Summary

- The report said the yen-dollar rate posted its biggest drop in six months as expectations spread that US and Japanese FX authorities would intervene against yen weakness.

- It said that as the yen turned stronger, the won also strengthened, with the won-dollar 1-month tenor in New York non-deliverable forwards (NDF) falling to 1,444.60 won.

- FX authorities said they see much of the early-year uptrend in the exchange rate as linked to yen weakness, and added that if yen strength persists, the odds tilt toward further declines in the won-dollar rate.

Two countries seen intervening against yen weakness

Bank of Japan and Federal Reserve Bank of New York

As signs of yen market intervention emerge

Yen-dollar posts biggest drop in six months

Won-dollar rate also turns lower

In New York non-deliverable forwards market

1-month tenor falls into the 1,440 won range

The yen rebounded sharply as market expectations grew that the US and Japanese governments would step in to curb yen weakness. The won-dollar exchange rate also plunged into the 1,440 won range in the offshore forward market. With the won recently tracking the yen closely, the likelihood of further declines in the won-dollar rate is gaining traction.

◇Will the US and Japan mount joint yen intervention?

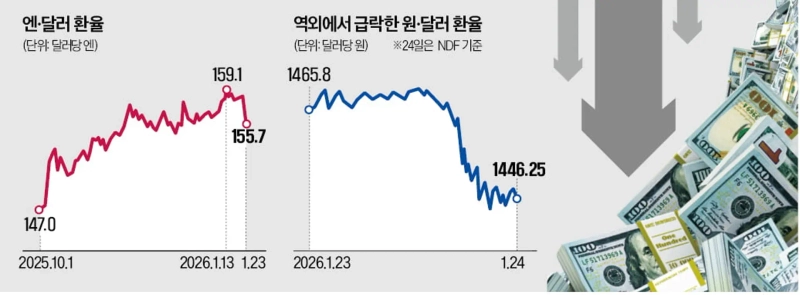

On the 23rd (local time) in the New York FX market, the yen-dollar rate fell 1.7% from the previous day (yen strength) to 155.7 yen per dollar—the steepest decline in six months. The Nikkei reported that "yen buying intensified as speculation spread that the US and Japanese FX authorities had moved in a coordinated response to prevent excessive yen depreciation."

It also became known that the Bank of Japan (BOJ) had conducted a 'rate check' by inquiring with major banks and others about trading conditions. A rate check is typically carried out ahead of official FX market intervention. Reuters, citing sources, reported that the Federal Reserve Bank of New York also conducted a rate check at the instruction of the US Treasury.

It has not been confirmed whether the US Treasury contacted Japan’s FX authorities ahead of the move, but markets are increasingly judging that the two countries are acting together in yen intervention. Earlier, Japanese Finance Minister Satsuki Katayama said after a bilateral meeting with US Treasury Secretary Scott Bessent, "I conveyed concerns about a one-sided phase of yen weakness, and Secretary Bessent shared that view."

The yen-dollar rate has been on a steady uptrend since Sanae Takaichi was elected Japan’s prime minister in October last year, amid analysis that she is likely to carry on former Prime Minister Shinzo Abe’s expansionary fiscal policies. As the yen-dollar rate approached the 'psychological resistance level' of 160, Japan’s FX authorities repeatedly signaled they could intervene. Minister Katayama said at a recent press conference, "We are always watching exchange rates with a sense of urgency."

The Wall Street Journal (WSJ) reported that the US Treasury moved to intervene out of concern that yen weakness was accompanied by rising Japanese government bond yields. If JGB yields rise, advanced-economy sovereign yields tend to rise in tandem, increasing the likelihood that US Treasury yields would also move higher. The fact that a significant portion of Japan’s FX reserves is held in US Treasuries is also a burden for the United States.

◇Won strengthens in tandem

As the yen-dollar rate fell sharply, the won also surged. The won-dollar rate, which closed at 1,465.80 won in daytime trading on the 23rd, entered the New York session after rising to 1,467 won but turned lower alongside the yen’s strength. As of 2 a.m. on the 24th, the overnight close was 1,462.50 won, down 3.30 won from the daytime close.

As the yen’s strength intensified further, the decline in the won-dollar rate steepened in the New York non-deliverable forwards (NDF) market. The 1-month won-dollar NDF was last quoted at 1,444.60 won. Given that the recent 1-month swap point is 1.65 won, this corresponds to 1,446.25 won.

FX authorities judge that if yen strength continues, the won is also likely to strengthen in tandem, because they view a significant portion of the early-year rise in the exchange rate as having coincided with yen weakness. On the 15th, Secretary Bessent also made the unusual move of verbal intervention regarding won weakness, saying it "does not align with Korea’s solid economic fundamentals."

Choi Man-su/Kang Jin-gyu, reporters bebop@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.