PiCK

CPI surprise lifts… Bitcoin holds $95,000; Ethereum breaks above $3,300 [Lee Soo-hyun’s Coin Radar]

Summary

- It said the key variables are U.S. CPI, the possibility of Fed rate cuts, Bitcoin’s $95,000 support, and the $100,000 and $106,000 upper zones.

- It said Ethereum broke above $3,300, with 36 million ETH staked (30% of circulating supply), $8 trillion in stablecoin transfers, and a $7,500 year-end target presented.

- It said the investment points for XRP are the $2 support and scenarios for retesting $2.4, $2.7 and the $3 range, $1.2 billion in net inflows into spot XRP ETFs, and the possibility of being designated an ancillary asset under a regulatory bill.

Forecast Trend Report by Period

<Lee Soo-hyun’s Coin Radar> is a weekly column that tracks trends in the digital-asset (cryptocurrency) market and explains what’s driving them. Going beyond a simple listing of prices, it offers a multifaceted analysis of global macro issues and investor behavior, providing insights to gauge the market’s direction.

Major coins

1. Bitcoin (BTC)

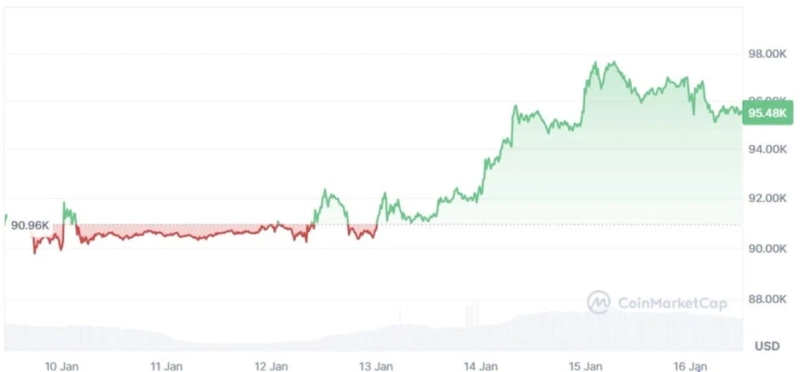

Bitcoin climbed steadily this week, briefly touching the $97,000 level on the 15th (local time), and as of the 16th it is still holding relatively steady around $95,000 on CoinMarketCap.

The immediate catalyst for the rebound was the U.S. December Consumer Price Index (CPI). Headline CPI rose 2.7% year on year, in line with market expectations, while core CPI came in at 2.6%, slightly below the forecast (2.7%). With inflation data not worse than expected, the dollar and U.S. Treasury yields stabilized, and that backdrop supported risk assets broadly.

Stronger-than-feared inflation data did not so much create conditions for the Fed to cut rates immediately as it helped to tamp down concerns about additional tightening. Markets are treating a hold at the January FOMC as all but a given, with attention shifting to the possibility of cuts in the second half of the year. According to the CME FedWatch Tool, the probability of a January hold topped 97%, while the likelihood of at least a 25bp cut after June was priced at roughly 70%.

Some interpreted President Donald Trump’s public remarks as also influencing sentiment. Immediately after the CPI release, Trump said, “The inflation numbers are great, which means Powell should be cutting interest rates meaningfully,” ratcheting up pressure and continuing calls for Chair Powell to step down.

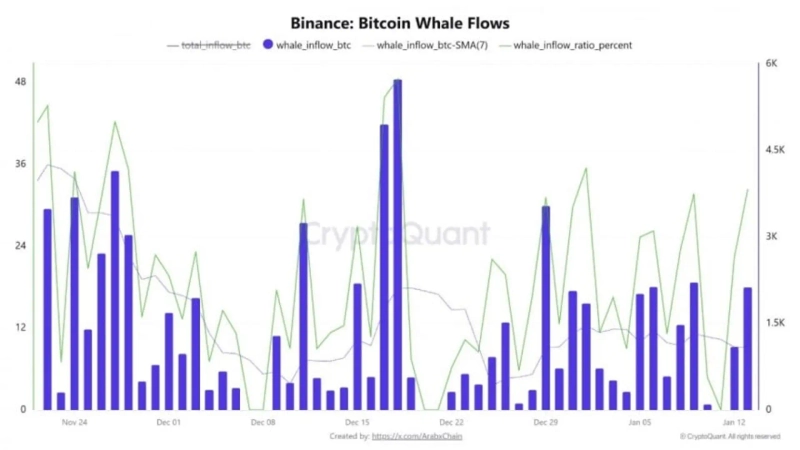

Signals also emerged that whale selling pressure has eased somewhat. According to CryptoQuant on the 15th, whale Bitcoin deposits to Binance totaled about 15,800 BTC since early 2026, sharply down from 37,000 BTC in December last year. Whales also accounted for around 20% of total inflows, a historically mid-range level. With prices trading steadily in the $90,000s, whales likely had less incentive to rush to offload holdings.

Policy uncertainty, however, remains. A markup vote on a U.S. Senate Banking Committee bill on digital-asset market structure—dubbed the “CLARITY Act.”—scheduled for the 15th was postponed. Industry pushback grew after a draft was released, and Brian Armstrong, CEO of Coinbase, withdrew support, saying there were “too many issues,” which proved decisive. The committee abruptly delayed the markup, creating an unavoidable gap in the timeline. Still, with major companies and organizations urging review to resume, discussion could restart later this month in conjunction with the Agriculture Committee’s schedule.

Near-term price action hinges on whether Bitcoin can establish $95,000 as firm support. Tony Sycamore, an analyst at IG Australia, said, “If it can secure the $95,000 area, a retest of $100,000 is possible, and there could also be scope up to the $106,000 range where the 200-day moving average sits.” Glassnode pointed to around $98,300—the average cost basis for short-term holders—as a key resistance level. Depending on whether Bitcoin can settle above that zone with volume, analysts say this rebound could either remain a technical recovery or develop into a trend-driven advance.

2. Ethereum (ETH)

Ethereum also had a solid week. It maintained a gradual uptrend and broke above $3,300. As of the 16th, it is hovering around $3,300 on CoinMarketCap.

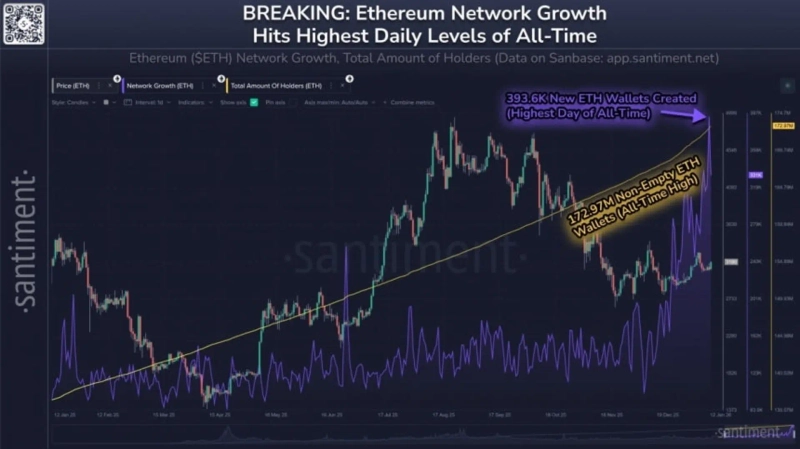

While the same macro backdrop as Bitcoin supported the rebound, Ethereum also stood out for simultaneous improvements in internal indicators. According to Santiment on the 14th, the number of new Ethereum wallets created recently averaged about 327,000 per day—an all-time high. Santiment said that following the “Fusaka upgrade” in December last year, the burden of network fees eased, accelerating new-user inflows. With gas fees lower, the return of retail-sized users and new participants has become more pronounced.

A shift was also evident in real-world usage. The total volume of stablecoin transfers processed on the Ethereum network in Q4 last year hit a record of roughly $8 trillion. The figure is seen as evidence that Ethereum remains a core infrastructure layer in real-use areas such as payments, remittances and settlement.

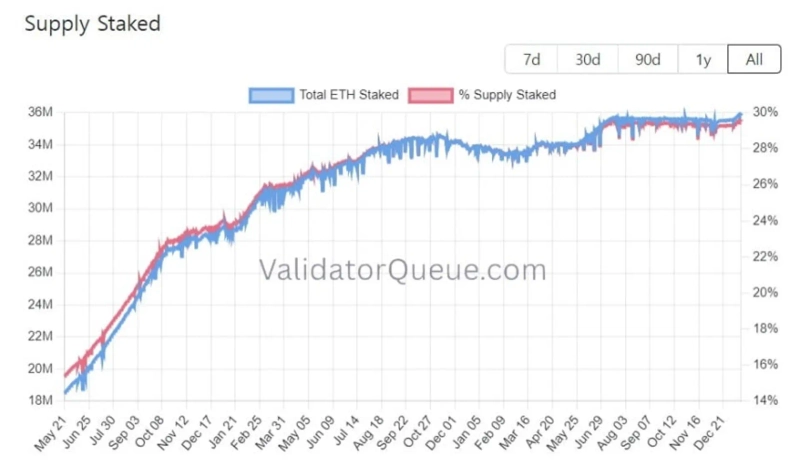

Staking dynamics also underpinned the move. According to digital-asset outlet The Block, the amount of staked ETH has surpassed 36 million, worth more than $118 billion. With roughly 30% of circulating supply locked up rather than available to the market, the structure could reinforce investors’ reluctance to sell.

The outlet noted that “Ethereum’s 11% gain since the start of the year and its more than 8% rise over the past week are not unrelated to the increase in staking,” adding that “institutional investors are leading the trend.” One example cited was BitMine, which reportedly holds about 4.17 million ETH and has staked more than 1.25 million of it.

Renewed derivatives activity and recovering leverage demand also served as catalysts. According to CryptoQuant, Ethereum open interest on Binance rose to about $8.6 billion on the 14th, the highest level since Oct. 9 last year. After large-scale liquidations in October, open interest fell sharply and then remained stagnant for a long period, but it has recently begun climbing again. Observers say this looks less like the kind of overheating seen when leverage piles up all at once, and more like a return flow in which participants rebuild positions gradually from lower levels. In other words, rather than betting on short-term price swings, more participants appear to be re-entering the market slowly with an eye on potential upside.

On the outlook, some medium- to long-term bullish calls are emerging. Standard Chartered, in a January report, labeled 2026 “the year of Ethereum” and set a year-end target of $7,500. In the near term, $3,350–$3,380 is cited as key resistance. Digital-asset outlet NewsBTC said, “The $3,350 and $3,380 areas are major resistance,” adding that “a clear break above that zone could open the way to $3,400, then $3,500 and even $3,650.” Conversely, if Ethereum fails to break above $3,400, $3,300 is the first support level, and if $3,280 gives way, the possibility of a pullback toward the $3,200s is also being discussed.

3. XRP (XRP)

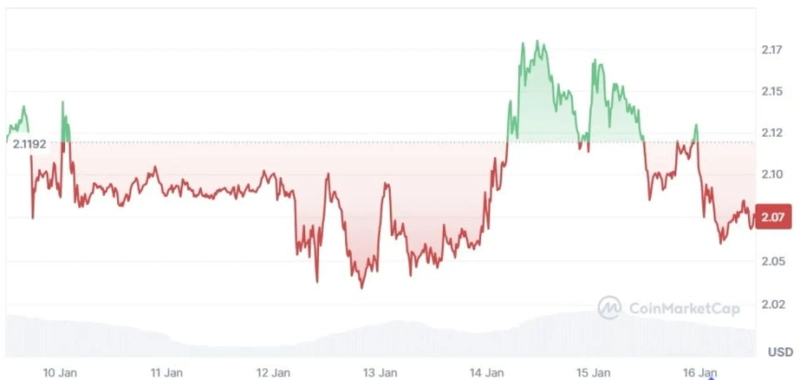

While the broader market rebounded this week, XRP was relatively quiet. As Bitcoin and Ethereum each rose more than 7% on a weekly basis, XRP gained only about 1%, continuing to trade sideways around $2.10. As of the 16th, it is barely holding the $2 level on CoinMarketCap.

Some said that after an attempted break above the $2.20 resistance failed, profit-taking emerged and the price fell back into a range. FXStreet reported that as sentiment improved on lower-than-expected U.S. core inflation, XRP rebounded to $2.19, but heavy selling near $2.20 quickly triggered a pullback.

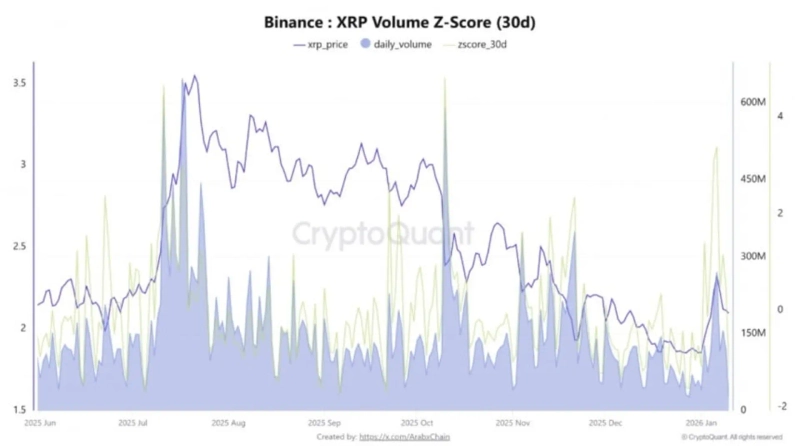

On-chain indicators also remained far from signaling overheating. According to CryptoQuant, XRP’s volume Z-score on Binance was about 0.44, only slightly above the 30-day average. That suggests there was no explosive surge in volume versus the mean, supporting the view that a lack of strong buying or selling kept the market balanced and extended the sideways move.

Still, there are more constructive narratives on the demand side. According to SoSoValue data, spot XRP ETFs launched in November last year have recorded cumulative net inflows of more than $1.2 billion, with inflows on nearly every day except one. Considering that spot Bitcoin ETFs saw roughly $2.4 billion in net outflows over the same period, the XRP ETF flow is being described as unusually resilient. In other words, while price has been stagnant, regulated demand has been building.

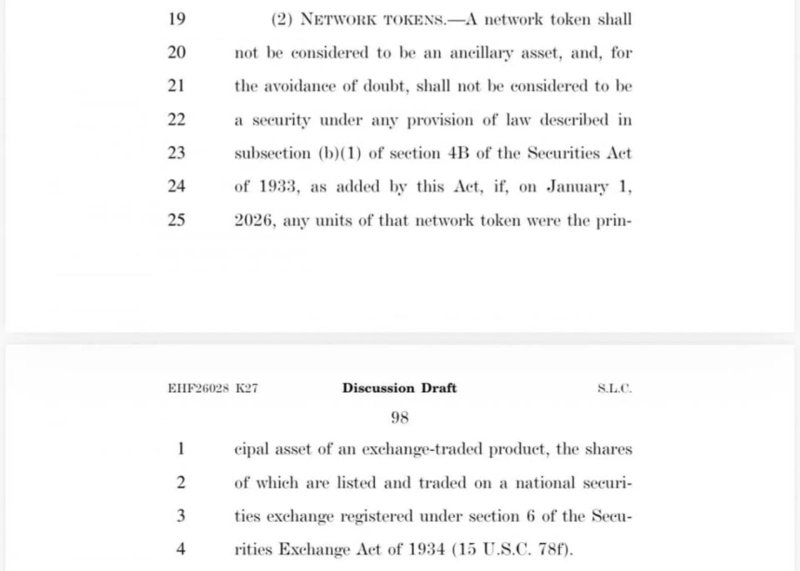

There was also news worth watching on the regulatory front. According to Eleanor Terrett, host of Crypto America, a draft of the U.S. Senate digital-asset market-structure bill includes a provision that treats tokens included as underlying assets of U.S.-exchange-listed exchange-traded funds (ETFs) and exchange-traded products (ETPs) as of Jan. 1, 2026, as “ancillary assets.” If the clause remains, some interpret it as opening the door for certain altcoins—including XRP as well as Solana (SOL), Dogecoin (DOGE) and Chainlink (LINK)—to receive regulatory treatment comparable to Bitcoin and Ethereum. However, as the Senate Banking Committee reviews and revises the bill, the language could change, leaving markets balancing optimism with caution.

On price, both a near-term pullback and further upside are being discussed. Digital-asset analyst Credible Crypto said, “Resistance was confirmed three times in the highs. Depending on how things play out, a pullback to $1.77 could occur,” while adding, “If support around $2 holds, a medium-term retest of the $3 range is also on the table.” Cointelegraph likewise argued that holding $2 support is pivotal for determining the next direction. The outlet said, “XRP’s daily chart broke upward from a falling-wedge pattern on the 1st,” and added, “If $2 support holds, additional upside to $2.4 and $2.7 is possible.”

Issue coin

1. Story (IP)

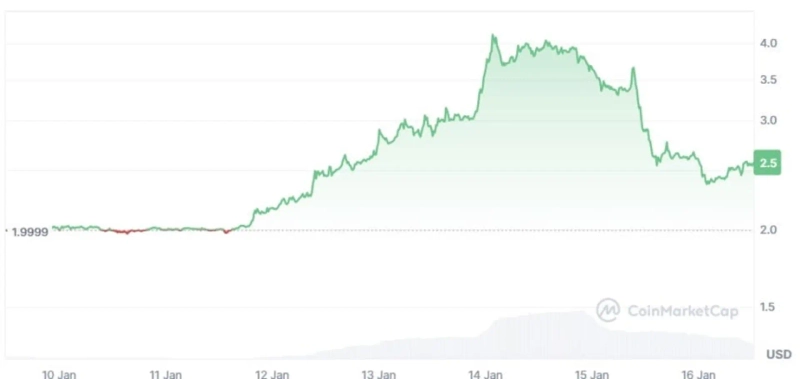

One of the strongest movers featured in Coin Radar this week was Story. It surged 100% over three days earlier this week and at one point rose above $4. After a subsequent pullback, it is still trading around $2.50 on CoinMarketCap, up nearly 26% on the week.

Story Protocol is a Layer 1 blockchain designed to handle the registration, licensing and revenue sharing of intellectual property (IP) on-chain. It has been cited as a candidate for key infrastructure in the AI era, as it enables creative works and AI training data to be managed as smart-contract-based assets.

The Story token is a native token used for network fee payments and staking. The spike this week is being linked to another wave of demand for AI-themed assets. After strength in AI-related coins such as Render (RENDER) and Virtual Protocol (VIRTUAL), there were signs that related demand rotated into Story. Expectations also grew ahead of a mainnet update on the 14th, and during that process short-term buying appears to have intensified as deposit/withdrawal restrictions at exchanges such as Upbit and Bithumb overlapped. There were supply-and-demand catalysts as well: the Story Foundation said it would extend its token buyback program through February 2026 and expand the purchase size to $100 million, also helping to push prices higher.

Technically, many say bullish signals remain intact, but after such a sharp short-term run-up, the risk of heightened near-term volatility is also being raised. As such, whether it can secure $2.57 or higher as stable support appears likely to be a key point for trend continuation.

Lee Soo-hyun, Bloomingbit reporter shlee@bloomingbit.io

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)