[Analysis] "New investors have been in unrealized losses since November 2025…$98,000 recovery is the inflection point"

Summary

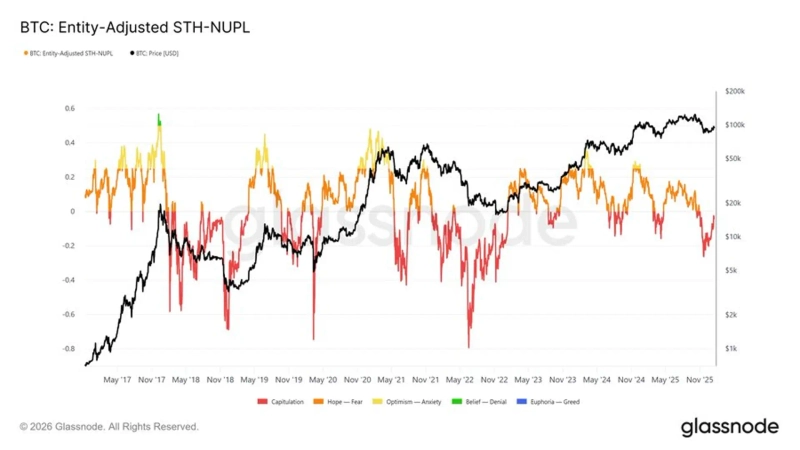

- Glassnode said, via the STH-NUPL metric, that new Bitcoin investors have been in net unrealized losses since November 2025.

- At current price levels, new investors overall are on average in loss territory, a setup that could turn a short-term rebound into selling pressure.

- It assessed that Bitcoin needs to recover to around $98,000 or higher to move new investors back into net unrealized profit—serving as a psychological and structural inflection point.

Forecast Trend Report by Period

An on-chain analysis finds that new Bitcoin (BTC) investors have remained in loss territory since late last year.

On the 20th (local time), Glassnode said via its STH-NUPL (Short-Term Holder Net Unrealized Profit/Loss) metric that “new investors have continued to sit in net unrealized losses since November 2025.” STH-NUPL measures short-term holders’ (STH) unrealized gains and losses relative to market capitalization, indicating the profit-and-loss status of recently arrived investors.

At current price levels, new investors overall are, on average, in the red. This implies short-term holders’ average cost basis is above the current spot price, creating a setup where even a short-term bounce could translate into selling pressure.

Glassnode suggested that Bitcoin would need to recover to around $98,000 or higher for the cohort of new investors to flip back into net unrealized profit. The firm assessed that this level could act as a psychological and structural inflection point, beyond a simple technical resistance line.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)