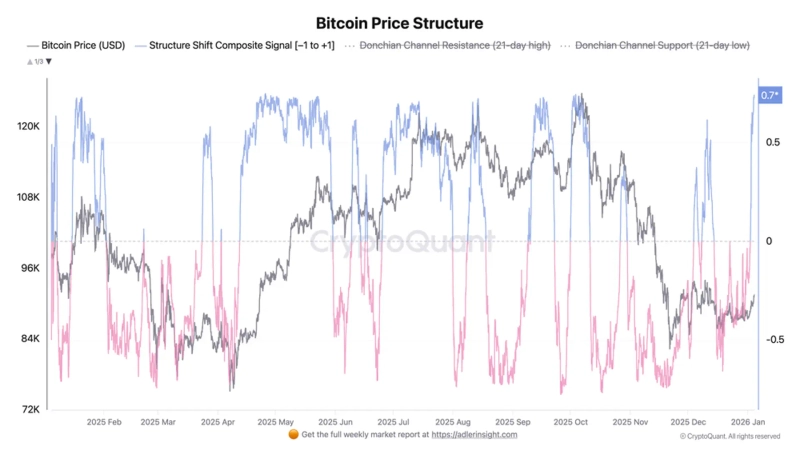

- "Analyst Axel Adler Jr. said that Bitcoin (BTC) is breaking away from the bearish trend at the end of last December and is showing signs of structural recovery."

- "He said that market structure indicators such as Structure Shift and momentum indicators are both bullish, but whether the recent $91,400 resistance is broken will be the turning point for a trend reversal."

- "While the current price level is approaching the top of the channel and short-term correction is possible, he projected that if the structural indicators stay above the zero line and the resistance zone is breached, there is room for further upside."

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Analysis indicates that Bitcoin (BTC) appears to be showing signs of structural recovery, breaking away from the bearish trend that continued at the end of last December. However, in the short term, whether it can break through major resistance zones is expected to be the turning point for a trend reversal.

On the 5th, on-chain and technical analyst Axel Adler Jr. said on his blog, "Market structure indicators are simultaneously shifting from a bearish phase to a bullish phase," and diagnosed that "Bitcoin is moving into a risk-asset preference phase."

Adler Jr. explained that his proprietary indicator 'Structure Shift', which combines price position within the channel, moving average trend, and price directionality, has recently moved out of negative territory and entered a strong positive area. The indicator had remained in a negative zone below –0.3 at the end of last December, reflecting bearish pressure, but it rebounded after the 2nd of this month and rose to +0.73 as of the 4th.

During the same period, Bitcoin's price also recovered from around $87,500 to about $91,400, which is seen as supporting the structural transition trend. Adler Jr. explained, "Periods in which Structure Shift exceeds +0.5 have often coincided with trend-driven rally phases in the past."

Momentum indicators are also showing bullish signals. Recently, Bitcoin momentum has been formed in the 0.85–0.89 range and is analyzed to have rapidly strengthened its rate of increase compared with the three-month average. However, since the price is approaching the upper end of the trading range formed over the past three weeks, the possibility of short-term overheating is also being mentioned.

Adler Jr. said, "The current price level is located at the top of the channel, so the possibility of a short-term correction cannot be ruled out," and predicted, "If it breaks through and settles above the resistance around $91,400, the room for further gains could open."

He added, "The key is whether the structural indicators can absorb the resistance zone while staying above the zero line," and added, "If the indicator falls back below neutral, this rebound could be limited to a technical bounce."

![Dow, S&P 500 Reach Record Highs... Micron Soars 10% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/e8e84b89-80b4-44ce-a1cb-974a1742b2a2.webp?w=250)