Bitcoin holders turn to realized losses on a 30-day basis… first time since October 2023

Summary

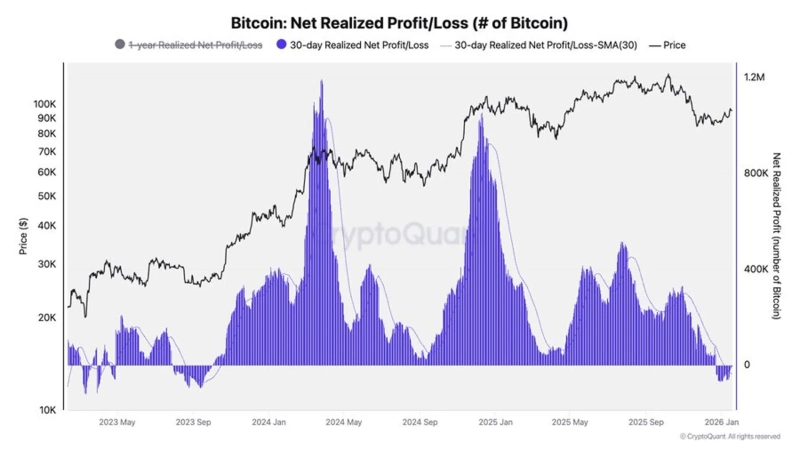

- According to CryptoQuant, Bitcoin (BTC) holders are recording realized losses on a 30-day cumulative basis.

- It noted that Bitcoin sold over the past month was disposed of at prices below the average purchase price, indicating a price correction trend and that short-term holders’ tolerance is being put to the test.

- The market sees this loss phase as potentially part of deleveraging and a cooling of short-term overheating, but warns that if it drags on, weakening investor sentiment and the possibility of further volatility are key risk factors.

Forecast Trend Report by Period

In the Bitcoin (BTC) market, the profit-and-loss profile of short-term investors is deteriorating again, with signs pointing to a corrective phase.

On the 20th (local time), CryptoQuant Chief Analyst Julio Moreno said on X that “Bitcoin holders are recording realized losses on a 30-day cumulative basis. This is the first time this has happened since October 2023.”

A shift to realized losses means that Bitcoin sold over the past month was disposed of at prices below the average purchase price. This pattern typically emerges when a price correction persists for a period, suggesting that short-term holders’ patience is being tested.

Some in the market interpret the move into a loss phase not as an immediate breakdown of the trend, but as part of a broader process of deleveraging and cooling off short-term overheating. Still, if the realized-loss phase becomes prolonged, deteriorating investor sentiment and the risk of further volatility are being flagged as key concerns.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)