Editor's PiCK

[Analysis] "Bitcoin open interest at its lowest level since 2022…could be a precursor to a rebound"

공유하기

Summary

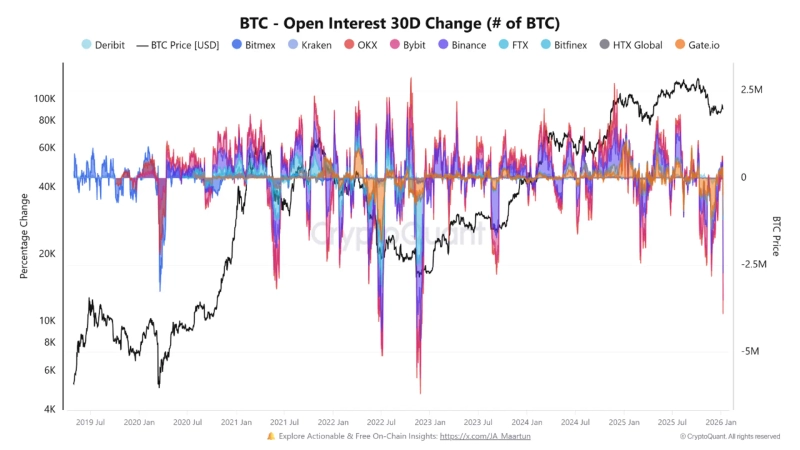

- CryptoQuant said Bitcoin’s 30-day open interest change indicator plunged, signaling a sharp decline in derivatives market activity.

- Open interest fell markedly on Binance, Bybit and Gate.io, and as risk appetite weakened in the futures market, Bitcoin’s price dropped to $90,150.

- The contributor said low open interest reflects a washout of excessive leverage and a decline in systemic risk, noting that similar episodes since 2022 have often preceded a consolidation phase or a bullish reversal after prices stabilized.

Bitcoin (BTC) derivatives open interest—a key gauge of market activity—has plunged.

On the 9th (KST), CryptoQuant contributor Arab Chain wrote in a report that “the 30-day open interest change indicator in the current Bitcoin market has dropped sharply,” adding that “this shows a steep decline in derivatives market activity.”

According to the data, the largest declines in open interest were seen on Binance (-1.53 million), Bybit (-784,000) and Gate.io (-505,000), in that order.

The contributor said, “This indicates risk appetite in the futures market has weakened,” adding, “Bitcoin’s price also fell to $90,150 alongside the drop in open interest.”

However, the contributor also suggested this could present an opportunity for Bitcoin to rebound. He emphasized that “such a low level of open interest signals a market reset in which excessive leverage is flushed out and systemic risk declines,” and that “historically, since 2022, when open interest reached similar levels, once price action began to stabilize it often led into a consolidation phase or even a bullish reversal.”

![AI, chip stocks rally… Dow, S&P 500 hit new all-time highs [New York markets briefing]](https://media.bloomingbit.io/PROD/news/37cb1f18-76d9-4651-be29-2e4bb84aa999.webp?w=250)