Editor's PiCK

About 3.2 trillion won in net inflows into digital-asset investment products last week…sentiment cools amid geopolitical jitters

공유하기

Summary

- Global digital-asset investment products recorded net inflows of about $2.17 billion last week, the largest weekly inflow since October last year.

- Investor sentiment cooled late in the week amid diplomatic tensions over Greenland, renewed tariff threats, heightened policy uncertainty, and fading expectations for rate cuts.

- Net inflows were broad-based across Bitcoin (BTC), Ethereum (ETH) and Solana (SOL), as well as altcoins and blockchain equity products.

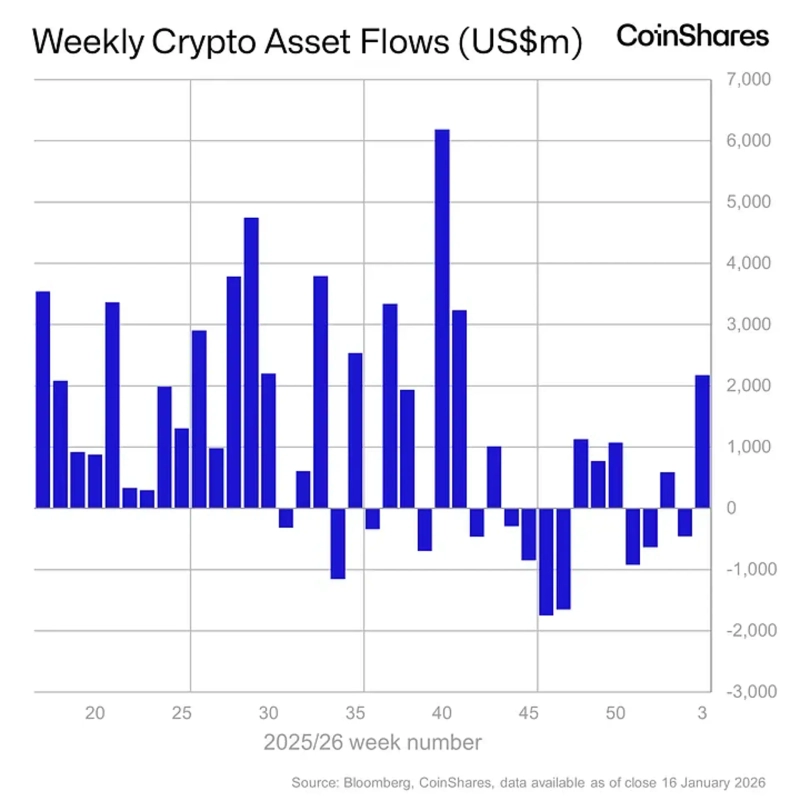

Global digital-asset investment products saw net inflows of about $2.17 billion (about 3.2 trillion won) last week, data showed—marking the largest weekly inflow since October last year. However, investor sentiment appeared to weaken somewhat toward the end of the week as geopolitical tensions and policy uncertainty piled up.

According to CoinShares’ “Digital Asset Fund Flows Weekly Report” released on the 19th, digital-asset investment products took in a total of $2.17 billion last week. Strong buying persisted early in the week, but the tone flipped after $378 million flowed out on Friday (the 16th) alone.

CoinShares pointed to escalating diplomatic tensions surrounding Greenland, renewed tariff threats, and policy-related uncertainty as drivers of the late-week deterioration in sentiment. It added that expectations for rate cuts also faded after reports suggested Kevin Hassett—previously mentioned as a candidate for the next Federal Reserve (Fed) chair—could remain in his current post, further weighing on sentiment.

By region, the United States led overall flows with $2.05 billion in net inflows. Germany and Switzerland recorded inflows of $63.9 million and $41.6 million, respectively, while Canada and the Netherlands also posted modest net inflows.

By asset, Bitcoin (BTC) accounted for the largest share with $1.55 billion in net inflows. Despite discussions in the CLARITY bill being advanced by the U.S. Senate Banking Committee—including a proposal to limit interest payments on stablecoins—Ethereum (ETH) and Solana (SOL) also drew inflows of $496 million and $45.5 million, respectively.

Inflows continued across the broader altcoin complex. XRP posted $69.5 million, Sui (SUI) $5.7 million, Lido (LDO) $3.7 million, and Hedera (HBAR) $2.6 million in net inflows.

Blockchain-related listed equities also strengthened. Blockchain equity products attracted a total of $72.6 million during the week, suggesting investor interest across the digital-asset ecosystem remained intact.