Michael Saylor posts SaylorTracker chart… Strategy hints at additional Bitcoin purchases

Summary

- Strategy said it has continued to accumulate Bitcoin aggressively even in 2026.

- Strategy shares have fallen about 52.7% over the past 12 months, prompting analysis that a disconnect persists between its Bitcoin strategy and the stock price.

- Strategy said it faces a funding burden from issuing short-term debt such as convertible bonds and that there remains the possibility of selling some Bitcoin holdings.

Forecast Trend Report by Period

U.S.-listed company Strategy has once again signaled the possibility of continuing its large-scale Bitcoin buying.

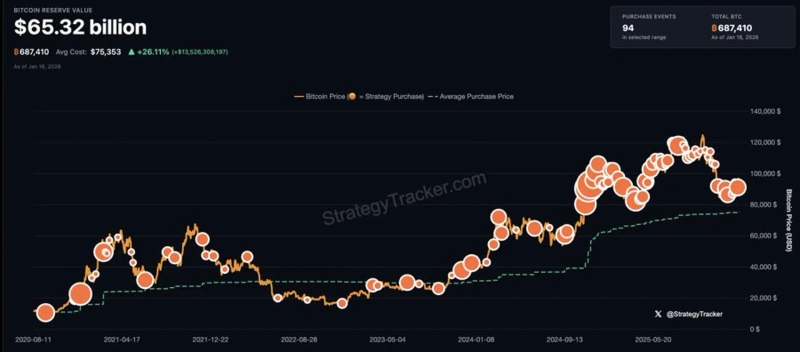

According to Cointelegraph on the 19th (local time), Strategy Chairman Michael Saylor shared an image of the SaylorTracker chart on X the previous day, leaving the phrase “Bigger Orange.” The chart marks Bitcoin’s price along with Strategy’s purchase points, and Saylor has previously used similar posts to hint at additional buying.

Strategy has maintained an aggressive accumulation stance even in 2026. After purchasing 1,283 BTC on January 4 for about $115.97 million, the company bought an additional 13,627 BTC on January 11 for $1.25 billion. Strategy currently holds a total of 687,410 BTC, with an average purchase price of around $75,353. Given recent Bitcoin prices, the company’s holdings are sitting on unrealized gains.

However, unlike Bitcoin profitability, the stock’s performance has been weak. According to Yahoo Finance, Strategy shares have fallen about 52.7% over the past 12 months, hovering at $173.71 as of January 16. The market is noting that the disconnect between the Bitcoin strategy and the stock price persists.

Concerns over the financial structure are also being raised. Strategy has actively relied on issuing short-term debt such as convertible bonds to fund its Bitcoin purchases, and conversion windows worth several billion dollars are expected to come due around 2027–2028. As a result, analysts say the burden of future capital raising could increase.

While the company has repeatedly maintained that it has no liquidity issues, it has also left open the possibility of selling a portion of its Bitcoin holdings to secure funding if necessary. The market is watching whether Saylor’s latest remark leads to actual additional purchases, and how the aggressive Bitcoin strategy will affect corporate value over the medium to long term.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)