[Analysis] "Gold above $5,000 signals a regime shift…Bitcoin digesting a range around $87K"

Summary

- It reported that after gold broke above $5,000 per ounce, it has maintained strength, prompting the view that this rally is closer to a 'regime shift' than a short-term event.

- It said that as Bitcoin trades sideways around $87,000, the $98,000 area—short-term holders’ average cost basis—and the heavy overhang above $100,000 are acting as overhead resistance, making a near-term breakout less likely.

- It reported that while derivatives and prediction markets assign higher odds to gold holding above $5,500, Bitcoin is seen as needing to first go through a consolidation/sideways phase, along with normalization of the supply overhang and a rebalancing of supply and demand, before a trend upturn becomes possible.

As gold extends its bullish run even after breaking above $5,000 per ounce, some are arguing that the rally is closer to a “regime shift” than a short-lived event. By contrast, Bitcoin (BTC) has been moving sideways around $87,000, failing to find a clear direction.

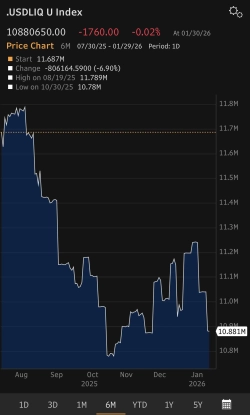

On the 25th (local time), CoinDesk, citing CryptoQuant data, reported that Bitcoin holders have started selling at a loss for the first time since October 2023. While prior high-price buyers are reducing positions, new participants are absorbing the supply—a pattern typically interpreted as characteristic of a consolidation or sideways phase rather than a strong uptrend.

Glassnode also assessed that Bitcoin’s price is being capped by internal supply pressure. It said that at each recent rebound attempt, sell orders have emerged near prior purchase levels, limiting upside. In particular, Bitcoin has yet to reclaim the area around $98,000, where the average cost basis of short-term holders sits, and a thick overhang of supply above $100,000 is seen as reducing the likelihood of a near-term breakout.

In practice, as break-even selling and stop-loss selling by investors who bought near the 2025 highs repeatedly hit the market, the structure has continued to reinforce overhead resistance. This suggests an environment in which it is difficult to sustain a move even if upside momentum forms.

Derivatives indicators are sending the same signal. Futures trading volumes remain subdued, and leverage usage is also limited. Recent price swings have occurred in thin-liquidity conditions, leading to the view that they are far from the kind of trend-driven move that comes with broader participation.

Views are also split in prediction markets. On Polymarket, higher odds are being assigned to the possibility that gold holds above $5,500 during the year, while the prevailing view for Bitcoin is that it will go through additional sideways trading and a digestion phase rather than a near-term rebound.

Market participants are describing the current phase as one in which “gold functions as an asset that absorbs macro stress, while Bitcoin is confronting internal supply clean-up ahead of external catalysts.” For Bitcoin to shift back into a sustained uptrend, normalization of the supply overhang and a rebalancing of supply and demand may need to come first, more than macro variables.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)