[Analysis] "Bitcoin deposits led by mid-sized whales…large whales shift to watch-and-wait"

Summary

- In the Bitcoin (BTC) market, mid-sized whales holding 100–1,000 BTC are said to be driving market liquidity and short- to mid-term market direction through exchange deposits.

- Exchange deposits by large whales holding 1,000–10,000 BTC fell sharply from about 13,542 BTC in December last year to around 2,500 BTC in January this year, suggesting a more conservative stance.

- With exchange deposits by mega whales holding 10,000 BTC or more scarcely observed, the Bitcoin market is seen as being led by mid-sized whale liquidity—a pattern often seen historically during stable stretches of a correction phase or in accumulation phases.

Forecast Trend Report by Period

An analysis suggests that in the Bitcoin (BTC) market, mid-sized whales are driving market liquidity, while large and mega whales have sharply scaled back their activity.

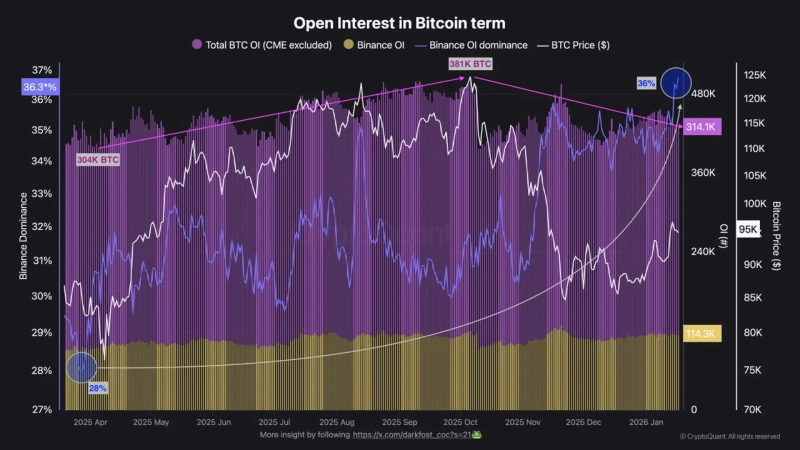

On the 18th (local time), CryptoQuant contributor Arab Chain wrote that “looking at Binance’s Bitcoin deposit flows by holding size, the so-called ‘mid-sized whale’ group holding 100–1,000 BTC remains the most active cohort.” Based on exchange deposits, they are considered the tier with the greatest impact on the market and are viewed as an important indicator for gauging short- to mid-term market direction.

Mid-sized whales tend to be more flexible in decision-making and actively supply liquidity during volatile periods. Their continued inflows to exchanges suggest that the market is not in a full watch-and-wait phase, but is still seeing limited turnover.

By contrast, movements by large whales holding 1,000–10,000 BTC have slowed markedly. Exchange deposits, which totaled about 13,542 BTC in December last year, plunged to around 2,500 BTC in January this year. Arab Chain assessed that “this shows large whales are taking a more conservative stance, holding assets off-exchange rather than engaging in short-term trading.”

In particular, exchange deposit flows from the mega-whale group holding 10,000 BTC or more were scarcely observed. This is interpreted as a signal that institutional-scale investors or ultra-large wallets are avoiding short-term risk or maintaining conviction in long-term holding. Overall, the current Bitcoin market appears to be structured around liquidity led by mid-sized whales in the 100–1,000 BTC range rather than capital from large whales—a pattern often seen historically during stable stretches of a correction phase or in accumulation phases.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)