Summary

- It reported that about $100 billion in total crypto market capitalization was wiped out as the possibility of a partial shutdown of the U.S. federal government came into focus.

- It said broad declines across altcoins, including Bitcoin BTC and Ethereum ETH, were accompanied by deleveraging and continued leveraged-position liquidations.

- It reported that the crypto Fear & Greed Index remains in the “Extreme Fear” zone around 20, with progress in shutdown negotiations cited as a key driver of near-term volatility.

The crypto market sharply contracted as the possibility of a partial shutdown of the U.S. federal government came back into focus.

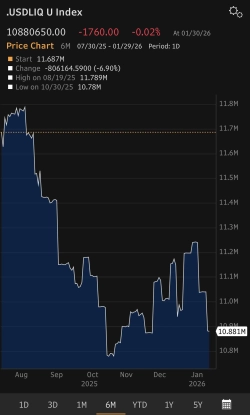

According to Cointelegraph on the 26th (local time), total crypto market capitalization late the previous day fell from about $2.97 trillion to $2.87 trillion in roughly six and a half hours, wiping out around $100 billion.

The decline was directly fueled by political uncertainty after Senate Democrats said they would block passage of the Department of Homeland Security (DHS) funding bill. Senate Minority Leader Chuck Schumer formalized the shutdown risk, saying, “I cannot support a DHS funding bill that lacks safeguards to control Immigration and Customs Enforcement (ICE).” In the wake of the remarks, Kalshi and Polymarket showed the odds of the U.S. government entering a shutdown by the 31st of this month surging to as high as 80%.

Risk-off sentiment spread quickly across markets. Bitcoin (BTC) fell 3.4% over the past 24 hours, slipping below the $87,000 level, while Ethereum (ETH) posted a steeper drop of more than 4% in a single day. Altcoins broadly also weakened in tandem, with volatility rising.

Deleveraging also continued in derivatives markets. Over the past 24 hours, about $360 million in leveraged crypto positions were liquidated, most of them long positions. Market participants said the pullback was driven more by leverage reduction tied to a political event than by large-scale spot selling.

Meanwhile, investors have been reinforcing their preference for safe-haven assets as tariff frictions among the U.S., China and Canada, along with military tensions in the Middle East, add to the risk backdrop. Over the same period, gold and silver prices continued to rally, breaking above $5,000 and $106, respectively, and marking fresh record highs.

The Crypto Fear & Greed Index, a gauge of crypto market sentiment, has fallen to around 20 and remains in the “Extreme Fear” zone. Markets are pointing to progress in shutdown negotiations as a key factor that will determine near-term volatility.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)