[Analysis] Ethereum remains skewed to selling… “Defending $3,000 is the key in the next phase”

Summary

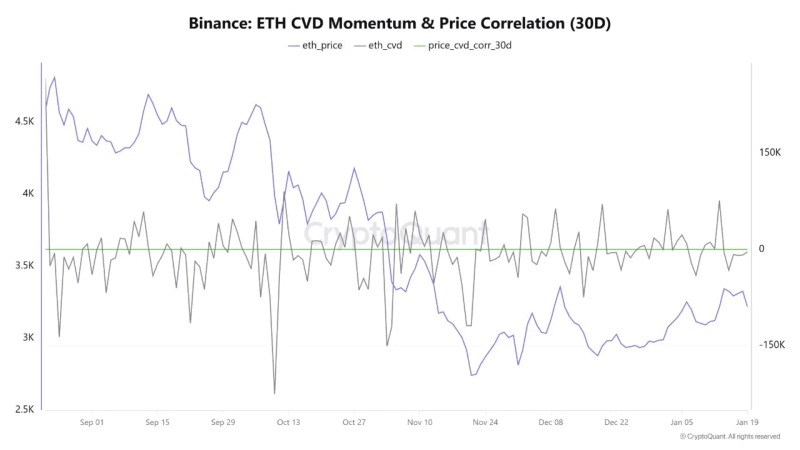

- On-chain analysis says Ethereum is holding around $3,200, but with CVD at -3,676, a short-term sell-dominant dynamic is persisting.

- Citing a 30-day correlation of 0.62 between price and CVD, Arab Chain said that while liquidity is tilted toward selling, order flow is still influencing price.

- He added that while a negative CVD indicates insufficient immediate buying demand, defending above $3,000 and institutional demand could make this a stabilization zone that later forms the base for the next upward wave, rather than an outright trend reversal.

Forecast Trend Report by Period

Ethereum (ETH) is maintaining a steady price trajectory, but an on-chain analysis suggests that selling pressure still dominates in the short-term supply-demand picture.

On the 20th (local time), CryptoQuant contributor Arab Chain said in a recent analysis that “as of early 2026, the Ethereum market on Binance has entered a sensitive part of the cycle,” adding that “price is holding around $3,200, but cumulative volume delta (CVD) is negative at -3,676, indicating a continued sell-dominant structure in the near term.” CVD is an indicator that reflects the cumulative difference between executed buy and sell orders; negative readings mean more sell orders have been filled.

He noted, however, that the divergence between price and CVD has not fully widened. Arab Chain said, “The 30-day correlation between price and CVD is about 0.62, remaining at a relatively solid level. This suggests that despite liquidity flows leaning to the sell side, prices are still being influenced by order flow.”

He interpreted the recent pullback as a typical post-rally correction phase. “Ethereum’s gradual decline to this price zone is a normal correction that follows a strong upswing,” he said, explaining that “while short-term investors take profits, large portfolios reposition and gradually build inventory.” The analysis suggests that rather than a sharp trend reversal, price action with a range-bound character is taking shape.

The fact that CVD remains negative implies that immediate buying demand is not yet sufficient to reverse the trend. Still, Arab Chain added that “the relatively stable hold above $3,000 suggests institutional demand is defending against a sharp drop,” and that “although volume momentum is weak, a resilient price structure could become a quiet stabilization zone that serves as the base for the next upward wave if positive liquidity flows re-enter later.”

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)