PiCK

U.S. takes a step back on Iran…oil gives up surge gains [Lee Sang-eun’s Washington Now]

Summary

- It reported that U.S. President Donald Trump signaled he is stepping back from plans for direct intervention in Iran.

- It said West Texas Intermediate (WTI) one-month futures rose about 10% from around $56 a barrel to about $62, but have now given back roughly half of those gains, slipping to the low $60s.

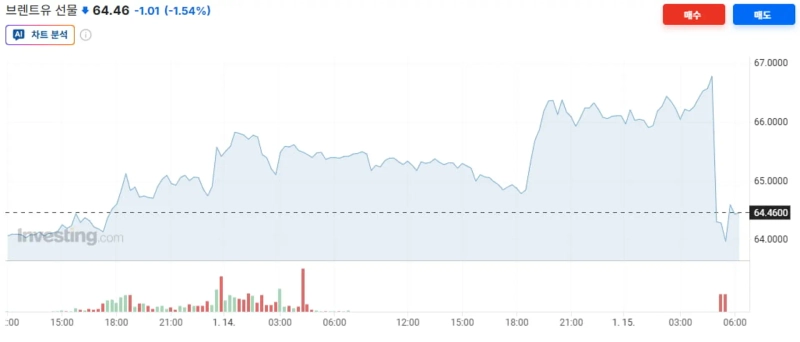

- It reported that North Sea Brent climbed to the high $66s a barrel before now trading around $64, with the price gap versus WTI widening to nearly $5.

Forecast Trend Report by Period

U.S. President Donald Trump signaled he is stepping back from plans for direct intervention in Iran.

On the 14th (local time), speaking to reporters at a White House executive order signing ceremony, he said he had heard Iran “has no plans for executions” and that “the killing in Iran has stopped, and I was told there are no plans for executions.” He added, “The killing has stopped. The executions have stopped.” As for the source of the information, he said only that it came from “an important source on the other side.”

With anti-government protests continuing in Iran, the U.S. had gone as far as encouraging the overthrow of the Iranian government, but the mood now appears to be shifting toward putting off direct intervention.

In a CBS interview the previous day, when asked about reports that Iran planned to execute protesters on the 14th, President Trump said he had not heard that, but warned there would be “very strong measures” if it happened.

He said the strong measure would be “winning,” citing as examples Maduro and the killing of Qasem Soleimani. And ahead of the interview, he urged protesters to “take over the institutions” and said that “a helping hand is on the way.”

Since the 2nd, President Trump has indicated the U.S. would intervene if Iran killed protesters, but he has hesitated to make a concrete decision. In this regard, The Washington Post, citing an anonymous official, noted that “the administration currently does not have assets in the (Middle East) region capable of carrying out a full physical attack without the risk of retaliation.” Still, the possibility remains that the U.S. could use separate strike assets, as in the ‘Midnight Hammer’ operation that bombed Iranian nuclear facilities.

Reuters reported there is also talk of considering a Venezuela model (pinpoint removal of the leader while leaving the surrounding leadership intact to cooperate). But for various reasons, direct intervention remains a heavy lift. That phrase—“a helping hand is on the way”—may itself have been the helping hand. In Tehran, pro-government rallies have been continuing day after day.

Oil prices have been moving sharply and reacting to these shifts. West Texas Intermediate (WTI) one-month futures, which had climbed steeply since last week, have turned lower. A week ago, WTI was trading around $56 a barrel and rose nearly 10% to about $62, but it has now given back roughly half of those gains, slipping to the low $60s.

Swings in WTI also reflect the issue of the U.S. securing control over Venezuelan crude. There was also wariness over an excessive run-up, and the pullback was larger than in Brent.

By contrast, North Sea Brent climbed faster than WTI and has seen a relatively smaller retreat, indicating it is reacting more sensitively to the Iran issue than to Venezuelan crude. After rising to the high $66s a barrel, it is now trading around $64. The spread versus WTI has widened to nearly $5.

Washington=Lee Sang-eun, correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)