Summary

- Bitcoin fell below 130 million won, which was attributed to stronger risk-off sentiment.

- Bitcoin slid into the 120 million won range amid Trump’s tariff threat against Canada and escalating geopolitical tensions.

- Mike McGlone presented a forecast that Bitcoin could fall to $50,000 within the year.

As geopolitical uncertainty spread across countries worldwide, Bitcoin fell below 130 million won. While the clash between the U.S. and the European Union (EU) over Greenland has eased, the U.S. has begun threatening tariffs on Canada, and rising military tensions in Iran have amplified risk-off sentiment.

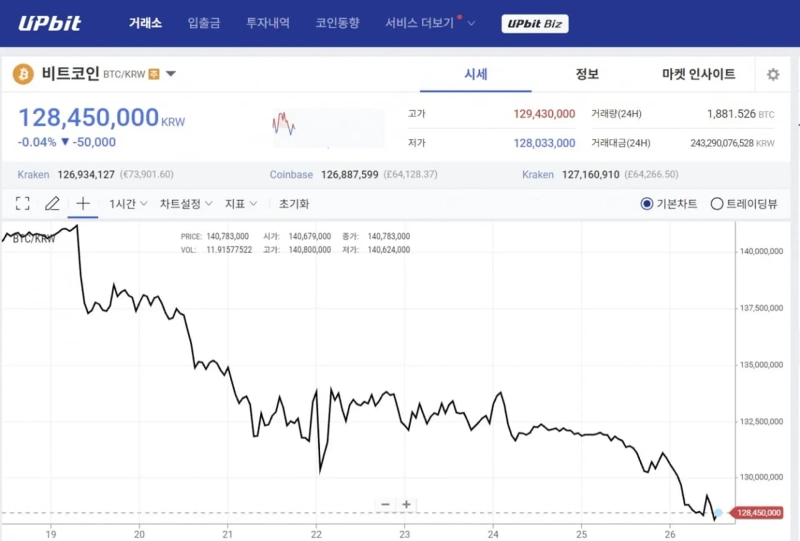

According to domestic crypto exchange Upbit on the 26th, Bitcoin was trading at 128.14 million won as of 12 p.m. that day, down 2.4% from 24 hours earlier. The price had held in the 130 million won range through the previous day, but slid into the 120 million won range early on the 26th.

Bitcoin has struggled to shake off weakness since mid-month amid a steady stream of headlines on geopolitical conflict. As recently as the morning of the 19th, Bitcoin was trading in the 140 million won range in the domestic market. However, media reports that the EU was preparing retaliatory tariffs on the U.S. worth 159 trillion won in response to Washington’s bid to annex Greenland pushed the price down to 137.27 million won at 10 a.m. on the 19th.

The sharp drop later eased after U.S. President Donald Trump said he had no plan to use force over Greenland and withdrew his tariff threats against the EU. But Bitcoin fell into the 120 million won range after Trump on the 25th said he would impose 100% tariffs on all imports from Canada, objecting to trade agreements involving China and Canada.

Meanwhile, reports that Trump is sending a “large fleet” to Iran, where authorities are cracking down on protesters with force, along with mounting concerns over a renewed shutdown of the U.S. federal government, are also cited as negative factors for Bitcoin. They have chilled investor appetite for risk assets. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, also posted on his social media on the 25th that he expects “Bitcoin to fall to $50,000 within the year.”

Reporter Jin Jeong-ui justjin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.