[Analysis] "Bitcoin long-term holders’ selling slows…signal of a mid-bull-market pullback phase"

Summary

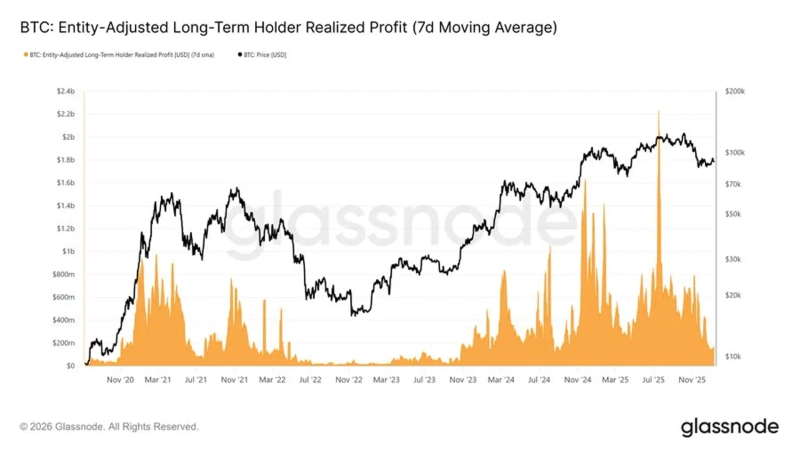

- Glassnode said profit-taking by Bitcoin long-term holders is cooling rapidly and the market is entering a new phase.

- Bitcoin long-term holders have moved out of the heavy-selling regime of the second half of 2025, and since January 2026 have cut spending and profit-taking to levels seen in past shallow bear markets.

- It said this points to the possibility that a significant portion of overhead supply has been absorbed and that market participants have entered a phase of re-assessing direction.

Forecast Trend Report by Period

On-chain analysis suggests the market is entering a new phase as profit-taking by Bitcoin (BTC) long-term holders cools rapidly.

According to Glassnode on the 13th (local time), Bitcoin (BTC) Long-Term Holders (Long-Term Holders, LTH) appear to have moved out of the heavy-selling regime that had persisted through the second half of 2025, and have sharply reduced spending since January 2026. As a result, the scale of profit-taking by long-term holders has fallen to levels seen during past shallow bear markets.

Glassnode said the shift reflects a change in market psychology rather than a simple end to selling. Slower selling by long-term holders typically emerges when uncertainty is rising, and is frequently observed during mid-bull-market correction phases or the early stages of a deeper bear market.

In particular, while long-term holders actively realized gains by taking advantage of price increases in the second half of 2025, the notable feature recently is that profit-taking pressure has eased quickly. This suggests that a significant portion of overhead supply may have been absorbed, while also indicating that market participants have entered a phase of re-assessing direction.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)