Dollar deposits lose momentum after three months…gold investing boom intensifies

Summary

- Dollar deposit balances at the top five banks fell 3.8% in a month, indicating that the “dollar hoarding” phenomenon has eased.

- It said corporate outflows of dollar deposits stood out amid the government’s recommendations to sell dollars and cuts to dollar-deposit rates.

- Meanwhile, gold-banking balances topped 2 trillion won and gold bar sales more than doubled, signaling an intensifying boom in gold investing.

Government presses companies to sell dollars

Balances at top five banks down 3.8% in a month

Gold-banking balances top 2 trillion won

U.S. dollar deposit balances at major commercial banks have turned to a decline for the first time in three months. With the won–dollar exchange rate calming after once rising above 1,480 won, analysts say the “dollar hoarding” phenomenon has eased. By contrast, a boom in “gold investing,” driven by demand for safe-haven assets, is gaining strength.

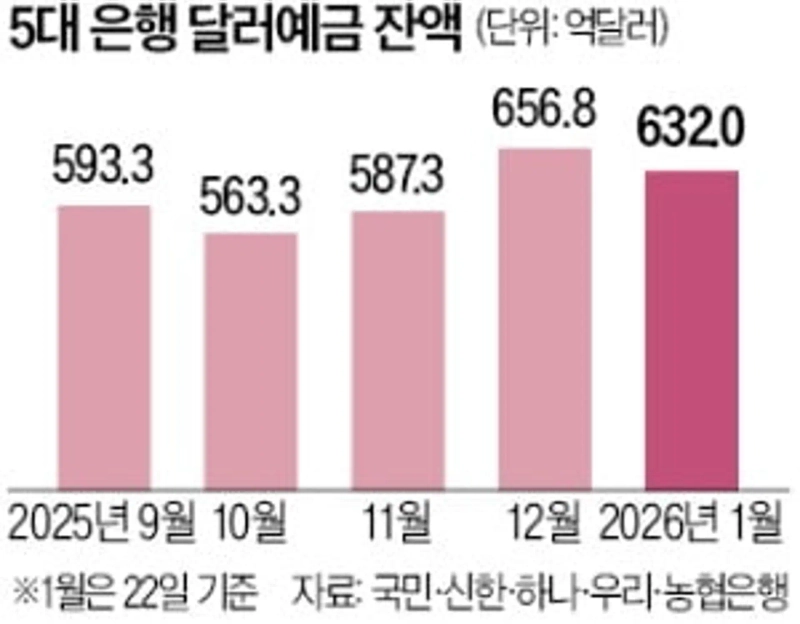

According to the financial sector on the 25th, dollar deposit balances at the five largest banks—KB Kookmin, Shinhan, Hana, Woori and NH NongHyup—totaled $63.20483 billion (about 91.9819 trillion won) as of the 22nd. That is down 3.8% from the end of last month ($65.68157 billion).

Dollar deposits are products in which customers convert won into dollars and place them with a bank. Balances rose for two consecutive months as the won–dollar rate surged from October last year, but have turned downward this month. The pullback was particularly pronounced among corporates, which account for about 80% of total dollar deposits. As of the 2nd, corporate dollar deposit balances at the five banks stood at $49.83006 billion, down 4.9% from the previous month.

The decline is seen as reflecting the government’s recommendations to sell dollars to defend the exchange rate, alongside growing perceptions that the rate has neared a peak. The exchange rate itself is also stabilizing. After breaking above 1,480 won, the won–dollar rate ended trading in the 1,460-won range in Seoul’s FX market on the 23rd.

Commercial banks are also cutting interest rates on dollar deposits in line with the government’s stance of defending the won. Shinhan Bank will lower the interest rate on its “SOL Travel” dollar deposit from 1.5% per year to 0.1% per year starting on the 30th. Hana Bank will also adjust the dollar deposit rate on its “Travelog” foreign-currency account from 2.0% per year to 0.05% per year on the 30th.

As “dollar hoarding” loses steam, enthusiasm for gold investing is heating up further. Gold-banking balances at KB Kookmin, Shinhan and Woori Bank totaled 2.1494 trillion won as of the 22nd, up 11.4% from the previous month (1.9296 trillion won). Gold banking is a product that allows customers to buy and sell gold through a passbook account. After topping 1 trillion won in March last year, gold-banking balances have now surpassed 2 trillion won this month.

Demand for gold bars is also strong. Gold bars sold at the five largest banks this month totaled 71.67311 billion won. That is more than double last month’s sales (35.00587 billion won). Analysts say related products are gaining popularity as gold prices, a safe-haven asset, have risen sharply amid domestic and external uncertainty.

By Jang Hyun-joo blacksea@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.