'Nice buy on Samsung Electronics'… Retail investors cheer as a 100 trillion won jackpot looms

Summary

- KOSPI-listed companies in Korea are forecast to post EPS growth of 54.3% this year, with the increase in net profit estimated at 108.5422 trillion won.

- Samsung Electronics and SK hynix are expected to account for 70.8% of the net profit increase, fueling expectations that the KOSPI could break above 5,000.

- The KOSPI broke above 4,700 for the first time ever, extending its record-high streak to nine straight sessions, and is up 11.6% so far this year.

Forecast Trend Report by Period

Korea’s EPS growth rate 54%… three times the U.S.; riding 'Samsung–Hynix' toward KOSPI 5,000

Semiconductor sprint… Korea ranks No. 1 in corporate profit growth

KOSPI-listed firms’ EPS expected to surge 54% this year

Of the 108 trillion won increase in net profit, Samsung and Hynix account for 70%

KOSPI breaks above 4,700… posts record highs for nine straight sessions

KOSPI-listed companies’ earnings per share (EPS) growth rate this year is expected to rank a decisive No. 1 among 10 major countries including the United States, China and Japan. That outlook reflects expectations that results at key companies such as Samsung Electronics and SK hynix will surge on the back of a memory-chip supply shortage and rising prices. Brokerages say the KOSPI, buoyed by expectations of strong earnings, could soon break through 5,000.

According to NH Investment & Securities and Bloomberg on the 14th, the KOSPI market’s EPS estimate for this year stands at 453 won 50 jeon, up 54.3% from last year (294 won). That is 2.2 times the growth rate of Taiwan’s TAIEX-listed companies (23.8%), which rank second. It is also expected to far outpace EPS growth in major markets including the U.S. S&P 500 (16.7%), India (16.6%), Vietnam (16.1%), Germany (15.2%) and Australia (13.7%).

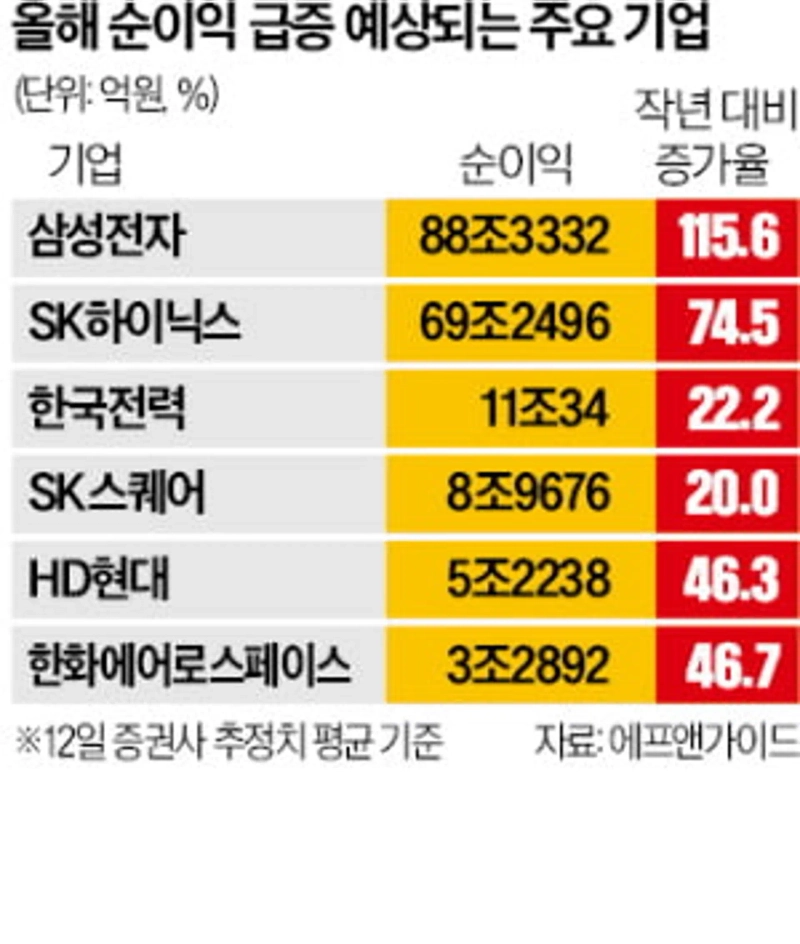

Korea is projected to post the highest EPS growth among major countries this year thanks to the “two-top” in semiconductors. An analysis by FnGuide shows that Samsung Electronics (47.3544 trillion won) and SK hynix (29.5654 trillion won) are expected to account for 70.8% of the increase in net profit this year (108.5422 trillion won) among 252 listed companies for which at least three brokerages have provided earnings estimates. In other words, semiconductor companies’ dominance is driving earnings growth for the broader listed universe.

As earnings expectations and market-boosting measures dovetailed, the KOSPI topped 4,700 for the first time ever on the day. It finished at 4,723.10, up 0.65% from the previous day, extending its record-setting streak to nine consecutive sessions. Despite sizable profit-taking by retail and foreign investors, institutional investors posted net purchases of 601.8 billion won. After rising 75.6% last year—ranking No. 1 among 42 indices across 32 countries—the KOSPI has gained another 11.6% so far this year, again leading major markets. That is twice the year-to-date rise of Japan’s Nikkei 225, which topped 54,000 for the first time on the day and is up 6.5% this year. Over the same period, the U.S. S&P 500 has risen just 1.2%.

In Seoul’s FX market, the won–dollar exchange rate (as of 3:30 p.m.) ended daytime trading at 1,477 won 50 jeon per dollar, up 3 won 80 jeon.

Net profit estimates jump 108 trillion won… 280 points left to KOSPI 5,000

Overwhelming results led by semiconductors

Analysts say the expected atypical surge in EPS for KOSPI-listed companies this year is above all driven by “semiconductor strength.” Net profit at shipbuilding and defense companies—emerging as new export-led industries—is also forecast to rise 40–50% from last year. Expectations are growing that the stock market rally will continue for the time being, underpinned by earnings growth in key export sectors such as semiconductors, shipbuilding and defense.

Semiconductors pull, shipbuilding and defense push

According to NH Investment & Securities and Bloomberg on the 14th, the KOSPI market’s EPS estimate for this year is projected to surge 54.3% from last year. Combined net profit for 252 listed companies for which at least three brokerages have issued earnings estimates is expected to total 338.6736 trillion won, up 108.5422 trillion won from last year (230.1314 trillion won).

The pace of upward revisions is unusually fast. Han Ji-young, a researcher at Kiwoom Securities, said, “Since the start of the year, the operating-profit consensus (average brokerage estimate) for KOSPI-listed companies has risen 10.8%,” adding, “The recent KOSPI rally reflects this earnings uptrend.”

Samsung Electronics and SK hynix in particular are expected to lead the earnings increase this year. Consensus estimates (compiled by FnGuide) put Samsung Electronics’ operating profit and net profit this year at 100.9736 trillion won and 88.3332 trillion won, respectively—up 144.2% and 115.6% from last year. Compared with three months ago, Samsung Electronics’ operating-profit and net-profit estimates have risen 112.9% and 105.8%. SK hynix’s operating profit is forecast at 86.4204 trillion won, with net profit at 69.2496 trillion won.

Foreign investment banks (IBs) have put forward far higher numbers. UBS forecast SK hynix will post operating profit of 150.2 trillion won this year. It also raised its operating-profit forecast for Samsung Electronics from 135 trillion won to 171 trillion won. The revisions reflect the continued surge in memory-chip prices.

Even if Samsung Electronics delivers only consensus-level operating profit, it could catch up with Taiwan’s TSMC, whose operating profit is expected to be around 100 trillion won. TSMC’s 12-month forward price-to-earnings ratio (PER) is about 26x. That comparison underpins the view that Samsung Electronics (9.19x) and SK hynix (7.36x)—both trading at relatively low PERs—have greater upside in their share prices.

Some warn of 'earnings concentration'

Shipbuilding is not much different. HD Hyundai, a holding company, is expected to post net profit of 5.2238 trillion won this year, up 46.3% from last year. Net profit at key subsidiaries such as HD Korea Shipbuilding & Offshore Engineering (40.8%) and HD Hyundai Heavy Industries (61.8%) is also projected to rise sharply. Hanwha Ocean is likewise expected to deliver net profit of 1.3636 trillion won, up 43.8% from last year.

Hanwha Aerospace, a defense bellwether, is projected to post net profit of 3.2892 trillion won this year, up 46.7% from last year. Hyundai Rotem is also expected to see net profit rise 29.9% to 1.0526 trillion won. Korea Electric Power is estimated to enter the era of 11 trillion won in net profit this year.

Still, concerns are being raised about “earnings concentration.” That is because Samsung Electronics and SK hynix are expected to account for 70.8% of the increase in net profit this year among the 252 listed companies whose earnings are estimated by at least three brokerages.

As many as 21% of listed companies are estimated to post losses this year or to see profit growth remain in the single digits. As of the fourth quarter of last year, 32% of companies were estimated to have recorded losses. Representative cases include BGF Retail and Orion, which are suffering from sluggish domestic demand, as well as shipping companies entering an oversupply phase.

With the won–dollar exchange rate surging, Korean Air’s net profit for the fourth quarter of last year (5.7 billion won) is estimated to have plunged 98.1% year on year. Recently, the stock market has also continued to see gains concentrated in only a handful of large caps, including semiconductors, shipbuilding, defense and autos.

Shim Seong-mi, smshim@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.