PiCK

"FX rate looks high relative to current fundamentals…a shift to 'won strength' expected this year"

Summary

- Professor Lee Chang-hoon said the won-dollar exchange rate is high relative to fundamentals and expects a shift to won strength this year.

- He said that despite a current-account surplus, the exchange rate stayed weak due to capital outflows, adding that the government and the market are discussing related policy responses.

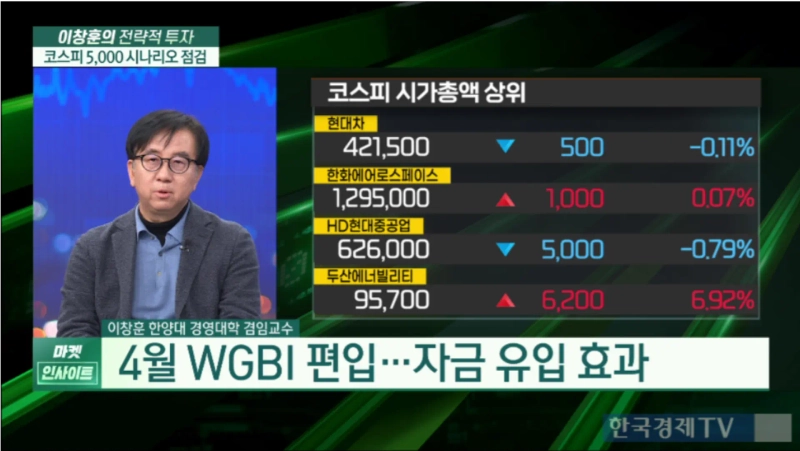

- He added that a rise in operating profit at listed companies, an expansion of the trade surplus, and bond inflows tied to April WGBI inclusion increase the likelihood of won strength around April.

Forecast Trend Report by Period

Lee Chang-hoon, an adjunct professor at Hanyang University Business School, said in an appearance on Korea Economic TV on the 16th that "despite structural problems such as slowing potential growth, aging demographics and high household debt, the current exchange-rate level looks high, and the Korean won is likely to turn stronger this year."

He added, "Even last year the current account posted a surplus, but with much more capital flowing out, the exchange rate has been weak," and said, "The won-dollar exchange rate is currently elevated relative to fundamentals, and the most fundamental factor is the significant capital outflow despite the current-account surplus—i.e., a pronounced capital outflow."

"In the short term it is a burdensome stretch, but the government and the market recognize the seriousness of the capital-outflow issue," he said, adding, "There is a strong possibility of new policy measures centered on the National Pension Service, and with a change of the NPS CIO there could be changes to the investment policy statement (IPS)."

Lee said, "With operating profit at listed companies set to hit a record high this year, the trade surplus is also expected to expand significantly, and in April Korea’s inclusion in the World Government Bond Index (WGBI) is expected to bring bond inflows," adding, "Even if there are capital outflows around the same time due to foreign investors’ dividend remittances, there is a strong chance the won will shift into a full-fledged strengthening trend from around April."

● Key points

- Despite structural headwinds, the won-dollar exchange rate is high relative to fundamentals, raising expectations that the won could shift to strength this year.

- Despite a current-account surplus, heavier capital outflows have kept the exchange rate weak, with capital outflows cited as the key driver.

- As the government and the market recognize the capital-outflow problem, potential policy changes centered on the National Pension Service are being discussed, including a possible CIO replacement and changes to the investment policy statement (IPS).

- With rising profits at listed companies expected to widen the trade surplus and April WGBI inclusion likely to bring bond inflows, a shift to won strength around April is being flagged.

Ahn Ik-joo, reporter aij@wowtv.co.kr

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.