Summary

- Sangsangin Securities said international oil prices fell despite the U.S. airstrike on Venezuela, and it maintained its 2026 average oil price forecast at $58 per barrel.

- Experts noted the potential for a rise in gold prices amid heightened geopolitical anxiety, saying the 'Gold Long (buy gold), Oil Short (sell crude)' strategy remains valid.

- Citing the S&P 500’s average 5.5% return over 90 days following U.S. military interventions, the report said the impact on equities would be limited to increased near-term volatility.

Forecast Trend Report by Period

U.S. military stages surprise raid, arrests President Maduro

Geopolitical risks resurface

Oil prices instead trend lower; $58 outlook

"Expectations of increased supply"

Sangsangin Securities: "This year’s core strategy is

'Gold Long, Oil Short' remains valid"

As the United States launched a sudden airstrike on Venezuela and arrested President Nicolás Maduro, uncertainty in global commodity markets has surged to an extreme.

Military intervention in an oil-producing nation typically triggers a spike in crude prices, but this time analysts say attention should instead turn to gold, a safe-haven asset.

Oil muted despite airstrikes… "Expectations of greater supply via industry rebuilding"

According to Sangsangin Securities’ research center on the 8th, the U.S. military on Jan. 3 struck the Venezuelan capital and arrested Maduro, citing the eradication of drug trafficking and the defense of democracy, before transferring him to the United States.

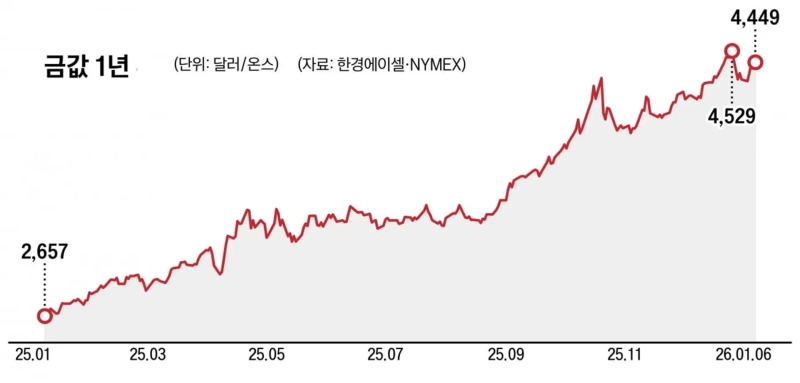

Despite the direct attack on an oil producer with the world’s largest proven reserves, international oil prices edged down shortly after the open.

Markets are focusing on the fact that the operation’s objective appears to be regime change rather than controls on oil exports. The outcome is seen as reflecting the possibility that supply could actually expand through U.S.-led rebuilding of the oil industry.

Sangsangin Securities maintained its 2026 average oil price forecast at $58 per barrel as OPEC+’s production increases gain momentum.

The real protagonist is 'gold'… higher returns than during the Iraq war

Experts are advising investors to focus on moves in gold prices rather than crude in commodity markets. Uncertainty remains, including the possibility of a second U.S. strike, and China’s response could spill over into concerns about an invasion of Taiwan—factors that are stoking medium- to long-term demand for safe-haven assets.

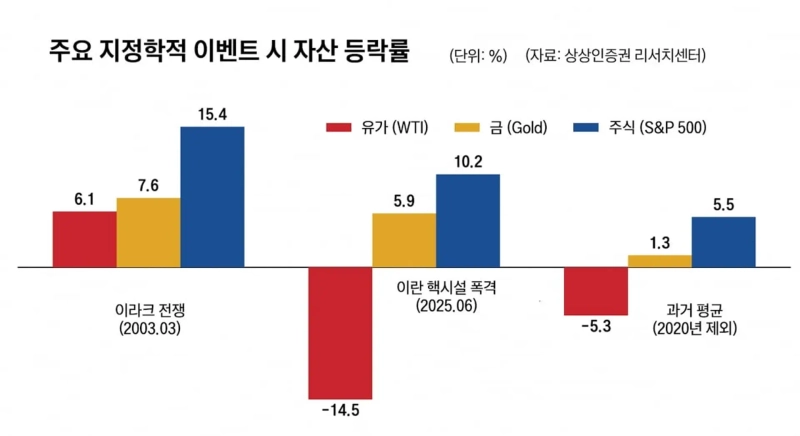

Past cases show that during the 2003 Iraq war, oil prices rose only 6.1% over 90 days, while gold climbed 7.6%, outperforming crude.

Choi Ye-chan, an analyst at Sangsangin Securities, said, "Rising geopolitical instability will be a driver of price gains for gold," and projected that the 'Gold Long (buy gold), Oil Short (sell crude)' strategy would remain a valid core theme for this year’s commodity markets.

Limited impact on equities… "Will remain a factor for near-term volatility"

Meanwhile, the negative impact of this military action on the stock market is expected to be limited. Historically, following U.S. military interventions, the S&P 500 has posted an average 90-day return of 5.5%, showing resilience.

After the 2003 Iraq war, it even surged 15.4% over 90 days. The report said that unless the battlefield expands across the globe, the impact on equities will likely be confined to heightened near-term volatility.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] “ETFs and short covering drove Bitcoin’s rebound…on-chain indicators are mixed”](https://media.bloomingbit.io/PROD/news/6c7dbd31-4aeb-400e-9c43-c2843062fc66.webp?w=250)