Summary

- Bitcoin modestly rebounded to around $87,800 after reaffirming the $86,000 support level, but noted that broader risk-off sentiment remains intact.

- It reported that in derivatives markets, defensive positioning and bearish sentiment are prevailing, with the Bitcoin futures premium (basis) staying around 5% and options delta skew at 12%, indicating a put-option premium.

- Despite record-high gold prices, a declining dollar, and a strengthening debasement trade, Bitcoin still shows risk-asset characteristics, and said restoring confidence among professional investors in derivatives markets is needed to recover the $93,000 level.

Bitcoin (BTC) posted a modest rebound after reaffirming support at $86,000, but caution about further upside is persisting in the derivatives market.

According to Cointelegraph on the 26th (local time), Bitcoin retested the area around $86,000 and then rebounded about 1.5%, trading in the $87,800 range. Still, with the possibility of a U.S. federal government shutdown being discussed through this weekend, risk-off sentiment across markets remains evident ahead of key events such as the Federal Open Market Committee (FOMC) meeting and earnings releases from global Big Tech.

Derivatives indicators point to investors’ cautious stance. The annualized Bitcoin futures premium (basis) remained around 5%. That suggests limited demand for leveraged long positions and falls well short of the 10%+ levels typically seen in bullish phases. Over the past two weeks, market sentiment has been assessed as staying in neutral-to-bearish territory.

The options market is also dominated by defensive positioning. Bitcoin options delta skew rose to 12%, indicating puts (downside bets) are trading with a premium. In a neutral market, the indicator typically moves within a -6% to +6% range, and the current level is similar to when Bitcoin plunged sharply in a short period in early December last year.

Meanwhile, gold prices broke above $5,100 per ounce, setting a fresh record high. Analysts say a so-called “debasement trade” is strengthening as a weaker dollar coincides with distrust in fiscal and monetary policy. However, because this trend is not immediately driving flows into Bitcoin, Bitcoin still appears not to have fully shed its risk-asset character.

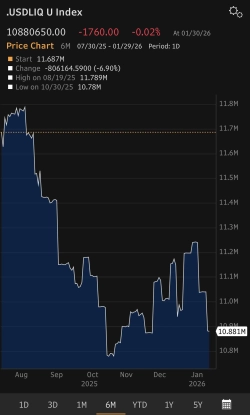

News that the Federal Reserve Bank of New York reviewed market conditions related to the Japanese yen also weighed on investor sentiment. The U.S. dollar index (DXY) fell below 97 for the first time in four months, but caution is being driven simultaneously by concerns over resurgent inflation and monetary-policy uncertainty.

Some in the market also expect that if this week’s Big Tech earnings come in better than anticipated, risk appetite could remain concentrated in equities, limiting rotation of funds into Bitcoin. For Bitcoin to reclaim the $93,000 level, a recovery in confidence among professional investors across derivatives markets likely needs to come first.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)