Summary

- U.S. spot Ethereum ETFs saw net outflows of $238.55 million, sharply denting investor sentiment.

- Outflows continued broadly across major issuers—BlackRock’s ETHA ($100.90 million) and Fidelity’s FETH ($51.54 million)—reinforcing an across-the-board bearish tone.

- Further selling pressure and withdrawals were seen in Grayscale’s ETHE and Grayscale Mini Trust ETH, while some products recorded neither net inflows nor net outflows.

Forecast Trend Report by Period

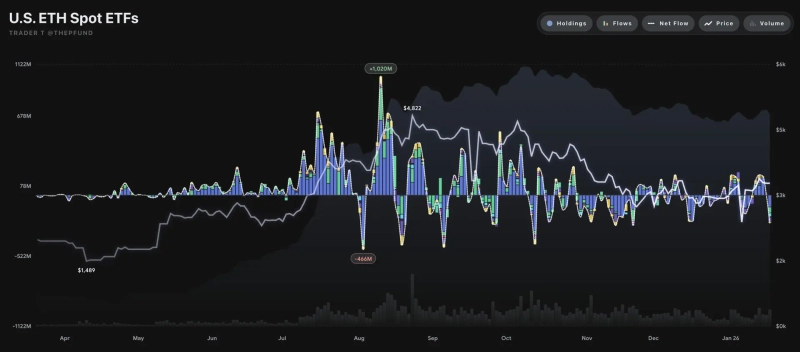

Investor sentiment also deteriorated sharply in spot Ethereum exchange-traded funds (ETFs), as roughly $238.55 million exited in a single day. Risk-off positioning appears to have spread across major cryptoassets alongside Bitcoin.

According to data compiled by TraderT on the 21st, total net outflows from U.S. spot Ethereum ETFs came to $238.55 million as of Jan. 20 (local time). Broad-based redemptions across major issuers contributed to an across-the-board bearish tone.

By product, BlackRock’s ETHA saw the largest outflow at $100.90 million. Fidelity’s FETH posted net outflows of $51.54 million, while Bitwise’s ETHW recorded $31.08 million in withdrawals.

Selling pressure also persisted in Grayscale products. ETHE saw $38.50 million in net outflows, and Grayscale Mini Trust ETH recorded $11.06 million. By contrast, 21Shares CETH, Invesco QETH and Franklin EZET saw neither net inflows nor net outflows. VanEck’s ETHV posted outflows of $5.47 million.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)