Summary

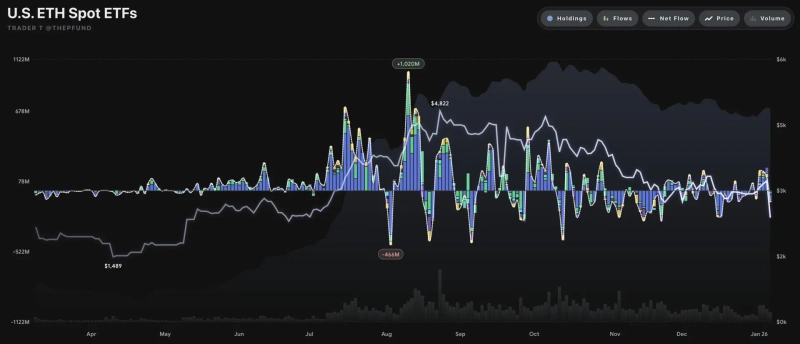

- The US spot Ethereum ETF market saw net outflows of $98.59 million from ETFs over a single day.

- Net outflows were reported at $52.05 million from Grayscale’s Ethereum Trust ETHE and $13.03 million from the Grayscale Mini Ethereum ETF.

- Franklin Templeton’s EZET posted net inflows of $2.38 million, while many products showed net outflows or no change in flows.

Forecast Trend Report by Period

US spot Ethereum exchange-traded funds (ETFs) saw a large one-day capital outflow. With multiple products posting outflows, the overall tally came in as net outflows.

According to TraderT’s tracking of US spot Ethereum ETF flows on the 7th (local time), the ETF complex posted net outflows of $98.59 million on the day. Most products were in the red, with only a few ETFs showing limited inflows.

By product, BlackRock’s ETHA saw $6.78 million leave the fund, while Fidelity’s FETH posted net outflows of $13.29 million. Bitwise’s ETHW also recorded $11.23 million in outflows, adding to the broad-based weakness.

Outflows were largest from Grayscale products. The legacy Grayscale Ethereum Trust (ETHE) logged net outflows of $52.05 million, and the Grayscale Mini Ethereum ETF saw $13.03 million withdrawn.

In contrast, Franklin Templeton’s EZET recorded net inflows of $2.38 million, the only fund to show a clear inflow. VanEck’s ETHV posted net outflows of $4.59 million, while 21Shares’ CETH and Invesco’s QETH saw no change in flows.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)