Summary

- Chainlink said it has added a data service called “24/5 U.S. Equities Streams” to support 24-hour on-chain trading of U.S. stocks and ETFs.

- Chainlink explained that the new service would allow crypto exchanges to buy, sell, and lend blockchain-based stocks and ETFs outside regular trading hours.

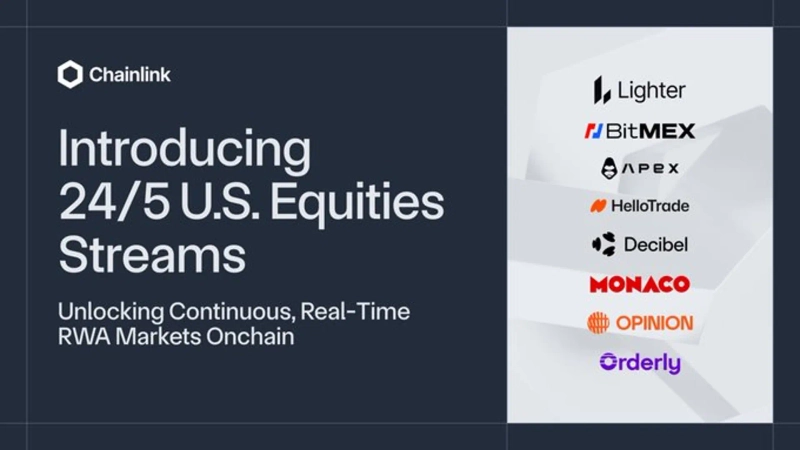

- Chainlink said demand is growing for highly reliable equity data alongside the expansion of on-chain financial products such as equity derivatives, noting that eight protocols—including Lighter, BitMEX, and ApeX—are using the new data streams.

Forecast Trend Report by Period

Chainlink, a crypto-asset infrastructure company, has unveiled a data service that supports 24-hour on-chain trading for U.S. stocks and exchange-traded funds (ETFs).

According to Cointelegraph on the 21st, Chainlink said it is adding “24/5 U.S. Equities Streams” to its existing market data services. The service is designed to provide market data—such as quotes and trading volume—for major U.S. stocks and ETFs 24 hours a day, five days a week.

Chainlink explained that this would enable crypto exchanges to buy, sell, and lend blockchain-based stocks and ETFs outside regular U.S. market hours. The key is to move beyond the limited trading hours of traditional equity markets and create a continuous trading environment similar to that of crypto markets.

Chainlink noted that despite the U.S. stock market’s size of roughly $80 trillion, the use of equity assets in the current on-chain environment remains very low. Because stocks trade only in segmented sessions and during fixed hours, they have been structurally mismatched with crypto markets that operate around the clock, it said.

“As on-chain markets mature and global participation expands, demand is rising for highly reliable equity data that is not confined to standard trading hours,” Chainlink said, adding that the proliferation of on-chain financial products such as equity derivatives is further accelerating this need.

Crypto protocols currently using Chainlink’s new data streams total eight: Lighter, BitMEX, ApeX, HelloTrade, Decibel, Monaco, Opinion Labs, and Orderly Network.

A similar push is also emerging in traditional finance. The New York Stock Exchange (NYSE) recently said it is developing a blockchain-based platform to support 24-hour trading and instant settlement for tokenized stocks and ETFs. The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) also noted in September last year that they were reviewing the feasibility of introducing a 24-hour market.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)