Bitcoin’s 2026 target set at $185,500... “Uptrend structure remains intact” [Tiger Research report]

Summary

- Tiger Research calculated Bitcoin’s neutral base price at $145,000 and presented a target price of $185,500, saying it implies roughly 100% upside from the current price.

- Bitcoin’s final support was presented at $84,000 and resistance at $98,000, and on-chain indicators were said to have moved out of the undervalued zone into a balanced state.

- While the Fed’s rate cuts, M2 expansion, and the potential passage of the Clarity Act support the medium- to long-term bullish structure, it said the macro adjustment factor was lowered from +35% to +25% due to ETF outflows and geopolitical uncertainty.

Forecast Trend Report by Period

Key Takeaways

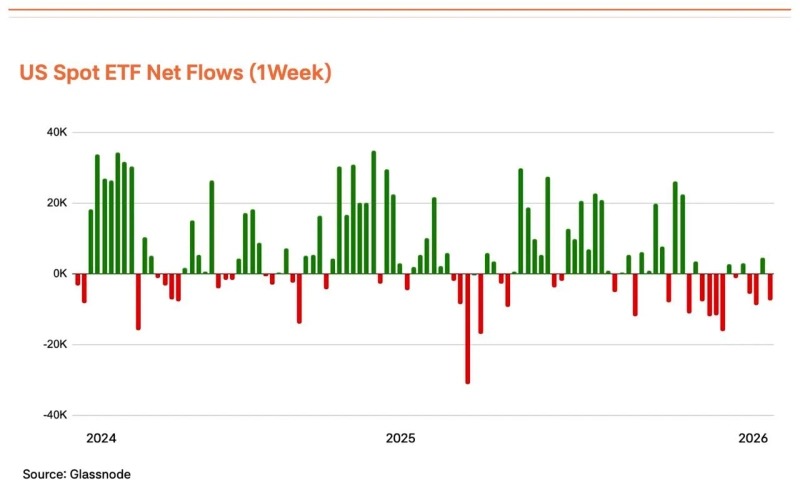

Macro backdrop supportive, but short-term momentum weakens: Fed rate cuts and M2 expansion continue, but $4.57bn flowed out of ETFs, weakening near-term momentum. If the Clarity Act passes, full-scale participation by traditional finance is expected

On-chain shifts to a balanced phase: “Buy-the-dip” demand concentrated around the 84K zone, forming support, while 98K acts as resistance as the average cost basis of short-term holders. Key indicators such as MVRV-Z have moved out of the undervalued zone and reached a balanced state

Target price $185,500; bullish structure still solid: Derived by applying a +25% macro adjustment to the neutral base price of $145,000. Analysis suggests roughly +100% upside remains from current levels

Global macro easing stance intact, upside momentum softens

Bitcoin is trading around $96,000, down 12% since Oct. 23, 2025, when we published our last report. Even so, the broader macroeconomic trend remains supportive for Bitcoin.

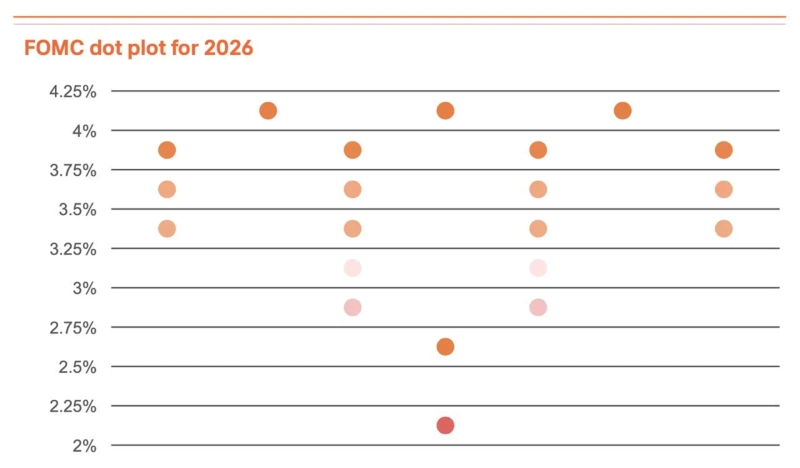

The Fed’s easing bias continues

The U.S. Federal Reserve (Fed) cut the policy rate by 25 bps three times from September through December 2025. As a result, the current policy rate stands at 3.50–3.75%, and the dot plot released in December pointed to 3.4% by end-2026. A sharp rate cut this year (50 bps or more) will be difficult, but with Chair Powell’s term ending in May, the Trump administration is likely to nominate a rate-cut-leaning figure—so the overall easing stance is expected to continue.

Institutional money exits, while DAT firms buy

Despite this macro backdrop, institutional enthusiasm has cooled. Bitcoin spot ETFs saw total outflows of $4.57bn in November and December 2025, the worst since launch. Annual net inflows of $21.4bn were down 39% from $35.2bn the prior year. Funds have been flowing back in due to rebalancing demand in early January 2026, but durability remains uncertain. By contrast, accumulation by listed companies such as MicroStrategy (673,783 BTC, 3.2% of total supply), Metaplanet, and Mara has continued steadily.

Clarity Act opens the door to mainstream finance

With institutional flows slowing, regulatory change is emerging as a potential new catalyst. The Clarity Act, which passed the House, clarifies jurisdiction between the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), and allows banks to provide digital-asset custody and staking services. In addition, it grants the CFTC authority to regulate the digital-commodity spot market, enabling exchanges and brokers to operate legally. A vote in the Senate Banking Committee is scheduled for Jan. 15, and if passed, full-scale participation by traditional financial institutions that have been on the sidelines is expected.

M2 is expanding, but Bitcoin is still waiting

Alongside regulatory improvements, liquidity is a key factor to watch. Broad money (M2) in major economies has continued to rise even after hitting an all-time high in Q4 2024. Bitcoin typically reacts ahead of liquidity expansions, and in the past it surged before M2 set new highs, then showed limited movement during the period of renewed highs.

Liquidity now appears poised to expand further. Paradoxically, that suggests upside potential remains. Given Bitcoin’s tendency to respond early, it may look increasingly attractive, and if expectations for major equity markets become stretched, capital could be reallocated into Bitcoin.

Macro factor lowered, structure still supportive

Taken together, the macro direction—rate cuts and liquidity expansion—remains unchanged from last quarter. However, reflecting slower institutional inflows, a leadership transition at the Fed, and geopolitical uncertainty, we lower the macro adjustment factor to +25% from +35%. Even after the cut, +25% remains supportive, and our view that structural drivers—regulatory improvements and M2 expansion—underpin medium- to long-term upside remains valid.

Final support at $84,000; hurdle at $98,000

Along with macro conditions, on-chain indicators provide important clues. During the price correction in November 2025, “buy-the-dip” demand concentrated near $84,000, creating a thick demand layer that acted as a potential support level. The market has since moved above that zone. On the upside, $98,000 represents the average purchase price of short-term holders, serving as a psychological resistance level.

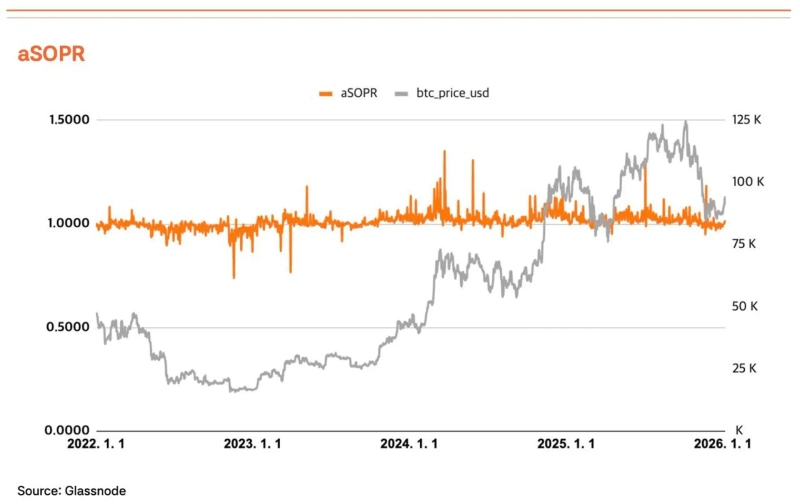

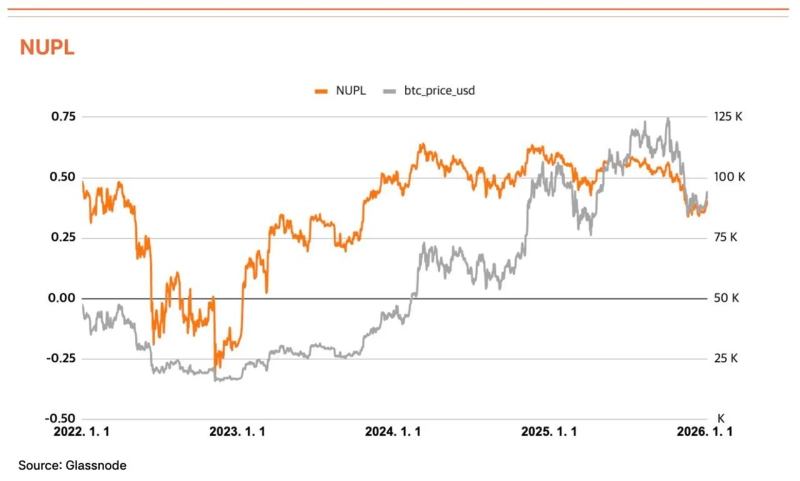

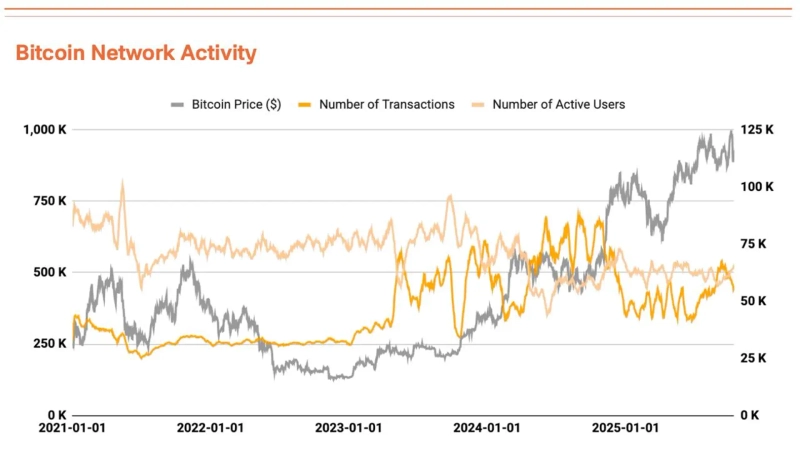

On-chain indicators are shifting from a short-term fear phase into a more balanced phase. Key metrics—MVRV-Z at 1.25, NUPL at 0.39, and aSOPR at 1.00—have moved through the undervalued zone and into a balanced state. This implies it may be difficult to expect a sharp rally like in a fear phase, but it still represents a regime where profits can be generated. Moreover, considering the macro backdrop and regulatory improvements discussed above, the statistical basis for forming higher price levels over the medium to long term remains intact.

Notably, the current market structure differs from the past. In an environment where institutional and long-term capital has increased its share, a panic-driven capitulation pattern typical of retail-led markets is less likely to recur. In fact, even in the recent pullback, a gradual rebalancing process has emerged. Considering on-chain indicators and supply-demand structure, short-term volatility remains, but it is difficult to conclude that the bullish structure has been damaged.

Target price lowered to $185,500, structure still solid

Based on our Q1 analysis using the TVM methodology, the neutral base price is estimated at $145,000, down from $154,000 in the previous report. Applying a 0% fundamental adjustment factor and a +25% macro adjustment factor yields a target price of $185,500.

We raised the fundamental adjustment factor to 0% from -2%. While fundamentals such as network activity are similar to the prior report, renewed attention to the BTCFi ecosystem has offset bearish and bullish factors. Meanwhile, we lowered the macro adjustment factor to +25% from +35%. The macro environment remains supportive—given rate cuts, M2 expansion, and the potential passage of the Clarity Act—but this change reflects slower institutional inflows and heightened geopolitical uncertainty.

Although the target price has been lowered, this is not a bearish outlook. It still suggests more than 100% upside potential. The slight decline in the base price reflects near-term volatility, while Bitcoin’s intrinsic value continues to rise over the medium to long term. The pullback appears to be a healthy rebalancing process, and the medium- to long-term bullish view remains valid.

Tiger Research is a blockchain-focused research firm that provides standards that enable sound decision-making in the complex Web3 industry. Since its founding in 2022, it has provided Web3 market research and strategic advisory services to more than 100 global blockchain foundations and over 150 institutions. Its reports are published in five languages—Korean, English, Chinese, Japanese, and Indonesian—and distributed via major media and platforms in each country. Leveraging local networks and analytical capabilities across key Asian markets, it is growing into a global knowledge hub delivering actionable insights.

Disclaimer

This Bitcoin valuation methodology (the “Methodology”) is prepared for research purposes and does not provide, in any form, investment solicitation, investment advice, or recommendations to buy or sell. The fair price presented in the Methodology is merely the result of a theoretical analysis based on objective data, and it is explicitly clarified that it does not, under any circumstances, solicit or recommend any investment action such as buying, selling, or holding at any specific point in time. The Methodology is academic research material that presents one perspective on Bitcoin valuation for market participants and must not be used as material for making investment decisions.

The Methodology has been prepared after careful review to ensure it does not constitute unfair trading practices such as market manipulation or fraudulent unfair transactions as stipulated in Article 10 of the Act on the Protection of Virtual Asset Users, etc. (the “Virtual Asset User Protection Act”). All analyses use only publicly available information accessible to anyone, such as on-chain data disclosed on the blockchain and officially released macroeconomic indicators; no material nonpublic information or inside information has been used. In addition, the target price calculation in the Methodology is based on reasonable grounds, and we state that it has been prepared transparently without false representations or intentional omission of material matters.

The author and distributor comply with the obligation to disclose conflicts of interest as stipulated in Article 10(4)2 of the Virtual Asset User Protection Act in relation to the Methodology. If, at the time of preparing and distributing the Methodology, the author holds the relevant virtual asset (Bitcoin) or plans to trade it in the future, such conflicts of interest will be clearly disclosed.

The calculation methods for the base price, fundamental indicators, and macro indicators used in the Methodology are based on methodologies the author deems reasonable; however, they are not absolute truths or the only correct answers. The Bitcoin market is extremely difficult to predict due to very high volatility, 24-hour trading, the characteristics of global markets, and uncertainty in the regulatory environment. There may be a significant divergence between the valuation results presented by the Methodology and actual market prices, and such divergence may, in fact, persist for a prolonged period.

The Methodology is written based on historical data and information available as of the present and does not guarantee or predict future performance or returns. There is no guarantee that past patterns or correlations will apply in the same way in the future, and the Methodology’s predictive power may be materially impaired or rendered meaningless by a range of factors, including unexpected market shocks, regulatory changes, technical issues, and macroeconomic shifts. In particular, the cryptocurrency market has a shorter history than traditional financial markets and undergoes frequent structural changes, so it should be recognized that there are fundamental limitations in the reliability of historical data and the ability to forecast the future.

All investment decisions must be made solely at the investor’s independent judgment and responsibility, and the Methodology must not be used as the sole basis or a primary basis for any investment decision. Investors should make prudent investment decisions after comprehensively considering their financial situation, investment objectives, risk tolerance, and investment experience, and should seek independent financial or investment advice if necessary. The author, distributor, and related parties bear no responsibility whatsoever for any direct, indirect, consequential, special, or punitive losses or damages arising from investment decisions made with reference to the Methodology.

This report is independent of the media outlet’s editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

![[Today's Key Economic & Crypto Calendar] US February Nonfarm Payrolls, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![Bitcoin rebounds on Trump remarks and reports of US-Iran contacts… Ethereum sees a 'short squeeze,' while XRP shows mixed signals with a sell indicator [Lee Su-hyeon’s Coin Radar]](https://media.bloomingbit.io/PROD/news/6010b32c-422b-424a-bc90-fd4d5df99ffe.webp?w=250)