[Analysis] "Bitcoin whales returning to market… Chance of surpassing $100,000 increases"

Summary

- CryptoQuant's on-chain indicator, Exchange Whale Ratio (EWR), has recently recorded high values, indicating whale investors are returning to the market.

- The analysis said that as the indicator maintains a stable high, the possibility of Bitcoin recovering to $100,000 has increased.

- It emphasized that global macro variables and an environment of expanded U.S. dollar liquidity could act positively for risk assets such as Bitcoin.

Bitcoin (BTC) whales (large investors) appear to be returning to the market. Analysis says the possibility of Bitcoin reclaiming $100,000 is also increasing.

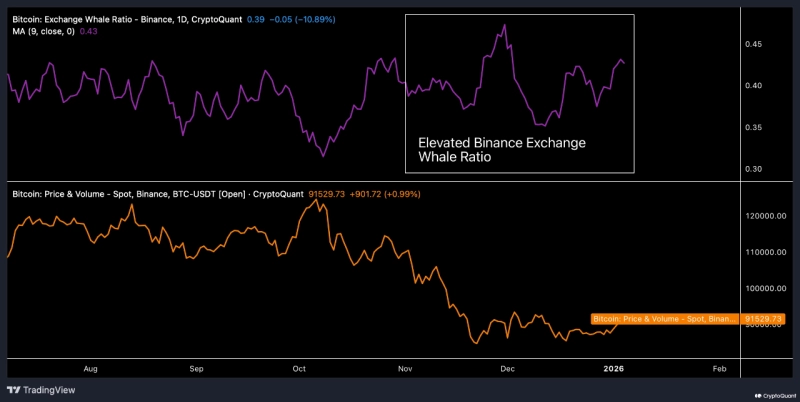

Oinonen_t, a CryptoQuant contributor, said on the 7th (local time) via CryptoQuant, "Binance's 'Exchange Whale Ratio (EWR·Exchange Whale Ratio)' has recorded high values over last month and this month," adding, "This shows whales are returning to the market." EWR is an on-chain indicator developed by CryptoQuant that measures the influence of large-scale trades within an exchange on the market.

Oinonen_t said, "The 9-day moving average of EWR rose to 0.43," and "this is the highest value so far this year."

Oinonen_t emphasized, "Given the current market structure, EWR is stably holding at a high level, so it can be seen that whale-originated selling pressure has entered a depletion phase." He noted, "Binance is an exchange preferred by whales and has served as a key indicator reflecting the overall market," and analyzed, "(According to Binance's EWR indicator) an environment is being formed in which Bitcoin can recover to the $100,000 range."

He also mentioned macroeconomic variables. Oinonen_t said, "In terms of the global macro environment, tensions are rising, but this could rather act as a positive factor for Bitcoin," and pointed out, "Arthur Hayes, co-founder of BitMEX, recently analyzed that geopolitical conflict related to Venezuela could push oil prices down and lower energy costs, which could ease inflationary pressure in the U.S."

He added, "This could create an environment in which the Federal Reserve (Fed) can supply large-scale dollar liquidity," adding, "Liquidity released in this way would inevitably flow into risk assets."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Analysis] “ETFs and short covering drove Bitcoin’s rebound…on-chain indicators are mixed”](https://media.bloomingbit.io/PROD/news/6c7dbd31-4aeb-400e-9c43-c2843062fc66.webp?w=250)