[Analysis] "XRP sees deepening build-up of short positions…potential for a short squeeze"

공유하기

Summary

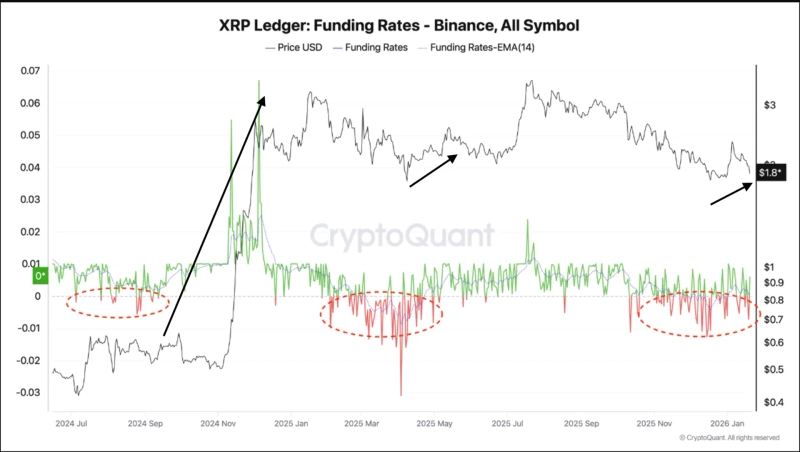

- Cointelegraph, citing CryptoQuant data, reported that Binance XRP funding rates have been in negative territory for the past two months.

- It noted that during August–September 2024 and April–July 2025—periods when XRP funding rates stayed negative for an extended time—XRP rose 50% and 100%, respectively.

- Darkfrost said the build-up of short positions is selling pressure in the short term, but could accelerate an uptrend through forced liquidations if prices rebound.

An analysis suggests that XRP could stage a sharp rebound. The reasoning is that an excessive build-up of short positions in the derivatives market could trigger a surge in buy-to-cover demand if prices rise.

On the 23rd (Korea time), crypto-focused outlet Cointelegraph, citing CryptoQuant data, reported that XRP funding rates on Binance have remained negative over the past two months. Funding rates refer to the balance between accumulated long and short positions in the market. A positive reading indicates more long positions than shorts, while a negative reading means short positions outweigh longs.

Cointelegraph assessed that "leveraged investors are betting on a decline in XRP’s price and are bearing the cost of maintaining short positions."

However, similar conditions have appeared ahead of XRP’s past sharp rallies. The only two periods when XRP’s funding rate stayed negative for an extended stretch were August–September 2024 and April–July 2025. During those periods, XRP rose 50% and 100%, respectively.

Darkfrost said that "the accumulation of short positions creates selling pressure in the short term, but at the same time builds potential buying pressure," adding that "once prices start to rebound, forced liquidations can occur and further accelerate the uptrend."

As of 4:38 p.m. that day, XRP was trading at $1.91, down 1.93% from the previous day, according to CoinMarketCap.

![[Key economic and crypto events for the week ahead] US FOMC policy-rate decision and more](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![Wall Street focuses on Fed chair nomination and Big Tech earnings…Shanghai stocks enter an earnings-driven market [New York·Shanghai stock outlook]](https://media.bloomingbit.io/PROD/news/b7d7a0aa-abf6-46e4-bbca-4270d970641d.webp?w=250)