Poll Ratings Hit a Low as Cost of Living Soars… Trump’s Risky Gambit [Im Da-yeon’s Main Street]

공유하기

Summary

- It reported that financial stocks including Visa, Mastercard and JPMorgan fell 3–4% after President Trump signaled the introduction of a 10% cap on credit-card interest rates.

- It said concerns are rising that policy credibility could be damaged as Trump presses ahead with limits on single-family home purchases and pressure on the Fed to cut the policy rate to below 1% annually.

- It reported that Trump’s plans—including a $50-a-barrel WTI oil target and $2,000-per-person cash payments—are populist policies that increase risks for the U.S. oil industry and fiscal/tariff policy.

7 in 10 Americans say they “can’t afford the cost of living”

Trump pivots to “tackling living costs” ahead of the midterms

Plan to cap credit-card rates at 10% hits financial stocks hard

Goal of “$50 oil” rattles the U.S. crude industry as well

In the U.S. right now, the term “affordable cost of living” (affordability) has emerged as a key talking point. That reflects how much public frustration over high prices has grown. Headline inflation looks relatively stable in the mid-to-high 2% range, but the problem is that the cost pressures people feel in daily life remain high.

According to a survey conducted last month by polling firm Marist of 1,440 adults, seven in 10 respondents said the cost of living where they reside is either “very difficult to afford” or “not affordable at all.” It is the highest reading since Marist began the survey in 2011.

Against this backdrop, U.S. President Donald Trump, heading into the midterm elections, has elevated “tackling the cost of living” as a central policy agenda and is rolling out a flurry of measures across housing, finance and energy. Trump had long dismissed the phrase “affordable cost of living” as “a fake term invented by Democrats,” but as his approval rating has fallen to the lowest level across his first and second terms in recent polling, analysts say he is in a position where he can no longer ignore it.

Still, some of the policies he has unveiled are being criticized as excessive or anti-market. Many also argue he is misdiagnosing the causes. Here is a closer look at the Trump administration’s “cost-of-living measures.”

1. Cap on credit-card interest rates

On Aug. 13–14 (local time), financial stocks took a direct hit in New York. On the 13th, shares of major card networks and banks including Visa, Mastercard and JPMorgan slid more than 3–4%. On the 14th, Wells Fargo, Bank of America (BoA) and Citigroup also fell more than 3–4%. The moves followed Trump’s warning that he would introduce a plan on the 20th to cap credit-card interest rates at an annual maximum of 10%.

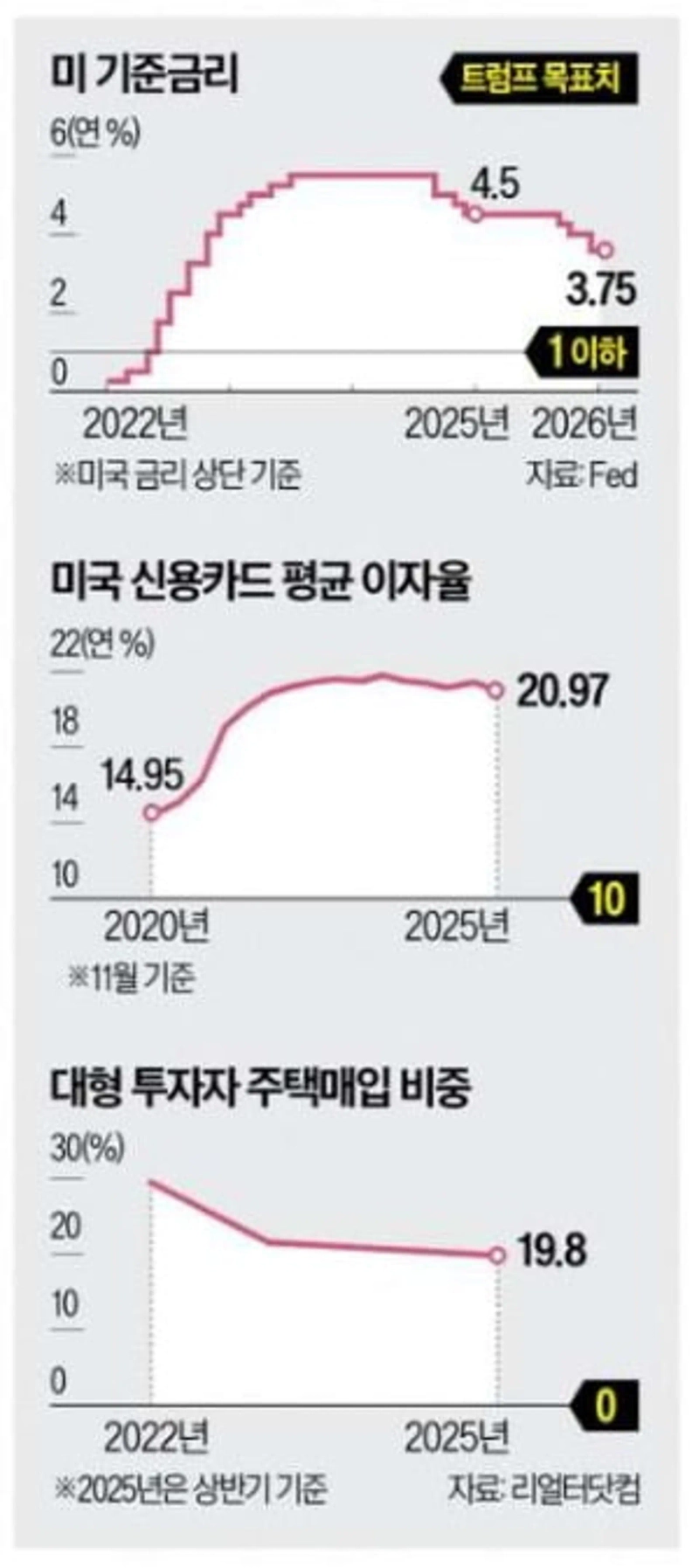

According to the Federal Reserve Bank of St. Louis, the average U.S. credit-card interest rate stood at 20.97% as of November last year. Since the data series began in 1994, it has never fallen below 10%. JPMorgan CFO Jeremy Barnum even hinted at legal action, saying that “if a directive with weak support unfairly changes our business materially, all options will be on the table.”

Experts say a cap could instead restrict credit access for lower-credit households and small businesses. Card issuers unable to charge above 10% annually may be reluctant to issue cards to low-income borrowers, potentially pushing them toward high-interest “payday loans” (ultra-short-term small loans) outside banks and card companies.

2. Limits on single-family home purchases

Trump has also said he would restrict institutional investors’ purchases of single-family homes, aiming to curb housing demand and bring prices down. In an SNS post on the 7th, he urged lawmakers to legislate the measure, saying, “People live in homes, not in companies.”

U.S. home prices rose about 55% from 2020 to 2025. Trump has pointed to expanded home buying by large investment firms as the main driver.

But the data show that large investors’ home purchases have actually trended down since COVID-19. According to real estate information provider Realtor.com, large investors’ share of home purchases stood at 21.7% in 2024, the lowest level since 2007. Last year, it fell below 20% in the first half. By contrast, small investors accounted for 59.2% of total home purchases in 2024, the highest share since the data series began in 2001.

In other words, he appears to have misidentified the cause. Critics say it is uncertain whether measures based on a flawed diagnosis can deliver the intended effect.

3. Pressure on the Fed

Pressure from Trump and his administration on the U.S. central bank, the Federal Reserve (Fed), is also tied to efforts to rein in perceived cost pressures. On the 9th, the U.S. Department of Justice sent a subpoena to Fed Chair Jerome Powell related to a renovation project at the Fed’s headquarters. Markets view it as a move to pressure the Fed to cut rates.

Trump wants the policy rate—currently 3.75% (upper bound)—to be lowered to below 1%. In a Wall Street Journal (WSJ) interview on the 12th of last month, when asked what level of rates he wanted a year from now, he replied, “(Annual) 1% and maybe even lower.”

However, the Fed’s dot plot released last month shows a year-end policy-rate projection of 3.4%. The gap with Trump’s demand is very large. In markets, concerns persist that sustained political pressure on the Fed could undermine policy credibility and make economic management more difficult.

4. “$50 a barrel” oil 5. Cash handouts

Trump has also floated expanding U.S. influence over Venezuela’s oil industry as a way to bring down gasoline prices at home—another policy the U.S. oil industry does not welcome.

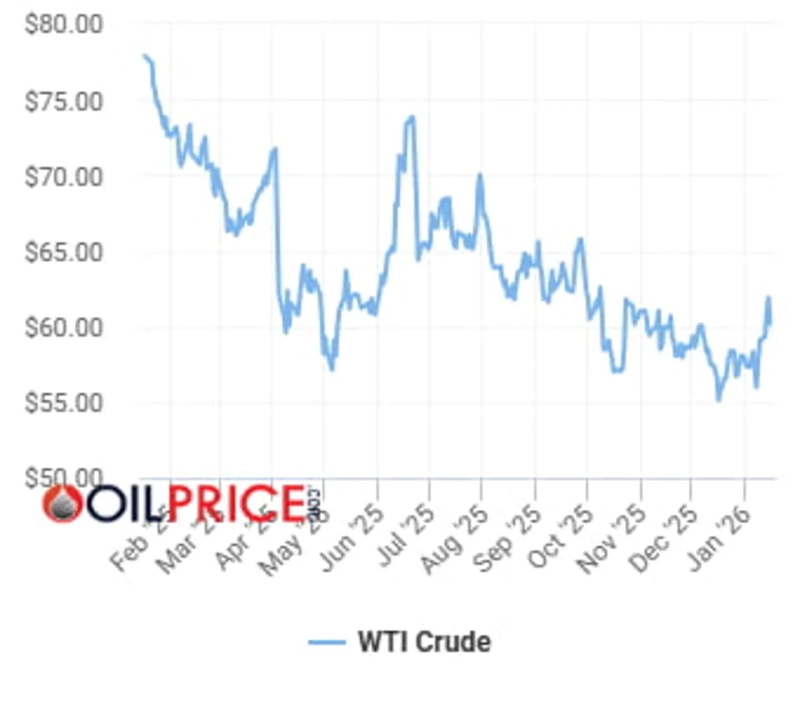

That is because legal and political risks are involved, and the West Texas Intermediate (WTI) level of $50 a barrel—reported to be Trump’s target—amounts to a break-even point. If oil falls below $50 a barrel, profitability would vanish. Concerns are growing that a prolonged low-oil-price environment could depress the broader U.S. oil industry.

Trump has also said he would use tariffs to pay most Americans $2,000 per person (about 2.94 million won). It is a populist policy ahead of the election. Its feasibility is also unclear: if the U.S. Supreme Court deems reciprocal tariffs imposed under the International Emergency Economic Powers Act (IEEPA) illegal, refunds of already-collected tariffs could become unavoidable.

By Im Da-yeon allopen@hankyung.com

![Bank of Korea governor: “Rate held steady with FX in mind”... hints easing cycle may be over [Wrap-up]](https://media.bloomingbit.io/PROD/news/944dfdce-5d7b-4218-8300-e850cdc5d7ac.webp?w=250)