Summary

- It reported that the outstanding value of tokenized U.S. Treasuries issued on blockchain has surpassed $10 billion.

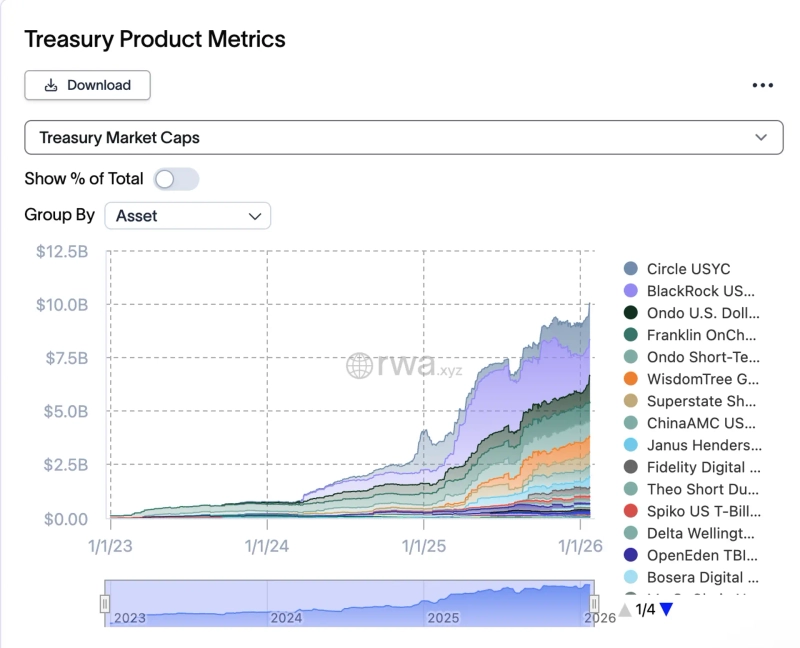

- According to data from RWA.xyz, the total value of tokenized U.S. Treasuries rose 7.6% from the previous week to $10.13 billion.

- By product, Circle’s USYC, BlackRock’s BUIDL and Ondo Finance (ONDO) USDY ranked among the top by market capitalization, and Ethereum (ETH) saw the largest issuance of tokenized Treasuries at $5.6 billion.

The outstanding value of tokenized U.S. Treasuries issued on blockchain has surpassed $10 billion.

On the 24th (Korea time), cryptocurrency news outlet Cryptopolitan, citing data from RWA.xyz, reported that the total value of tokenized U.S. Treasuries reached $10.13 billion, up 7.6% from the previous week.

By product, Circle’s USYC accounted for the largest share with a market capitalization of $1.69 billion, followed by BlackRock’s BUIDL ($1.68 billion) and Ondo Finance (ONDO) USDY (about $1.27 billion).

The network with the largest issuance of tokenized Treasuries was Ethereum (ETH). On Ethereum, more than half of the total—$5.6 billion worth of tokenized Treasuries—has been issued. It was followed by BNB Chain ($2.1 billion), Stellar ($690 million), Solana ($501 million), Aptos ($330 million) and Avalanche ($240 million).

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.