Summary

- It reported that the number of failed digital-asset projects in 2025 topped 11.6 million, the largest ever on an annual basis.

- It said token survival rates fell sharply, especially in the meme-coin sector, and analyzed that about 7.7 million tokens stopped trading after the October market plunge.

- It said meme-coin market capitalization increased from $38 billion at the end of December last year to $47.7 billion in early January this year, and has recently been hovering around $43.7 billion.

Meme coins were found to have taken the biggest hit as volatility in the digital asset (cryptocurrency) market increased last year.

According to crypto-focused outlet CryptoNews on the 12th, the total number of failed digital-asset projects in 2025 topped 11.6 million, the largest on record on an annual basis.

Losses were concentrated particularly in the fourth quarter. Shaun Paul Lee, an analyst at a research unit under CoinGecko, said in a report that "following the market plunge in October, about 7.7 million tokens stopped trading between October and December." The figure was compiled based on tokens listed on GeckoTerminal for which trading activity can no longer be confirmed.

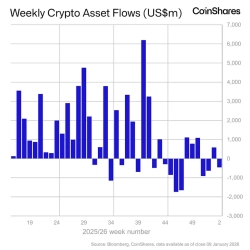

The report explained that a bout of sharp market turmoil—during which roughly $19 billion in leveraged positions were liquidated in a single day on Oct. 10 last year—served as a key catalyst accelerating project collapses. It also found that amid broader market instability, token survival rates fell sharply, particularly in the meme-coin segment.

CoinGecko defines failed digital-asset projects as tokens that were once actively traded on GeckoTerminal but later stopped trading. The scale of this collapse is unusual even compared with the past: about 1.3 million projects were tallied as having failed in 2024, and 2,584 in 2021. GeckoTerminal is a platform that aggregates and visualizes real-time token trading data from decentralized exchanges (DEXs).

Beyond the market shock, a surge in token supply was also cited as a major factor. According to GeckoTerminal data, the number of listed tokens jumped from about 3 million at the end of 2024 to nearly 20 million at the end of 2025. A low-cost token issuance environment that spread around the Solana ecosystem was mentioned as a driver behind the increase.

Still, after the broad pullback, the meme-coin market has also shown signs of a rebound since the start of this year. According to CoinMarketCap, meme-coin market capitalization rose from $38 billion at the end of December last year to $47.7 billion in early January this year, and has recently been hovering around $43.7 billion.