70% of Institutional Investors Say Bitcoin Is Undervalued in the $85,000–$95,000 Range

Summary

- According to a Coinbase report, 71% of institutional investors and 60% of independent investors said Bitcoin is in undervalued territory.

- About 25% of institutional investors assessed $85,000–$95,000 as fair value for Bitcoin, while only 4% said it was overvalued.

- Some 80% of respondents said they would hold or buy more even if the crypto market falls an additional 10%, and said they view the current phase as an accumulation phase or a bear market.

A survey has found that a majority of institutional investors view the current price of Bitcoin (BTC) as being in undervalued territory.

A Coinbase report cited by Cointelegraph on the 26th (local time) released the results of a survey conducted from early December last year to early January this year of 75 institutional investors and 73 independent investors. According to the survey, 71% of institutional investors and 60% of independent investors said Bitcoin is undervalued.

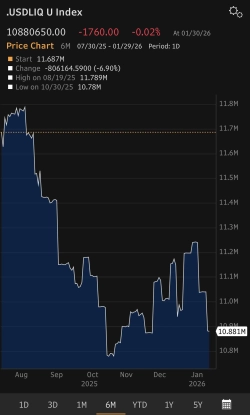

During the survey period, Bitcoin mostly traded in the $85,000–$95,000 range. About 25% of institutional investors assessed that price band as “fair value,” while only 4% said Bitcoin was overvalued. Bitcoin is currently around $87,600, more than 30% below the all-time high of $126,080 set in October last year.

Coinbase pointed out that Bitcoin has recently underperformed relative to precious metals such as gold and silver as well as the stock market. Gold prices surpassed $5,000 per ounce for the first time on record, and silver prices have also nearly doubled in market capitalization terms since October last year. By contrast, the Standard & Poor’s (S&P) 500 Index rose only about 3% over the same period.

Institutional investors’ medium- to long-term outlook appeared relatively firm. Some 80% of respondents said they would maintain their holdings or even buy more if the crypto market falls an additional 10%. More than 60% were found to have maintained or increased their Bitcoin allocation since October last year. As many as 54% of respondents described the current market phase as an “accumulation phase” or a “bear market.”

Coinbase also noted that the macro backdrop could turn more supportive for crypto markets going forward. It cited forecasts that the Federal Reserve (Fed) could deliver two rate cuts in 2026, and said solid US economic indicators—including easing inflation (December CPI up 2.7%) and real GDP growth of more than 5% in the fourth quarter—could underpin a recovery in risk appetite.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)