Dunamu AI Gains Traction on the Global Stage… Presents Research Results at AAAI 2026 Demo Track

Summary

- Dunamu said its Machine Learning Team presented research results at the AAAI 2026 Demo Track that combine digital-asset prices with financial news understanding.

- The company explained that the system combines news data with digital-asset price-chart volatility data to select and provide the key news that caused price movements.

- Dunamu said the AI technology has demonstrated practical utility that can reduce investors’ information asymmetry and contribute to improving market transparency.

Dunamu’s Machine Learning Team presented its research results at AAAI 2026, a leading global artificial intelligence conference.

Dunamu said on the 26th that a paper by its Machine Learning Team was accepted to the Demo Track of the international AI conference, the Association for the Advancement of Artificial Intelligence (AAAI), and that it successfully completed a live demonstration.

Marking its 40th edition this year, AAAI is a prestigious conference where AI researchers from around the world present the latest technologies and research achievements, and is regarded as one of the world’s three major AI conferences. AAAI 2026 will be held at Singapore Expo from January 20 to 27.

Dunamu’s Machine Learning Team paper was selected for the highly competitive Demo Track. Rather than stopping at theoretical presentations, the Demo Track requires participants to demonstrate a working system in person to have the technology’s effectiveness assessed, making it significant in that research results must be validated through applied use cases.

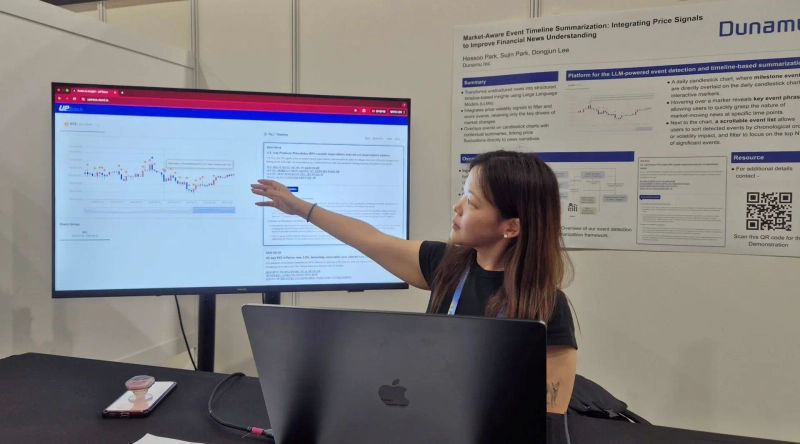

In the AAAI Demo Track, Hee-su Park, a researcher on Dunamu’s Machine Learning Team, presented the paper titled “Market-Aware Event Timeline Summarization: Integrating Price Signals to Improve Financial News Understanding,” and conducted a live demonstration of a system developed in-house by Dunamu.

The research introduces a system that combines news data with volatility data from digital-asset price charts to identify and provide only the key news that drove price movements. Previously, it was difficult to pinpoint the key issues that actually influenced price fluctuations amid large volumes of news, and to immediately determine the reasons behind price moves.

To address this, Dunamu’s Machine Learning Team proposed a new modeling approach that combines a large language model (LLM) with price-volatility indicators. The structure automatically extracts digital-asset-related events from news feeds, filters only the events that influenced periods of elevated price volatility, and then has the LLM summarize those events and background information, visualizing them as a timeline alongside charts.

Dae-hyun Kim, Dunamu’s Chief Data Officer (CDO), said, “This AAAI presentation is meaningful not only because Dunamu’s AI technology has received global academic recognition, but also because it demonstrated practical utility in reducing information asymmetry for real investors,” adding, “We will continue to use AI technology to provide more valuable information to investors and contribute to enhancing market transparency.”

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io