[Analysis] "XRP volatility hits highest level since November…entering a phase of heightened risk"

공유하기

Summary

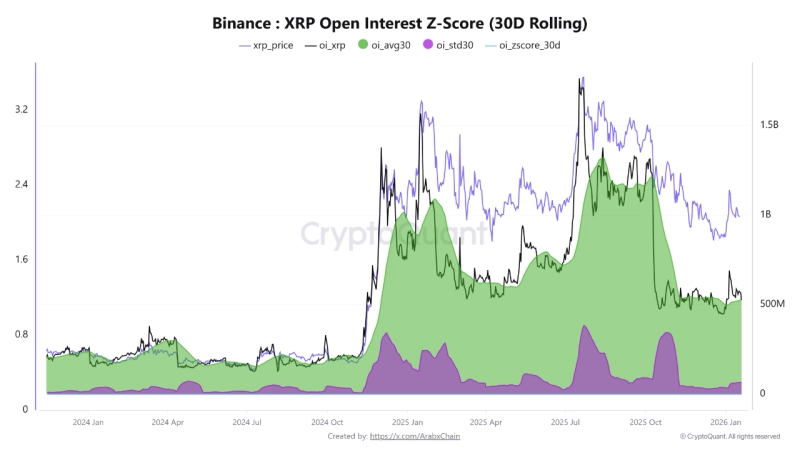

- It said XRP’s total open interest (OI) stands at $566.48 million, above the 30-day moving average, indicating new positions are flowing in.

- It noted that the standard deviation of open interest has climbed to about $65.70 million, the highest since November last year, and is interpreted as an early signal of a potential increase in price volatility.

- It emphasized that while the Z-score is around 0.57 and speculative overheating is limited, the market is in a cautious accumulation phase with risk gradually expanding, and the indicator should be closely monitored.

XRP price volatility has been shown to have reached its highest level since November last year.

An Arab Chain contributor to CryptoQuant said on the 20th (local time) via CryptoQuant, "XRP’s total open interest (OI) currently stands at $566.48 million," adding that it "is above the 30-day moving average of $528.84 million." Arab Chain said this "means new positions are flowing in," but noted that "the pace of inflows is gradual, suggesting investors are taking a relatively cautious approach rather than piling in abruptly."

What Arab Chain focused on was the standard deviation of open interest. Arab Chain said, "The standard deviation has risen to about $65.70 million, the highest reading since November last year," adding that "a widening standard deviation means open-interest volatility relative to the average has increased, and is interpreted as an early signal of expanding price volatility ahead."

It also mentioned the Z-score. The Z-score is calculated as the difference between a token’s market capitalization and realized market capitalization divided by the standard deviation. Arab Chain analyzed, "With the Z-score remaining around 0.57, it is difficult to say the market has entered a phase of extreme leverage buildup or overheating," adding, "In other words, volatility is rising, but speculative overheating still appears relatively limited."

Arab Chain stressed, "The current XRP market can be interpreted as a cautious accumulation phase in which risk is gradually expanding." It added, "Such periods often lead to strong price moves," and said, "To capture the next directional move, it is necessary to closely monitor the standard-deviation indicator alongside price action."