[Analysis] "Bitcoin ETF drew in $56 billion over two years... inflows expected to resume"

Summary

- Matrixport said Bitcoin spot ETFs inflows are expected to resume this year.

- About $34 billion and $22 billion flowed in during 2024 and 2025 respectively, which it said provided meaningful downside support for Bitcoin.

- Matrixport analyzed that this year Bitcoin spot ETF inflows would act as a strong buying force and be an important upward catalyst for Bitcoin's price.

There is a view that the inflow of funds into U.S. Bitcoin (BTC) spot exchange-traded funds (ETFs), which were sluggish in the second half of last year, will resume this year.

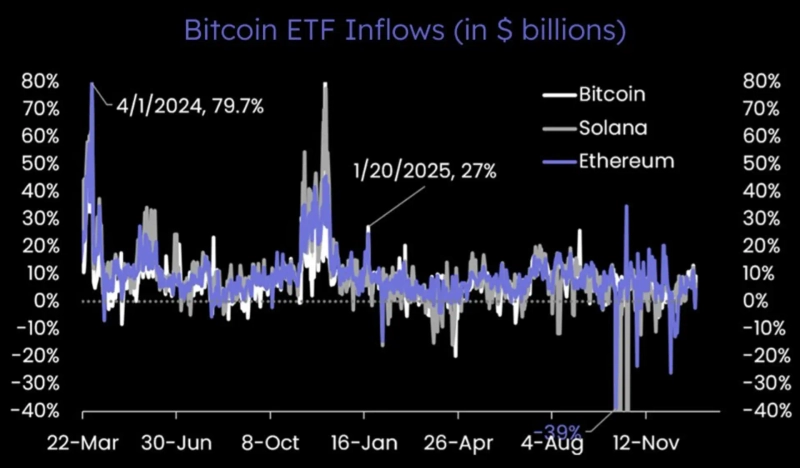

Crypto analytics firm Matrixport said on the 7th (local time) via its official X account, "Approximately $34 billion flowed into Bitcoin spot ETFs in 2024 and about $22 billion in 2025," adding, "the steady inflows from buyers have provided meaningful downside support to Bitcoin."

Matrixport noted, "What is noteworthy is that the pace of ETF inflows in Q1 2025, despite being sluggish due to tariff shocks from U.S. President Donald Trump earlier in the year, exceeded the 2024 inflow pace until the Federal Open Market Committee (FOMC) meeting at the end of October." It added, "Afterward, the inflow pace rapidly accelerated until mid-last year," and said, "(the inflows) entered a temporary stagnation phase in the fourth quarter."

Matrixport emphasized, "The prevailing interpretation is that this trend is closer to a cyclical adjustment rather than a structural change." Matrixport analyzed, "There is a high likelihood that fund inflows into Bitcoin spot ETFs will resume this year," adding, "this will act as a stronger buying force than before and become an important upward catalyst for Bitcoin's price."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul