Showy FX measures end up stoking the market… “Failing to dent expectations”

Summary

- Despite the KRW/USD exchange rate breaking past 1,470, the government’s FX-market stabilization measures were said to have failed to curb expectations, instead only stirring up the market.

- The Korea Customs Service’s ongoing inspections of illegal FX transactions and pressure on companies to “nego” (sell dollars) were said to be drawing criticism for chilling legitimate FX transactions and provoking industry backlash.

- The government was criticized for focusing on short-term supply-demand imbalances and performative intervention rather than addressing structural drivers, leaving it unable to effectively bring down the exchange rate as it had previously.

Forecast Trend Report by Period

Government measures that only hobble companies… KRW/USD breaks past 1,470

Government rolls out a barrage of ineffective steps

Vows to inspect illegal FX transactions

Companies: “Even legitimate trades are being flagged”

FX authorities fail to manage market sentiment

The won–dollar exchange rate, which had been inching up since the start of the year, has again broken past KRW 1,470 per dollar. Despite a raft of market-stabilization measures mobilizing the FX authorities as well as the presidential office and multiple ministries, the assessment is that they have failed to curb expectations of further gains in the exchange rate. Critics also argue that premature responses exhausted policy options and, in doing so, only stirred up the market. In particular, the government has drawn fire for taking issue with companies’ legitimate FX transactions and for continuing to pressure exporters to “nego” (sell dollars), triggering pushback from industry.

◇ Korea Customs Service checks FX transactions

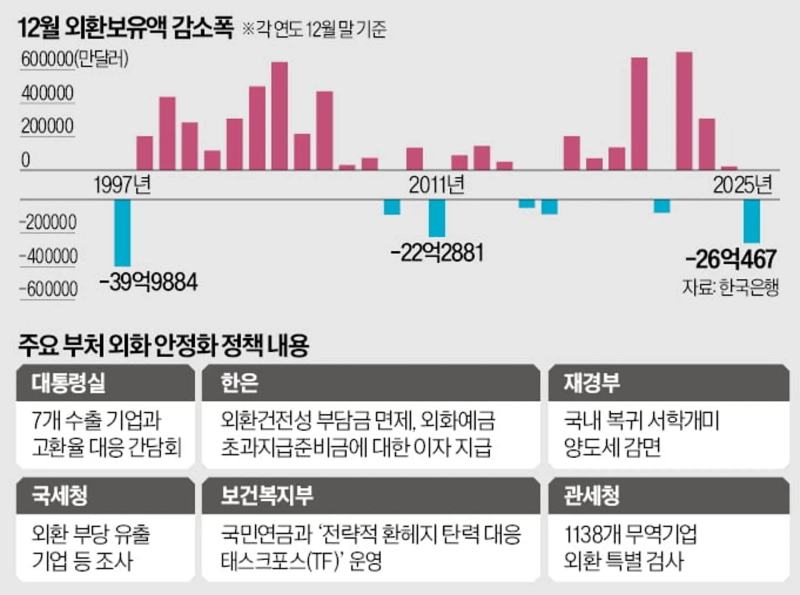

On the 12th, the Korea Customs Service held a “Nationwide Customs FX Investigation Officials Meeting on Responding to a High Exchange Rate” at the Government Complex Daejeon and announced a plan for year-round, ongoing inspections of illegal FX transactions. The targets are 1,138 companies with large discrepancies between export/import amounts reported to customs and trade payments paid/received through banks.

From January to November last year, the gap between export/import amounts reported to customs (USD 640.1 billion) and actual trade payments paid/received (USD 417.6 billion) totaled USD 168.5 billion, the largest in the past five years. As the exchange rate has surged, companies have delayed paying import bills and repatriating export proceeds.

For example, Company A may keep export proceeds received from an overseas counterparty in an overseas branch account rather than bringing them into Korea, and when obligations arise to pay another overseas counterparty, offset them locally without reporting to the FX authorities. Failing to collect export receivables in this manner is not illegal. However, cases where required filings or reports to the FX authorities are not made in the process are classified as illegal FX transactions.

Many large corporations operating production plants overseas, including in the United States, do not bring all export proceeds into Korea for purposes such as local facility investment. Companies say that even in such cases they manage foreign-currency funds in compliance with relevant laws, including the Foreign Exchange Transactions Act.

A senior official at an economic organization said, “Even if the government pressures companies to release ‘nego’ volumes or launches FX-transaction investigations, the effect on the FX market will be no more than a stopgap,” adding, “Pressuring dollar selling without considering companies’ hedging strategies will only provoke backlash from the market and from firms.”

◇ Criticism: “FX authorities only stirred up the market”

Some also say the government’s FX-market management has been all show and little substance. Since late last year, the government has unveiled numerous FX-market stabilization cards. A representative policy is exempting capital-gains tax for investors who sell overseas equities and make long-term investments in domestic stocks. With the focus placed solely on easing supply-demand imbalances, critics say it failed to break expectations of a higher exchange rate driven by structural factors such as the Korea–U.S. interest-rate differential, large-scale investment in the U.S., and Korea’s rising national debt.

Another regrettable point is that the government failed to manage market sentiment by revealing signs of anxiety. Examples cited include publicizing the National Pension Service’s “new framework” initiative by the FX authorities and related ministries such as the Ministry of Health and Welfare, as well as a series of meetings with exporters involving Kim Yong-bum, chief policy secretary at Cheong Wa Dae, and Koo Yun-cheol, deputy prime minister and minister of the Ministry of Finance and Economy. Ahn Dong-hyun, a professor in Seoul National University’s Department of Economics, said, “The FX market is a battle against expectations, and the government’s premature intervention further stimulated the market,” adding, “To break market expectations, it should have decisively deployed FX reserves to push it down to the KRW 1,300 level, but it failed to do so.”

Unlike the period from the second half of 2022 to early 2023, when the won–dollar exchange rate surged to around KRW 1,450 per dollar before being brought down to around KRW 1,200, the recent response by FX authorities is being criticized as somewhat sloppy. At the time, the Ministry of Economy and Finance (now the Ministry of Finance and Economy) first concluded a currency swap between the National Pension Service and the Bank of Korea, and then intervened aggressively by deploying nearly KRW 30 trillion in FX reserves in September 2022 alone, pulling the exchange rate down.

By Kim Ik-hwan / Jung Young-hyo / Lee Kwang-sik, lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)