Summary

- The KOSDAQ index surged 2.43% to close at 993.93, with institutions posting record net buying of KRW 987.3 billion.

- Hopes for the government and ruling party’s KOSDAQ revitalization policy, including the National Growth Fund and venture capital injections, have fueled talk of KOSDAQ 3,000 and a move into the mid-1,000s.

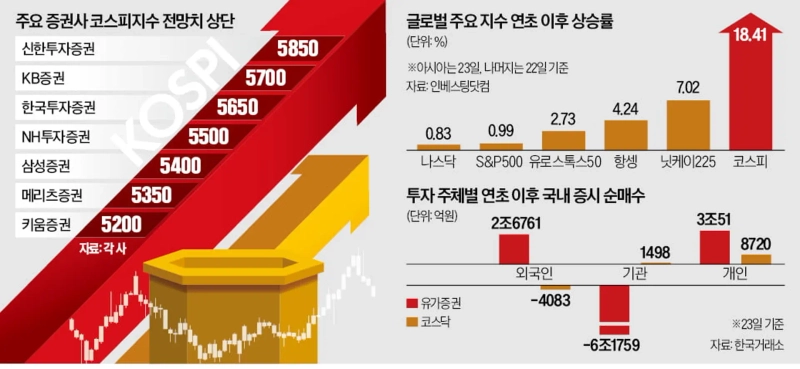

- Expectations remain that strength could persist, with sideline cash in investors’ deposit balances at KRW 95.7276 trillion, foreigners’ net buying of KRW 2.6761 trillion, and brokerages raising the KOSPI ceiling to 5,850.

KOSDAQ up 2.4% to close at 993

Institutions post record net buying of KRW 1 trillion

Expectations build for government policy support

The KOSDAQ market, which had lagged somewhat compared with the KOSPI—whose intraday level topped 5,000 this year—is heating up. On the 23rd, institutional investors bought a record amount of shares on the KOSDAQ on expectations of the government’s policy drive to revitalize the market. Some forecasts say the KOSDAQ could stage a “catch-up rally” to match the KOSPI.

The KOSDAQ index closed up 2.43% from the previous day at 993.93, putting the “Chunsdaq” milestone within reach. A break above 1,000 would be the first in four years, since January 2022 when a global liquidity rally followed the spread of COVID-19. Institutions posted net buying of a record KRW 987.3 billion worth of shares on the KOSDAQ that day. The previous record was KRW 826.2 billion on Dec. 28, 2021. Biotech stocks that had fallen sharply recently rebounded, pushing the index higher. Heavyweight Alteogen rose 4.73%, while ABL Bio and Samchundang Pharm surged 10.24% and 13.74%, respectively.

Expectations for government policy support also lifted risk appetite. The Democratic Party’s “KOSPI 5,000 Special Committee” was reported to have mentioned a target of KOSDAQ 3,000 during a closed-door luncheon with President Lee Jae-myung. Earlier, the government had signaled a range of measures to support the KOSDAQ, including the National Growth Fund and the injection of venture capital.

Cautious calls are also emerging that the KOSDAQ’s rise could gather pace. Shin Jin-ho, CEO of Midas Asset Management, said, “A hallmark of the Lee Jae-myung administration is that it rolls out stock-market support measures consecutively,” adding, “Given its intent to improve the KOSDAQ market’s fundamentals, the KOSDAQ index is likely to trend higher.”

Retail investors’ expectations have also grown after failing to generate big gains in a large-cap-led market. The retail-heavy KOSDAQ index is up 7.4% year to date, far below the KOSPI’s 18.41% rise over the same period. This year, individuals have been net buyers of KRW 872.0 billion on the KOSDAQ, while foreigners have been net sellers of KRW 408.3 billion.

The KOSPI closed up 0.76% at 4,990.07. It again “touched” 5,000, rising to as high as 5,021.13 intraday, but pared gains on profit-taking.

KOSPI Pauses After Hitting 5,000…Sideline Cash Nears KRW 100 Trillion

Naver up 8%, Kakao up 4%…Hopes for Gains From Stablecoin Policy

On the 23rd—the day after the KOSPI touched 5,000—the main board took a breather while the KOSDAQ strengthened. Expectations grew that the previously overlooked KOSDAQ could show a stronger trend ahead. With investors’ deposit balances—cash on the sidelines—nearing KRW 100 trillion, the prevailing view was that the KOSPI’s strength could also continue.

◇KOSPI Takes a Breather; KOSDAQ Strong

The KOSPI ended the session at 4,990.07, failing to break above 5,000 on a closing basis. It climbed as high as 5,021.13 intraday, but profit-taking emerged, centered on Hyundai Motor Group shares. As gains narrowed, the index even briefly slipped into negative territory. Individuals posted net selling of KRW 726.7 billion, while institutions and foreigners were net buyers of KRW 491.6 billion and KRW 134.0 billion, respectively.

Hyundai Motor, which had led the year-to-date rally, fell 3.59% from the previous session to close the regular session at KRW 510,000, and Korea Electric Power plunged 7.27% after a foreign brokerage downgraded its investment rating. On stablecoin policy expectations, Naver and Kakao jumped 8.35% and 4.45%, respectively.

Brokerage stocks also surged on hopes for a bullish market, with Mirae Asset Securities and Shinyoung Securities rising 16.58% and 13.02%, respectively. Lee Kyung-min, a researcher at Daishin Securities, said, “Given the steep run-up, profit-taking emerged, centered on Hyundai Motor Group shares,” adding, “The KOSPI appears to have entered a consolidation phase after reaching 5,000.”

The long-overlooked KOSDAQ posted a sharp rebound on strong institutional buying. Biotech names, which had slid in a streak following the “Alteogen shock,” managed to rebound. Alteogen had plunged 22.35% on the 21st after it was reported that the royalty rate it receives from global drugmaker Merck was far lower than market expectations. Alteogen rose 4.73% on the day to recover, while ABL Bio and Samchundang Pharm surged 10.24% and 13.74%, respectively. Ligachem Bio also gained 12.32%.

◇“KOSPI Isn’t Overheated”

Forecasts are emerging that the KOSDAQ could attempt to close the gap with the KOSPI and remain strong. With the Democratic Party’s “KOSPI 5,000 Special Committee” mentioning a KOSDAQ 3,000 target during a closed-door luncheon with President Lee Jae-myung, the market expects a series of support measures. Expectations are that supply-demand conditions will improve through measures such as the National Growth Fund and the injection of venture capital. One asset management CEO said, “With government support policies, the KOSDAQ index could rise to the mid-1,000s.”

The KOSPI, which briefly paused that day, is also expected to maintain its uptrend. Earnings momentum continues to improve, especially in semiconductors, and sideline cash is also setting record highs. Investors’ deposit balances stood at KRW 95.7276 trillion as of the 22nd, nearing KRW 100 trillion. Analysts say retail funds are shifting en masse into equities.

Foreigners’ buying—net purchases of KRW 2.6761 trillion so far this year—is also expected to continue. While the U.S. S&P 500 and Nasdaq indexes are up 0.99% and 0.83%, respectively, Asian indexes have been strong. Along with the KOSPI’s 18.41% gain, Japan’s Nikkei 225 and Hong Kong’s Hang Seng Index have risen 7.02% and 4.24%, respectively.

Brokerages are continuing to raise their year-end ceilings for the KOSPI. Shinhan Investment Corp. forecast the KOSPI could climb to 5,850, while KB Securities and Korea Investment & Securities projected 5,700 and 5,650, respectively. NH Investment & Securities and Samsung Securities also forecast rises to 5,500 and 5,400, respectively. Lee said, “The recent KOSPI rise is earnings-driven, and the forward price-to-earnings ratio is only 10.5 times.”

Reporter Park Han-shin phs@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.