Summary

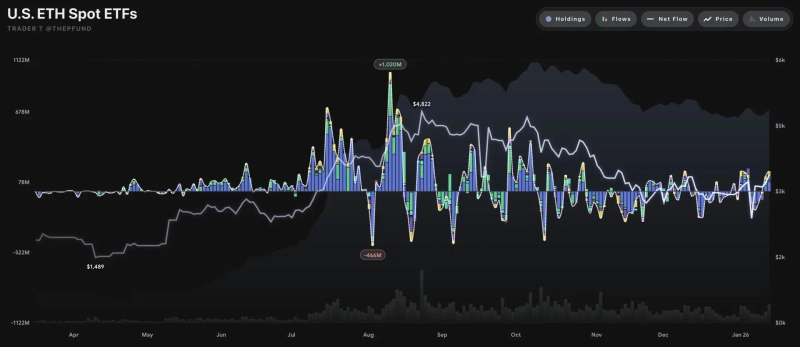

- It reported that large inflows into the spot ETF market for Ethereum are driving a renewed expansion in institutional investor demand.

- It said total net inflows into spot ETFs for Ethereum reached $175.03 million on the 14th, helping improve investor sentiment across the broader market.

- It reported broadly distributed net inflows into BlackRock’s ETHA, Grayscale’s ETHE, and Grayscale Mini Ethereum Trust ETH.

Forecast Trend Report by Period

Large inflows are pouring into the spot Ethereum exchange-traded fund (ETF) market, signaling a renewed pickup in institutional demand. Following bitcoin ETFs, Ethereum ETFs are also showing a clearer net-inflow trend, helping lift investor sentiment across the broader market.

According to data released on the 14th (local time) by Trader T via X, total net inflows into spot Ethereum ETFs came to $175.03 million on the day. A notable feature was broadly distributed inflows across products from multiple major asset managers.

By product, BlackRock’s iShares Ethereum Trust (ETHA) accounted for the largest share, drawing $81.65 million. Grayscale Ethereum Trust (ETHE) posted $32.35 million in net inflows, while Grayscale Mini Ethereum Trust (ETH) saw $43.47 million.

Fidelity’s FETH brought in $5.89 million, Bitwise’s ETHW $7.97 million, and VanEck’s ETHV $3.70 million. By contrast, 21Shares’ CETH, Invesco’s QETH, and Franklin’s EZET saw no changes in flows.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)