"Binance sees slowdown in short-term investor inflows… easing Bitcoin sell pressure"

공유하기

Summary

- An analysis said that as inflows of Bitcoin from short-term holders into Binance decline, near-term selling pressure is easing.

- Current short-term holder Bitcoin inflows are below 6,000 BTC, far lower than the November peak, indicating that a significant portion of immediately sellable supply has already been distributed to the market.

- The analyst added that if short-term holder inflows surge again, it could signal a resumption of adverse volatility, and that maintaining inflows below November levels will be the key variable determining the near-term direction.

An analysis suggests that as Bitcoin inflows to Binance from short-term holders have declined markedly, near-term selling pressure is easing.

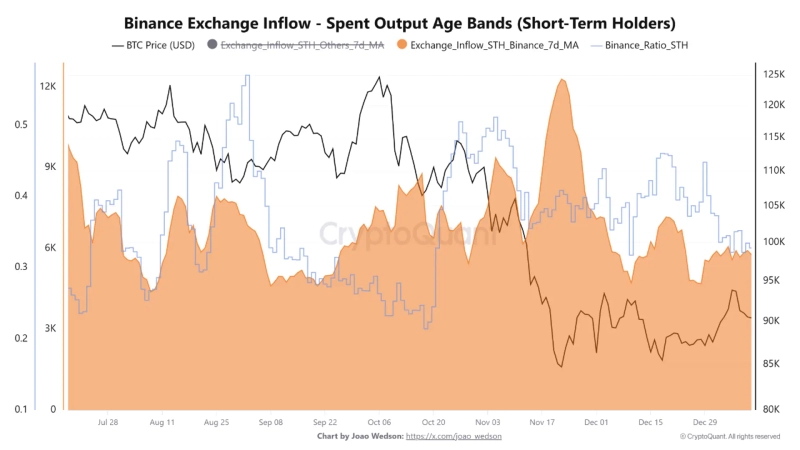

On the 12th, ArabChain analyst said via a CryptoQuant Quicktake report that "since January, the amount of Bitcoin from short-term holders flowing into Binance has fallen noticeably compared with November and December last year."

He explained, "In November last year, the 7-day moving average of short-term holder Bitcoin inflows exceeded 12,000 BTC, reaching a very high peak," adding that "with Bitcoin trading around $84,000 at the time, panic selling or aggressive profit-taking became concentrated, creating strong selling pressure."

He continued, "In December, inflows from short-term holders persisted, but the intensity fell sharply, and the inflow size did not exceed 7,000 BTC," adding that "during this period, Bitcoin entered a sideways phase after a sharp drop and attempted only a limited rebound."

He assessed that clearer signs of easing are emerging in recent trends. He said, "Current short-term holder inflows to Binance remain below 6,000 BTC, showing a clear difference from the November peak." He also noted, "The share of short-term holders on Binance is also maintaining a relatively stable trend, and no new wave of large-scale selling by short-term traders is being observed."

The analyst said, "This suggests that a significant portion of immediately sellable supply was already distributed to the market during the previous correction," adding that "as direct selling pressure diminishes, Bitcoin has room to form a price bottom and attempt a gradual stabilization phase."

However, he added, "If short-term holder inflows surge again, it would be a warning signal that negative volatility could resume," and "for now, whether inflows remain below November levels will be the key variable determining the near-term direction."