Editor's PiCK

BlackRock files S-1 for Bitcoin Premium Income ETF…to use a covered-call strategy

공유하기

Summary

- BlackRock said it is moving to launch an exchange-traded fund (ETF) that combines tracking the price of Bitcoin (BTC) with option premium income.

- It explained that the ETF aims to provide premium income by using call option selling centered on shares of the iShares Bitcoin Trust (IBIT).

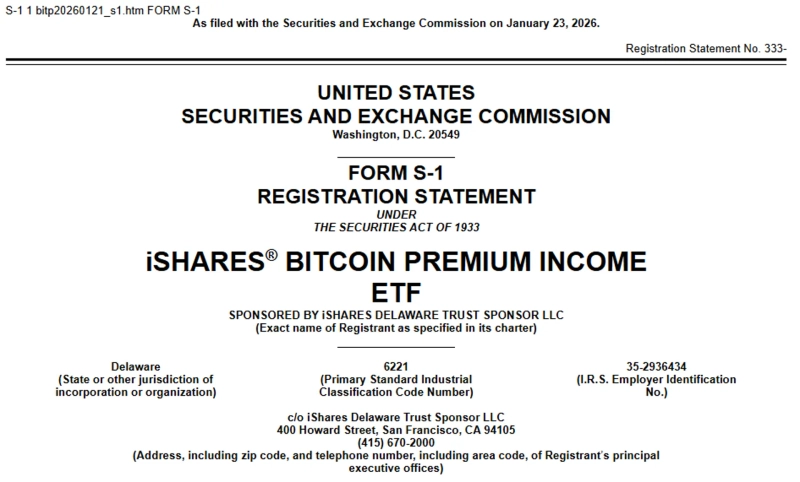

- BlackRock has filed the official S-1 for the ‘iShares Bitcoin Premium Income ETF’ with the U.S. Securities and Exchange Commission (SEC), but fees and the ticker have not yet been disclosed.

BlackRock is preparing to launch an exchange-traded fund (ETF) that combines tracking the price of Bitcoin (BTC) with income from option premiums.

On the 26th, Eric Balchunas, a senior ETF analyst at Bloomberg, said on X (formerly Twitter) that “BlackRock has filed the official S-1 registration statement for the ‘iShares Bitcoin Premium Income ETF.’” Fees and the ticker have not yet been disclosed.

Balchunas explained the ETF’s strategy, saying it aims to provide premium income by tracking Bitcoin’s price moves while employing an actively managed approach that sells call options primarily on shares of the iShares Bitcoin Trust (IBIT). He added that “in some cases, options on exchange-traded product (ETP) indices may also be used.”

An S-1 is a securities registration statement filed with the U.S. Securities and Exchange Commission (SEC), an official document that discloses an ETF’s structure, management strategy and risk factors in advance.