BitMine sees potential for $160 million in annual revenue from expanded Ethereum staking

Summary

- BitMine said that expanding its Ethereum staking allocation could generate annualized revenue of about $164 million.

- Chairman Tom Lee said that staking all Ethereum holdings could generate roughly $374 million a year.

- BitMine’s current ETH holdings are about 3.52% of circulating supply, and it said its long-term goal is to secure 5% of total ETH.

As BitMine rapidly increases its share of Ethereum staking, an analysis suggests it could generate roughly $160 million a year in staking income at current levels.

According to Cointelegraph on the 26th (local time), BitMine said it purchased an additional 40,302 ETH last week, lifting its total holdings to about 4,243,338 ETH. Over the same period, staked ETH rose by 171,264 ETH to a total of 2,009,267 ETH. Applying the company’s stated Composite Ethereum Staking Rate (CESR) of 2.81% implies annualized revenue of about $164 million from the currently staked amount alone.

Tom Lee, BitMine’s chairman, said that if all of the company’s Ethereum holdings were staked, it could generate about $374 million a year—more than $1 million a day. BitMine is working with multiple staking operators and plans to internalize staking by building its own validator infrastructure in the U.S. in 2026.

Its financial position is also robust. BitMine reported total crypto and cash assets of $12.8 billion, including $682 million in cash, 193 BTC and certain equity investments, in addition to its Ethereum holdings. BitMine’s current ETH holdings amount to about 3.52% of circulating supply, and its long-term goal is to secure 5% of total ETH.

Staking is increasingly becoming a core revenue source for companies pursuing Ethereum treasury strategies. SharpLink Gaming also disclosed that its fully staked strategy generated rewards of 10,657 ETH (about $33 million) over the past seven months. Bit Digital has pivoted toward reducing its bitcoin mining assets and increasing Ethereum holdings, while Ether Machine is also preparing yield-oriented Ethereum investment products for institutions.

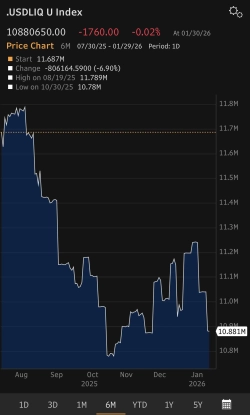

Rising staking demand is also evident in on-chain indicators. Ethereum’s staking “exit queue” has recently fallen to zero, while the entry queue has topped 2.6 million ETH, the highest level since mid-2023. Industry observers say generating stable returns through staking is becoming the standard for ETH treasury strategies.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)